For months, crypto traders eagerly awaited the significant unlocking day for TIA Coin. The much-anticipated day finally arrived, leading to massive costs in short selling for TIA Coin futures trading. This situation arose because many believed a decline was imminent; however, investors have faced unexpected surges in recent months, contradicting their expectations.

Market Analysis of TIA Coin

While this article was being prepared, TIA Coin continued its downward trend. Today’s significant unlocking event is expected to cause considerable fluctuations in prices, particularly with BTC dropping to $72,000, further supporting this decline. Renowned analyst Altcoin Sherpa shared his insights on the current situation, stating:

“To be honest, I have no idea what will happen with this chart. At any moment, the locks could open, but this is not a bullish chart. I could see arguments for the closure of hedges and some kind of upward movement, but there’s too much uncertainty to try to play this ahead of time.”

Current State of Bitcoin (BTC)

The largest cryptocurrency by market capitalization, BTC, remains around $72,100, having tested $71,500 during the U.S. market opening. Investors have been enduring a nightmare for over two quarters, growing weary of the shallow range movements. BTC must now exceed its all-time high and provide more room for altcoins.

If it falls again like in previous attempts, this will likely yield poor results for altcoins. Daan Crypto Trades remarked:

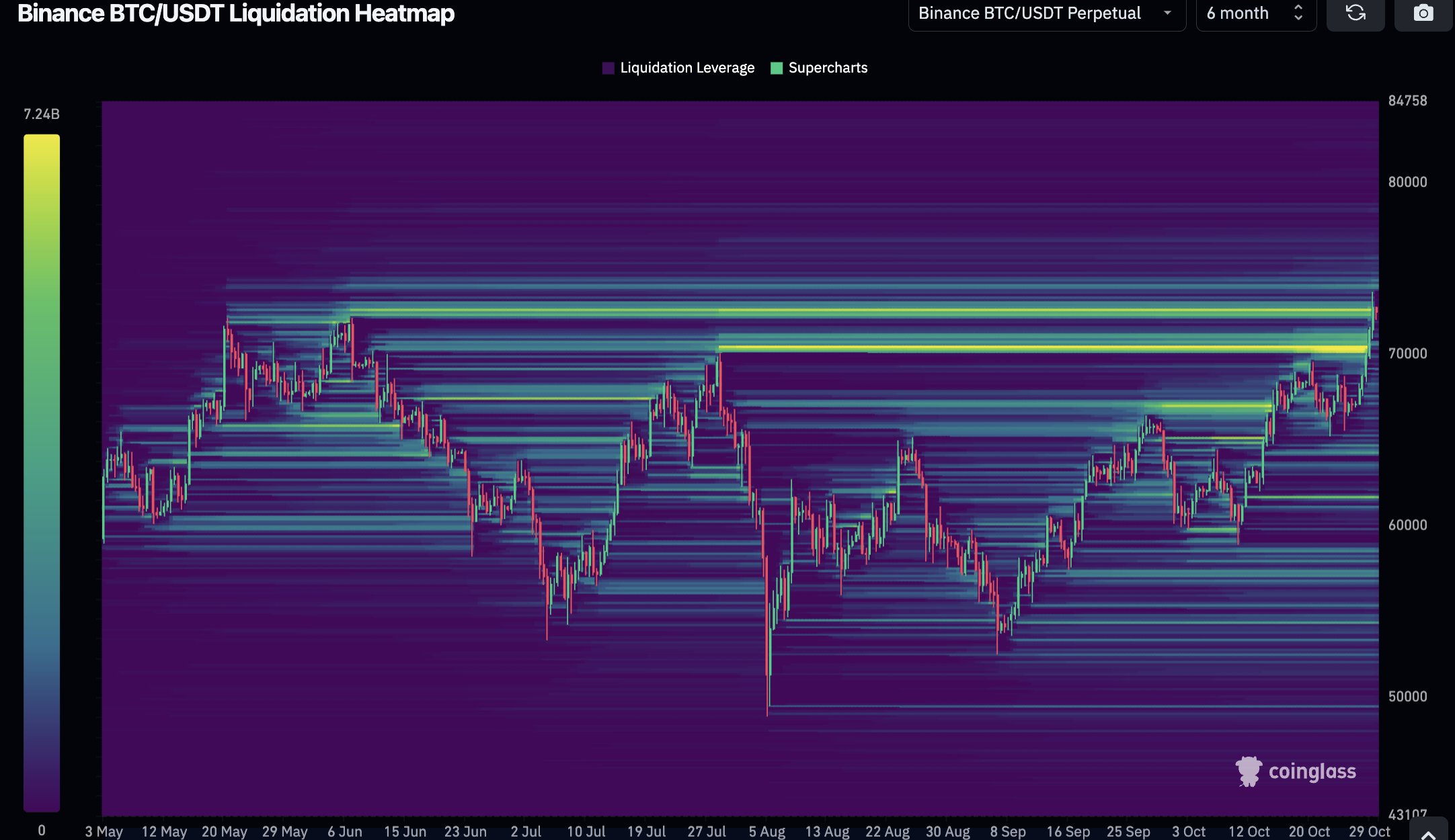

“Bitcoin  $106,342 has taken most of the liquidity we targeted above. The only remaining level is the all-time high. Remember, in a strong trend/price discovery environment, many levels will be left behind, making liquidity charts less useful.”

$106,342 has taken most of the liquidity we targeted above. The only remaining level is the all-time high. Remember, in a strong trend/price discovery environment, many levels will be left behind, making liquidity charts less useful.”

Unlike many analysts, Carl believes that BTC needs to drop to $70,000 before rebounding.

Altcoins face losses ranging between 1-3%. For the overall cryptocurrency market to gain momentum, BTC’s market dominance must achieve a new all-time high, setting the stage for potential altcoin all-time high trials.

Türkçe

Türkçe Español

Español