In the bull run of 2021, DeFi coins emerged as stars and provided significant gains to investors. Tokens like AAVE and MKR set an example for the potential in the decentralized finance sector by achieving blue-chip status. As the crypto community prepares for the next bull run, it is crucial to strategize and identify promising assets. In this context, DeFi altcoins that offer both trading and passive income opportunities are standing out. Let’s take a look at 5 altcoins with a high probability of exploding.

COMP Fuels the Revolution

The first contender on our list is COMP, the protocol token of Compound Finance, a leading lending project on the Ethereum network. Compound offers users the opportunity to deposit crypto as collateral and earn annual yields, making it a formidable force. With a market cap of $358,940,000 and priced at $52.48, COMP holds the distinction of being the coin with the highest market value in our selection. According to DefiLlama data, it has a total locked value (TVL) of $2,239,000,000.

JST: Tron’s DeFi Powerhouse

In second place, we have JST, the native coin of JUST, a DeFi project on the Tron Blockchain. JST is associated with JustLend, a lending and borrowing protocol with a TVL of $5,986,000,000, making it an attractive choice for those rising in the Tron ecosystem. With a price of $0.033 and a market cap of $291,000,000, JST currently ranks 147th in the cryptocurrency market.

RDNT: Radiant Capital’s Unique Approach

Next, we have RDNT, the native coin of Radiant Capital, a decentralized application aiming to combine liquidity from Arbitrum, BNB Chain, and Ethereum. RDNT has a distinctive feature that allows securing credits on one chain with collateral from another chain. According to DefiLlama, it has a TVL of $351,800,000. With a price of $0.26 and a market cap of $92,700,000, RDNT currently ranks 321st in the cryptocurrency market.

SILO: Rising Security in Lending

SILO, ranked fourth, is the token of Silo Finance, an unsupervised lending protocol prioritizing security through segmented money markets. SILO, active on Ethereum and Arbitrum, has a TVL of $206,980,000 according to DefiLlama. With a market cap of $18,000,000 and trading at $0.071 at the time of writing, SILO is ranked 761st in the cryptocurrency market.

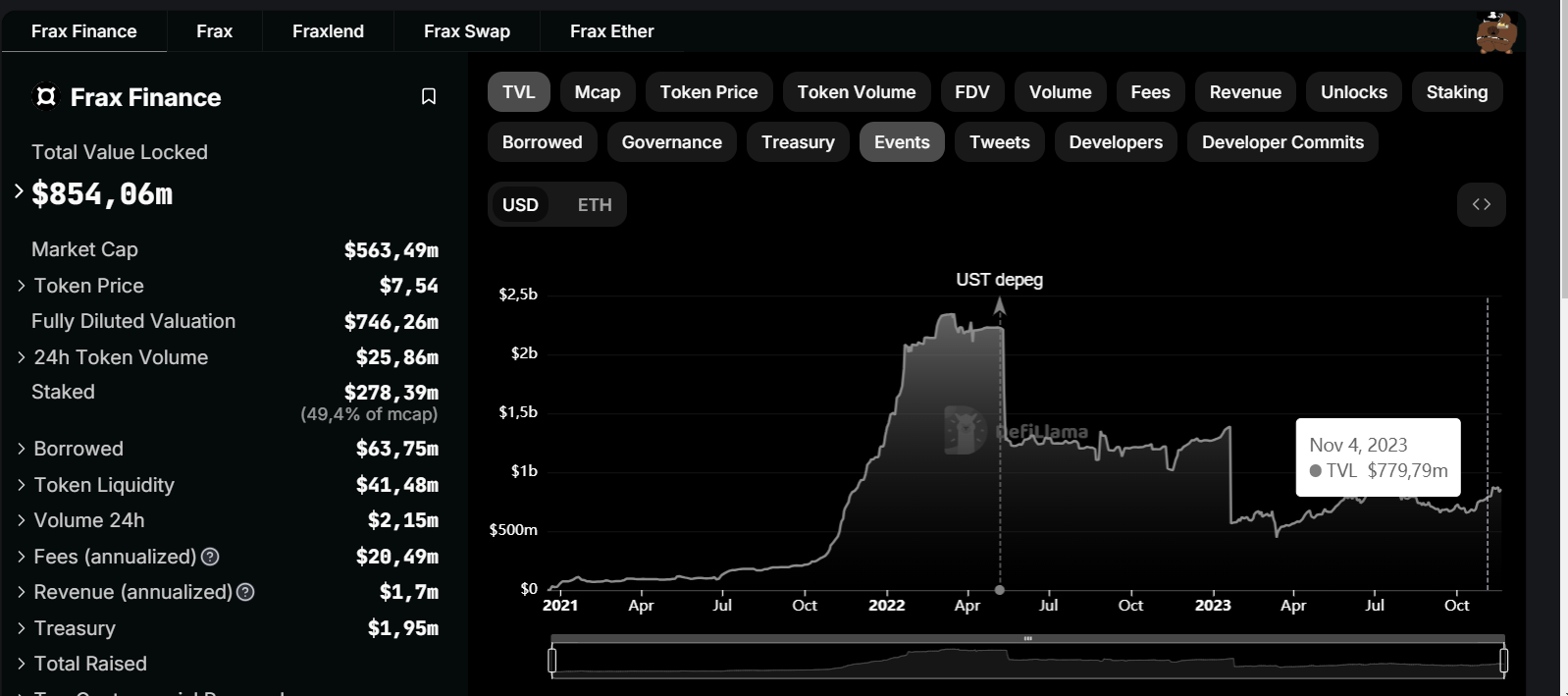

FXS: Strengthening Frax Finance’s Ecosystem

At the end of our list is FXS, the driving force behind Frax Finance. This token contributes to a total locked value of $854,000,000 by fueling products like FraxSwap, FraxFerry, and FraxLend. Priced at $7.54 and with a market cap of $563,490,000, FXS currently holds the 90th position in terms of market value.