Despite Bitcoin‘s price exceeding $40,000, some investors are still unsure if we are in a definitive period of recovery. It’s hard to be convinced of a return after a destructive period of 1.5 years, a sentiment shared by many analysts. However, the big bull may come with ETF approval, a detail highlighted by Nate Geraci, which appears to be a leading signal.

GBTC Court Decision

In August, Grayscale won its lawsuit against the SEC, paving the way for other potential ETF issuers. We had shared with you all the details of the process from the first hearing of the case to its victory during the past months. The judge didn’t find the SEC’s ETF rejection decision justified on the grounds of price manipulation. In the US, unresolved problems, political issues, rights and freedoms are usually resolved by such court decisions.

This court decision marked a historic turning point for crypto. As the SEC has approved future BTC ETFs in 2021, it can’t hide behind excuses of price speculation and volatility. As a result, we know that it has been holding discussions with issuers for months, files are being updated and we are getting closer to approval every day. The GBTC decision was the main reason for the SEC to move away from its negative approach and take its counterparts into consideration.

Crypto Bull Run

The SEC is cornered from all sides. If it doesn’t approve the ETF applications that it will receive in the future in January, it may be sued by the world’s largest asset manager, BlackRock, and other trillion-dollar giants. Senators say that they should approve and that this ridiculous attitude cannot be explained by the institution in the future.

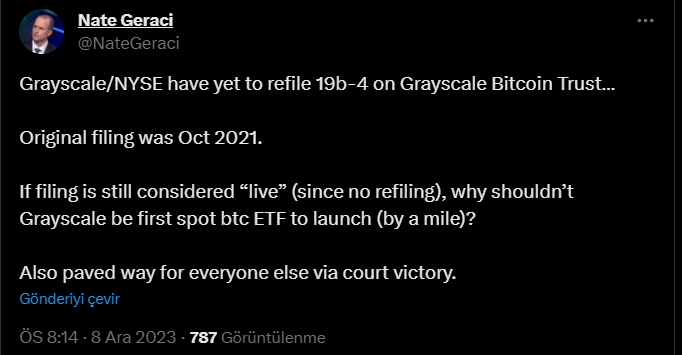

So, the SEC will approve the spot Bitcoin ETF. However, this decision could come much earlier than January 10. The ETF Institute’s founding partner Nate Geraci wrote the following on this subject;

“Grayscale/NYSE has not yet re-filed the 19b-4 file for the Grayscale Bitcoin Trust. The initial filing was made in October 2021.

If the filing is still considered “active” (since it hasn’t been re-filed), why shouldn’t Grayscale be the first spot BTC ETF to hit the market? It also paved the way for everyone else with its court victory.”

Despite the months that have passed, if there is no new application, the SEC may already be preparing to approve GBTC’s conversion from a trust to an ETF. If this is the case, we may see approval for GBTC’s conversion to an ETF before the other ETF decisions on January 10.

Türkçe

Türkçe Español

Español