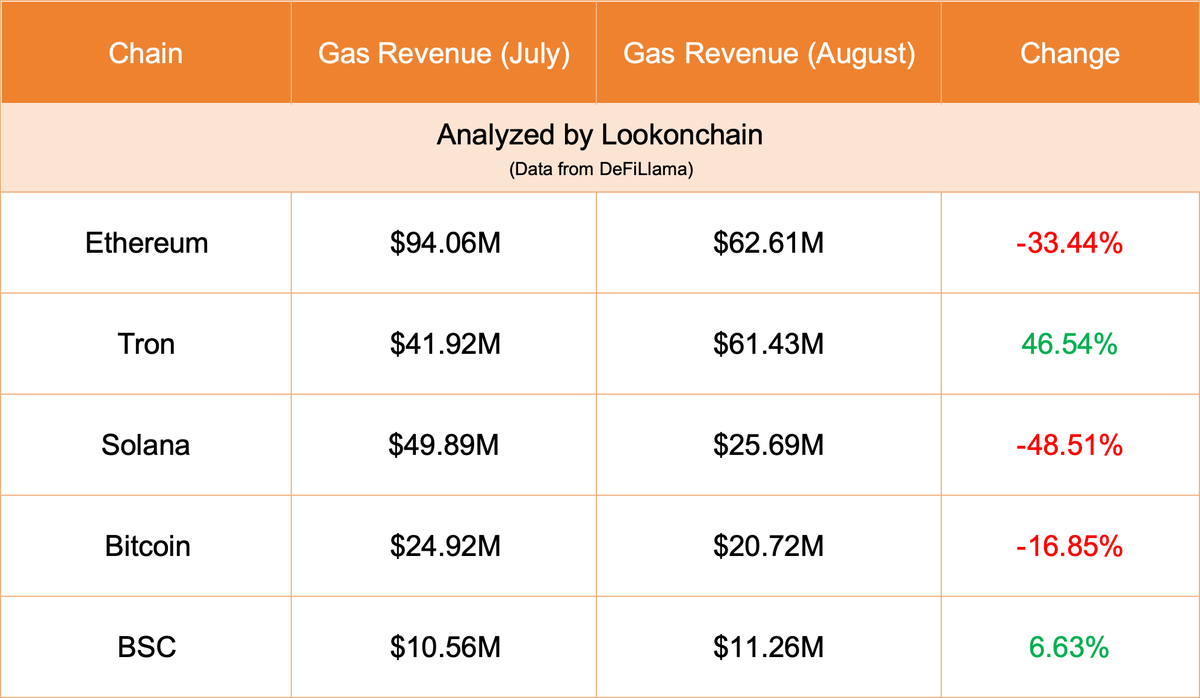

According to Lookonchain’s data, in August, Tron Network‘s transaction fee revenues increased by 46.54% compared to the previous month. The rise in transaction fee revenues is seen as an indicator that the Tron network is attracting more users and transaction volume.

Tron Rises While Ethereum, Solana, and Bitcoin Decline

BNB Smart Chain (BSC) also showed positive performance in August, recording a 6.63% increase in transaction fee revenues. The same period did not show a similar trend for other major Blockchain networks. According to the data, Ethereum‘s transaction fee revenue decreased by 33.44%, Solana‘s by 48.51%, and Bitcoin’s by 16.85%.

The impressive transaction fee revenue performance of Tron Network is a result of the network’s low-cost transactions and high speed, which are preferred by investors and developers. Especially decentralized finance (DeFi) applications and NFT marketplaces significantly contribute to the growth of the Tron network.

BSC‘s more modest increase in transaction fee revenues compared to Tron shows that the network maintains its popularity and users benefit from low transaction fees. The decline in transaction fee revenues in more established and popular Blockchain networks like Ethereum and Solana indicates that their user base and transaction volume are weakening.

Users Avoid High Transaction Fees

On the other hand, the significant drop in transaction fee revenues on the main network of the largest altcoin ETH has led to comments that users are avoiding high transaction fees or preferring alternative Blockchain networks. Similarly, the declines in Solana and Bitcoin networks are interpreted as a decrease in investor interest in these networks.

While it is uncertain whether the trend of increasing transaction fee revenues in Tron and other Blockchain networks will continue, the main determinants seem to be hypes, trends, future network updates, user feedback, and the overall state of the cryptocurrency market.