Just as in the previous days, the price of Bitcoin is currently trading close to $27,000. Apart from intermittent drops, the price is predominantly stable within a narrow range. But why is this so? What’s more, what does the future hold for cryptocurrencies? We are here to dissect current data, expectations, and crypto predictions.

Why is the Crypto Market Stagnant?

Bitcoin seems to have found a home in the $27,000 price range. Despite notable increases in the price movement, Glassnode reports that the current level of 2023’s Bitcoin Coin Destruction Day remains lower compared to the high destruction seen during the 2021 bull market. This indicates that long-held Bitcoins remain inactive against the long-standing baseline, and haven’t changed hands yet.

The Average Dollar Investment Age (ADIA) metric of Bitcoin corroborates this. As per Santiment, when an asset’s ADIA increases (as is typically the case for most coins), investments associated with this asset become progressively less active over time. However, when this metric increases over several months, it’s a cause for concern as it usually signifies stagnation within the asset’s network, making it difficult for the price to increase.

Data from Santiment reveals a consistent rising trend in Bitcoin’s ADIA since February, suggesting that long-held tokens are refusing to change hands. Interestingly, this occurred despite the significant price increase that marked the first quarter of the year. Investors seem to avoid trading, which dries up the market liquidity, causing Bitcoin’s price to seem stuck in a narrow range.

It’s worth noting that this stagnation also impacts altcoins.

Insights on Bitcoin and Altcoins

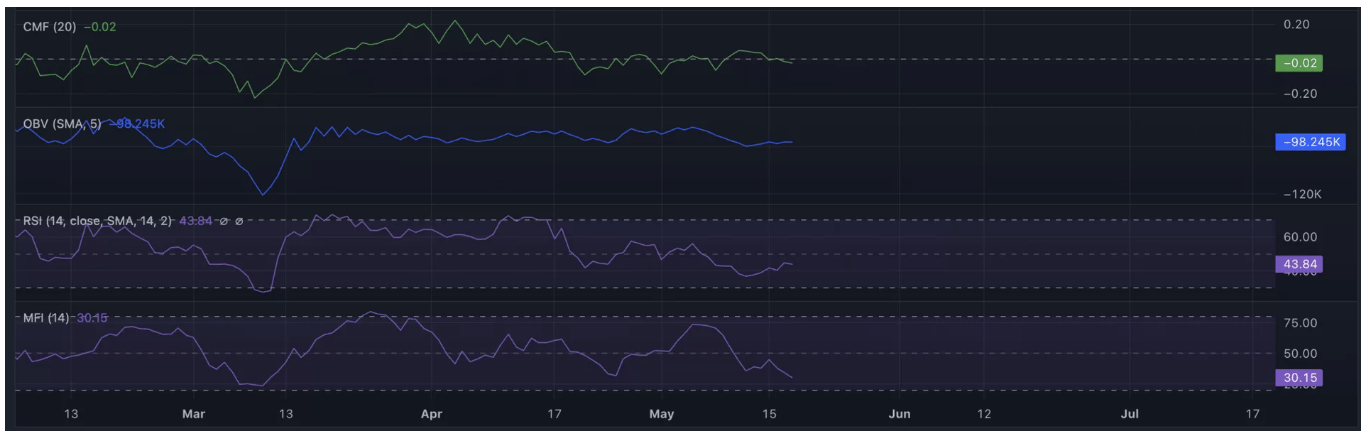

At the time of writing, momentum indicators for Bitcoin point to a downturn. The Money Flow Index (MFI) emphasizes overselling. The RSI is below the neutral zone, falling as low as 42.7. The Chaikin Money Flow slipped into the negative range on May 16 and has stayed there since, indicating a continued outflow of money from BTC pairs.

While the addresses with assets ranging between 1000 to 10,000 BTC have increased despite the sideways price movement, the negativity in Bitcoin’s price affects altcoins even more adversely. Powell’s statements scheduled for 6 pm tomorrow, along with the following developments, could determine a clear direction for the price in the coming days:

- U.S. PMI data on May 23

- Fed Minutes on May 24

- U.S. Core Personal Consumption Expenditures on May 26

If the PMI is low, Fed Minutes signal a near approach to the interest rate ceiling, and Core Personal Consumption Expenditures come in below expectations, cryptocurrencies could find the support necessary for a rally. As of now, the speech by the Fed Chairman set for 24 hours later seems to be the most important imminent development that could influence the price in the short term.