Telegram-based project Toncoin continues to see a decline in market dominance despite outperforming Bitcoin for much of the year. Before the recent surge, TON faced a challenging two-week period with a 15% drop in price. At the time of writing, TON is trading at $6.79, indicating that the token is not yet out of danger.

What is the Current Status of Toncoin?

Toncoin’s potential decline is primarily driven by the actions of whales. Whales are entities or individuals holding a large amount of a cryptocurrency’s circulating supply, thus their actions or inactions affect prices. According to IntoTheBlock, the netflow rate of TON whales decreased by 97.05% over the past seven days.

This contrasts with the significant inflows from a few weeks ago. Netflow is the difference between large inflows and outflows. A positive rate means whales are accumulating more than they are selling. However, a negative rate implies the opposite, which is the case for TON. A careful review also shows that whales sold 1.4 million TON between July 21-28. If this continues, TON’s recent slight gains could be erased.

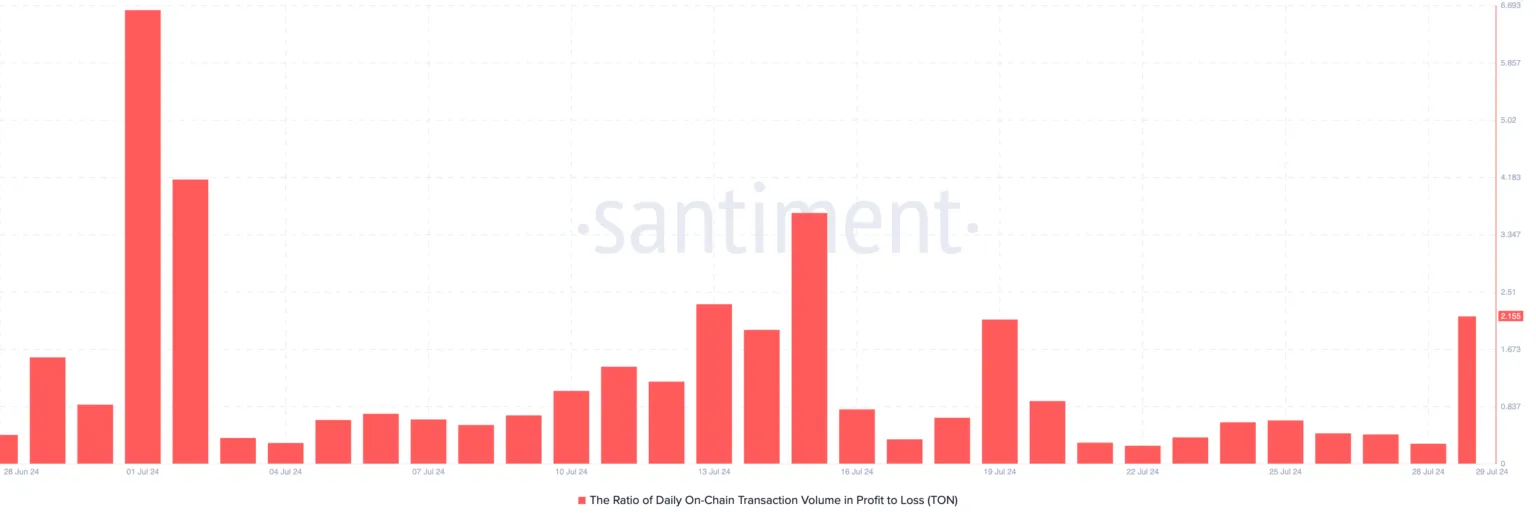

TON’s price increase has led to the highest daily on-chain transaction profit/loss ratio since July 19. This data shows whether token holders are realizing losses or gains. When negative, there are more realized losses than gains. In Toncoin’s case, the price increase has led to a rise in profit-taking. However, profit-taking usually leads to a decline, especially if selling pressure increases. Therefore, if the on-chain transaction profit/loss ratio rises, TON’s upward trend could be halted.

TON Chart Analysis

According to the daily chart, Toncoin’s price increase is not supported by vital indicators. For example, the Awesome Oscillator (AO) is negative. AO measures market momentum and identifies early changes in a cryptocurrency’s price. When AO is positive, momentum increases upward. However, if the reading is negative, as it is for TON, momentum decreases.

Another oscillator showing a similar downward trend is the MACD. At the time of writing, MACD is in the red zone, strengthening the likelihood of a downtrend. If this continues, TON’s price could drop to $6.57. However, if selling pressure increases, the value could fall to $6.02.

However, if whales start accumulating more TON contrary to current trends, the value could recover. If this happens, Toncoin’s price could rise to $6.90 and eventually reach $7.18.