MakerDAO may potentially be the first WEB3 platform to introduce tokenized treasury bonds to the market. It is reported that the DeFi protocol is in talks for an experiment with tokenized tokens, which is estimated to require a $100 million investment.

MakerDAO Developments!

There are several reasons why the treasury bond experiment by MakerDAO can change the game for the platform. Every DeFi protocol aims to benefit from a robust service that unlocks powerful liquidity. Facilitating the tokenization and issuance of treasury bonds can unlock significant value not only for MakerDAO but also for users and governments.

Tokenized treasury bonds can blur the lines that restrict access to such investment instruments. This feature can enable anyone from anywhere in the world to invest in treasury bonds. It emphasizes that distributing on-chain assets or tokens pegged to real-world assets is one of the most convenient ways. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Good News for MKR!

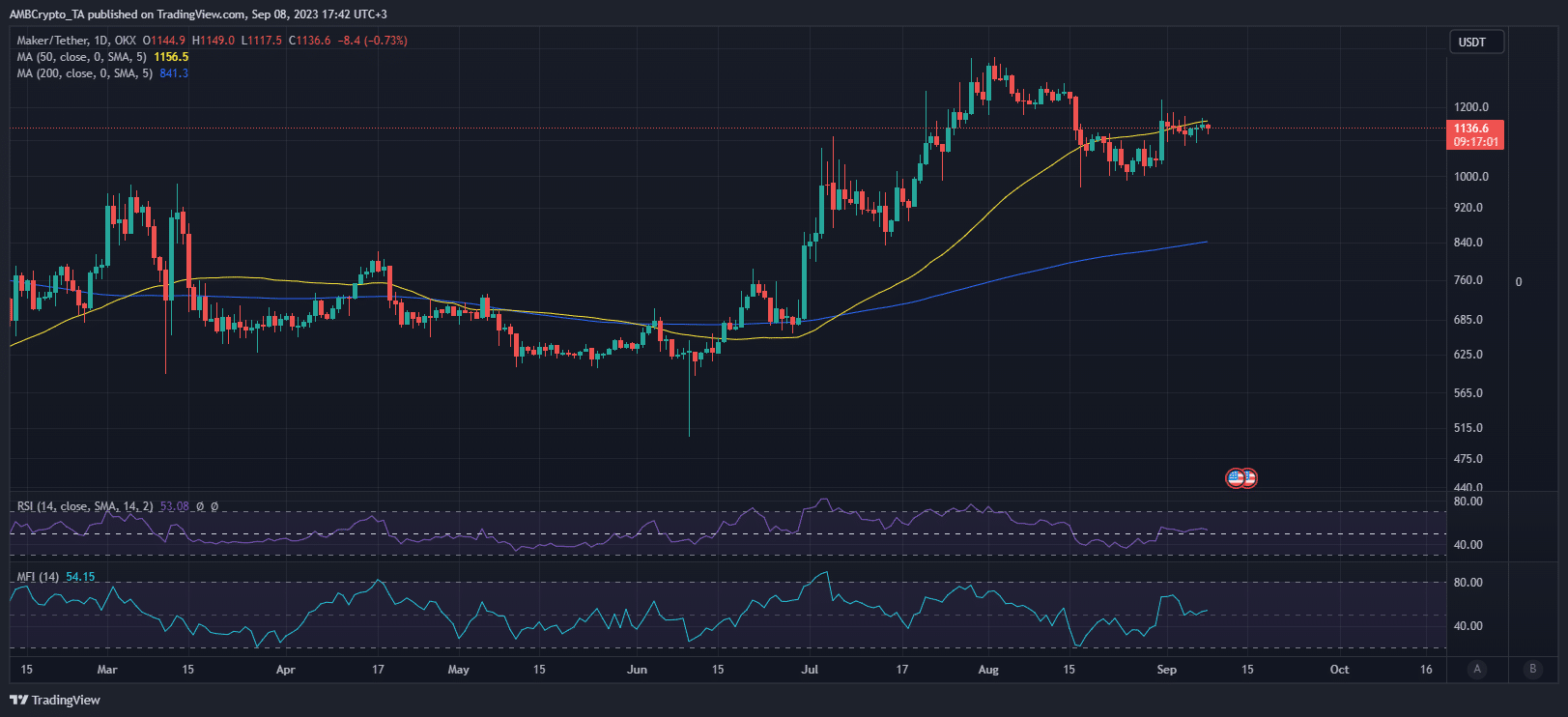

Furthermore, tokenized treasury bonds can unlock more benefits for the MakerDAO protocol. Importantly, initial reports suggest that DAI could play a role in the collateral mechanism. In both cases, this development could be positive for both MakerDAO and the MKR token. MKR has been one of the top-performing cryptocurrencies in terms of market value over the past four months, currently trading at higher levels compared to the lows of June.

However, its price experienced some weakness in August and is struggling to maintain bullish dominance. The Money Flow Index (MFI) for MKR has shown some outflows since the beginning of September. But this is not the only bearish signal. The weighted sensitivity metric closed August on a high note but has since returned to negative levels. Nevertheless, the limited extent of recent negativity may indicate that MKR holders are still optimistic about the future.

Türkçe

Türkçe Español

Español