Bitcoin (BTC) began trading below the $70,000 threshold on Wednesday. The recent pullback of Bitcoin over $70,000 led to declines exceeding 5% in many altcoins, including Ethereum (ETH). The volatility in the cryptocurrency market has caught the attention of investors awaiting clues about interest rates ahead of the US inflation data release.

Eyes on US Inflation Data Release

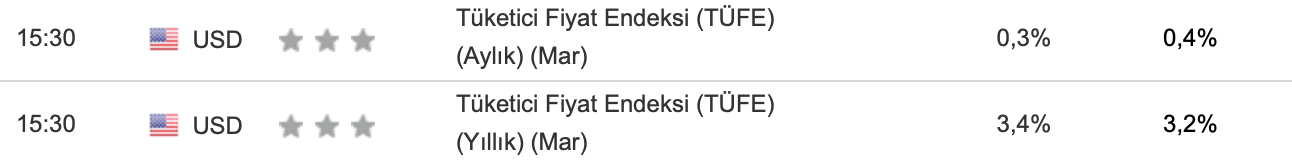

The recent movements in the cryptocurrency market are primarily attributed to the US inflation data for March, set to be announced today at 15:30 GMT+3. Inflation in the US is expected to show a 3.4% year-on-year increase and a 0.3% monthly increase for March. Excluding volatile items such as food and energy, the core inflation rate is anticipated to rise by 3.7% annually and 0.3% monthly.

A Bloomberg survey with economists indicates expectations of some easing in the March inflation figures. This suggests that the Federal Reserve might have more room to consider interest rate cuts.

Current Status of Bitcoin and Altcoins

As the market awaits the US inflation data, the largest cryptocurrency, Bitcoin, reversed its direction after reaching $72,668 earlier in the week and fell to $68,381 on April 9. At the time of writing, Bitcoin is priced just below the psychologically important threshold of $70,000. Data shows that Bitcoin’s price has increased by 63.93% since the beginning of the year.

Following the recent pullback in the largest cryptocurrency, the altcoin market also faced selling pressure, with many altcoins experiencing sharp declines. The ‘altcoin king’ Ethereum’s main network asset, ETH, is trading at $3,515, down 5.03% in the last 24 hours at the time of writing. ETH’s price has risen by 54.09% since the start of the year.

According to the crypto data and price platform CoinMarketCap, the top gainer of the day is Fantom (FTM), trading at $1.03 with a 10.34% increase, followed by Bittensor (TAO) and Toncoin (TON), trading at $597.48 and $6.79 with increases of 5.84% and 5.11%, respectively.

Short-term fluctuations in the prices of BTC and altcoins are expected as a result of the upcoming US inflation data release.

Türkçe

Türkçe Español

Español