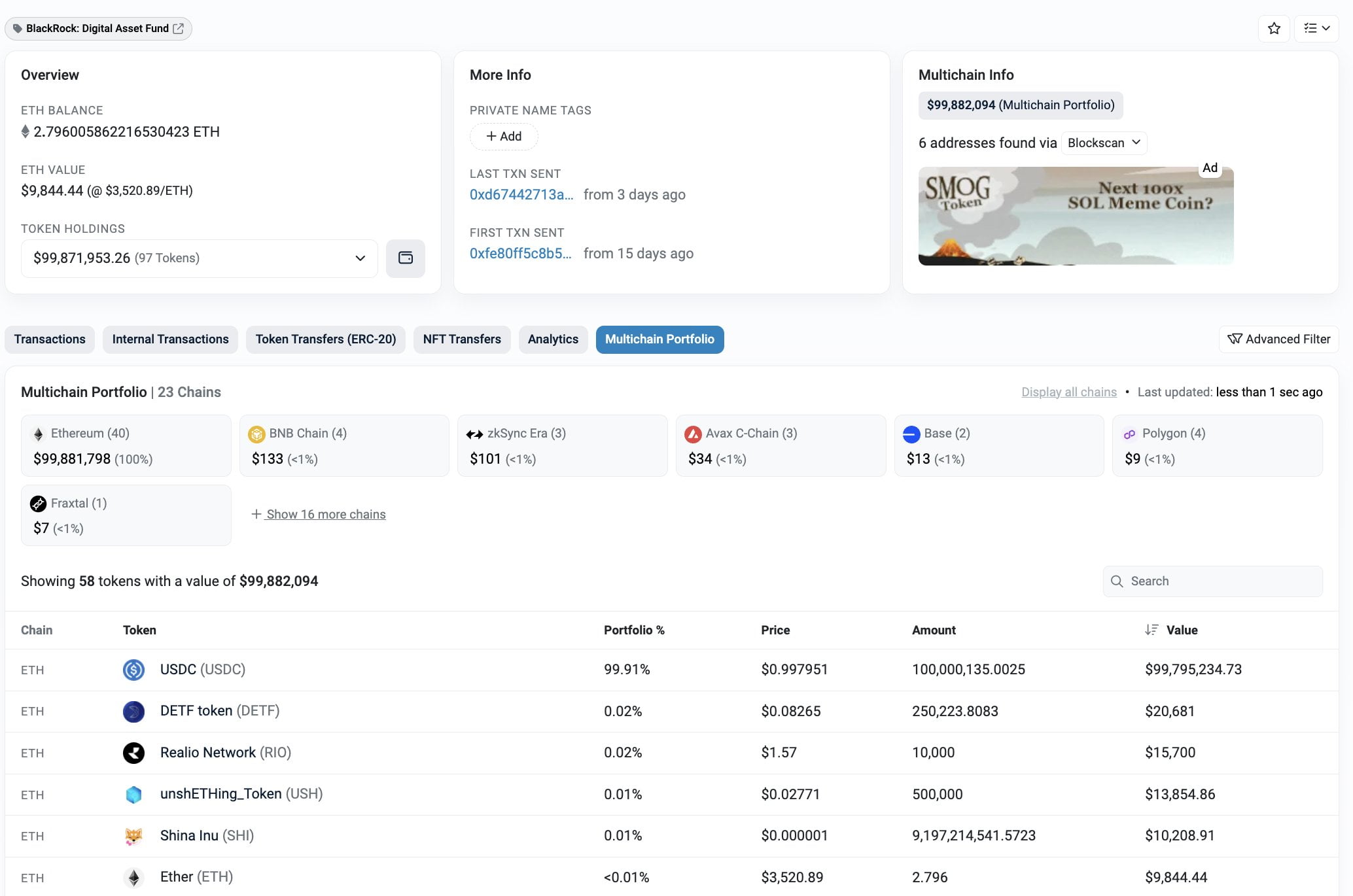

Leading on-chain data provider Spot On Chain reported that following the launch of BlackRock’s first $100 million tokenized fund on the Ethereum (ETH) network, the USD Corporate Digital Liquidity Fund (BUIDL), various memecoins and NFTs worth approximately $100,000 were sent to the fund’s wallet starting with 0x13e… and continue to be sent.

Rain of Tokens Detected in BUIDL Fund’s Wallet

BlackRock‘s tokenized fund wallet on Ethereum has been found to receive thousands of dollars worth of tokens from various wallets. According to on-chain data provider Spot On Chain, the tokenized fund received 250,000 DTF tokens valued at $20,700, 10,000 RICO tokens valued at $15,700, and 500,000 USH tokens valued at $13,900. Data also shows transfers of various other altcoins to the fund’s wallet.

Market observers anticipate that the fund wallet will receive token transfers from a wider variety of altcoin projects. It should be noted that the sending of memecoins and NFTs to BlackRock’s tokenized fund wallet could be attributed to the investors of these projects or the projects themselves.

Until now, such transfers were usually made to the wallets of leading industry figures like Vitalik Buterin for promotional purposes, but with giants like BlackRock entering the sector, the focus has shifted in this direction.

While the transfer of tokens like DETF, RICO, and USH to BlackRock’s fund wallet may be aimed at getting noticed by institutional players, it’s important to remember that various deceptive marketing campaigns could also be conducted through these transfers. Especially, projects sending their tokens to wallets of giants like BlackRock could make claims that these companies have invested in their projects. This highlights the need for investors to be cautious about such initiatives.

BlackRock’s USD Corporate Digital Liquidity Fund

As known, BlackRock had launched the ‘USD Corporate Digital Liquidity Fund’ (BUIDL), which allows investors to earn returns in US dollars, through a collaboration with Securitize, a platform offering a fully digital, regulatory-compliant solution for the issuance and trading of digital asset securities.

BlackRock had withdrawn 100 million USDC worth $100 million from stablecoin issuer Circle six days before establishing this fund. This move marked another significant step for the world’s largest asset management company in the digital asset space, following spot ETFs.

Türkçe

Türkçe Español

Español