We have experienced extremely exciting days for cryptocurrencies in the first quarter of the year, and Bitcoin made its latest all-time high (ATH) in March. They were beautiful, thrilling, sleepless days, and they were worth it. Investors who took advantage of the lows were greatly rewarded over the past 3 months. So, which altcoins made their mark in the first quarter of 2024?

The Best Altcoins

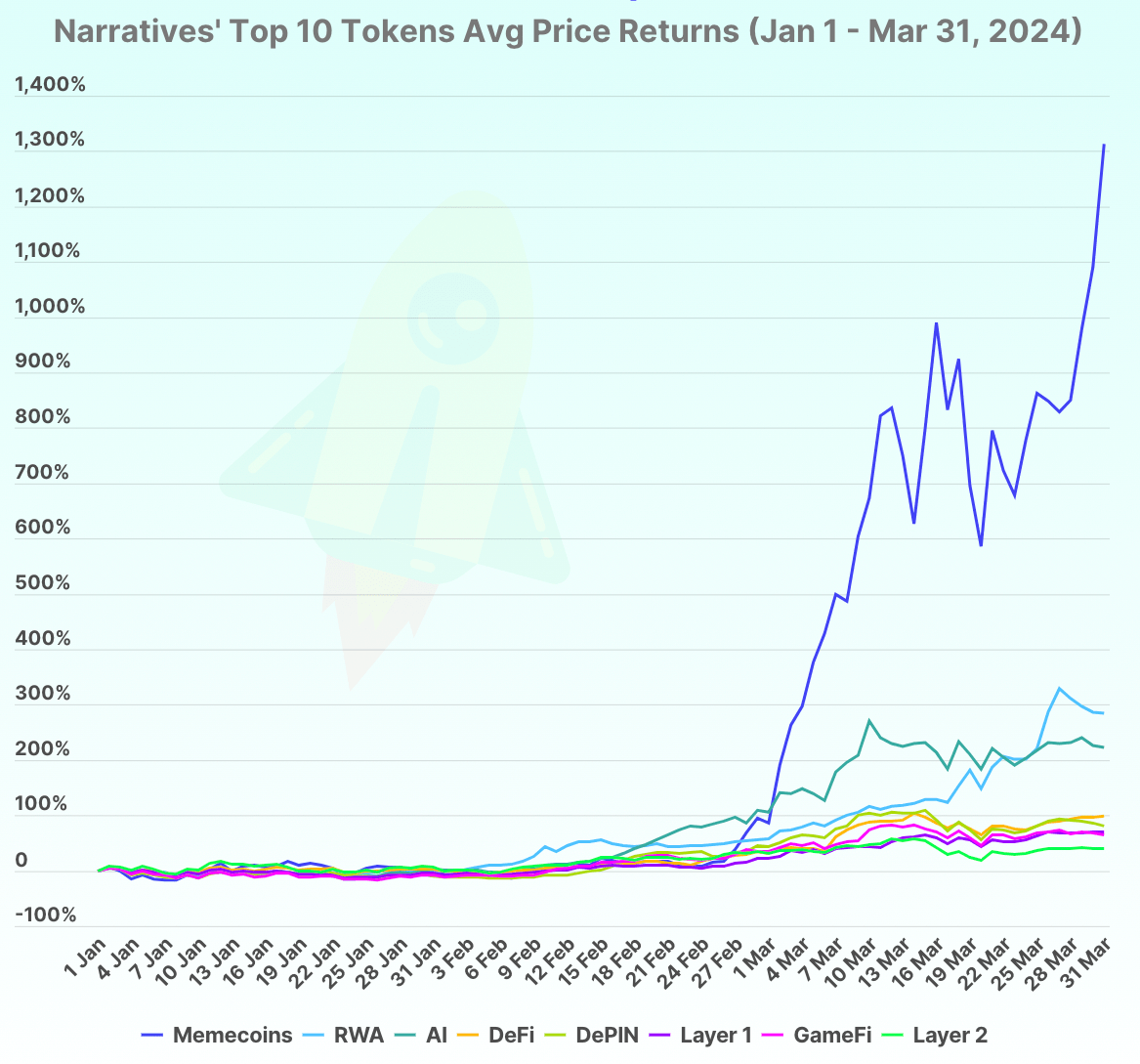

For the majority of investors, the best altcoins are those that bring the highest returns. In the first quarter of the year, the biggest gains were made by meme coins. According to a recent report by CoinGecko, the memecoin sector has experienced one of its most profitable periods to date this year. Memecoins achieved an average gain of 1,312.6% in terms of market value among the top tokens.

Meme coins like Book of Meme (BOME), Brett (BRETT), and Cat in a Dogs World (MEW), which only entered our lives in March, even made it into the top 10 list. BRETT Coin became the highest-earning meme coin in the first quarter of 2024 with a return of 7,727.6%. Dogwifhat (WIF) also made a name for itself with an increase of 2,721.2%.

CoinGecko analyst Lim Yu Qian wrote;

“Especially the memecoin narrative was 4.6 times more profitable than the next best-performing crypto narrative of tokenized real-world assets (RWA) and was 33.3 times more profitable than the least profitable layer2 solutions of this year’s first quarter.”

Meme Coins

We have seen that especially the newly introduced meme coins have been experiencing parabolic rallies for a long time. So much so that the two biggest meme coins by market value, DOGE and SHIB, were overshadowed by them. Nevertheless, we witnessed that these two giants also made notable movements last month, albeit belatedly.

Meme coins’ total market value is around 60.9 billion dollars, accounting for 2.32% of the total value of all cryptocurrencies. However, compared to the last quarter of 2023, the market value of meme coins has experienced an increase of 176.9%.

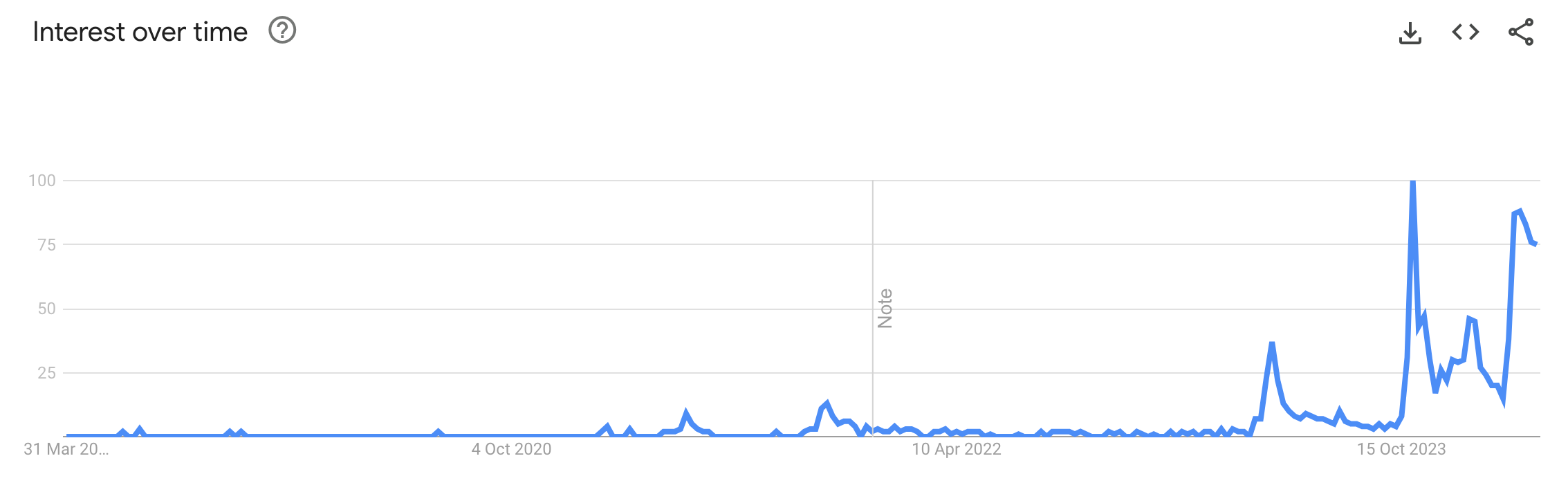

According to Google Trends data, global interest in the term “memecoin” took the indicator to 88 last month. Considering that this level of interest was only seen once in the past five years (the previous was higher), it’s not hard to understand the unique performance.