Cryptocurrency investors often overlook Bitcoin (BTC) supply inflation. Understanding that predictable inflation still has economic impacts can be beneficial for investment outcomes in this market.

Bitcoin Price and the Critical Inflation Metric

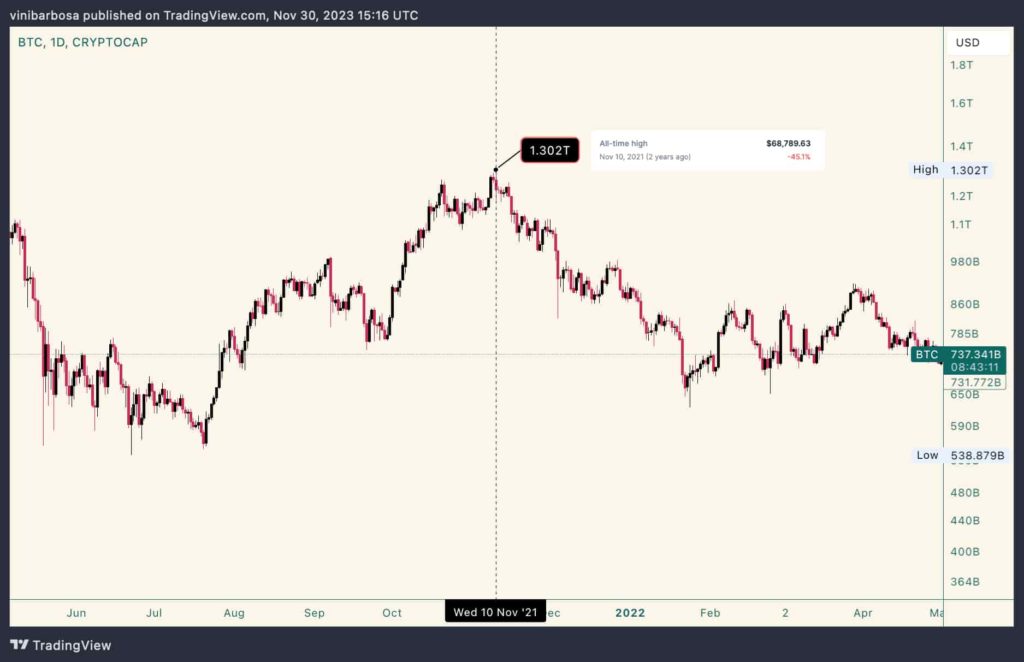

The inflationary supply of a commodity requires more demand to maintain its value. These two factors affect whether the price of a commodity, including every cryptocurrency unit, will rise or fall. According to the TradingView index, on November 10, 2021, Bitcoin had the highest market value of all time, at $1.302 trillion.

BTC was trading at a high price of $68,789 as recorded by CoinMarketCap. Calculations showed a circulating supply of approximately 18.927 million BTC at that time. On November 30, there was a circulating supply of 19.557 million cryptocurrencies. This represents a supply inflation of 630,000 BTC (3.32%) over two years, or approximately 1.66% per year. Price projections also illustrate the relevant economic effects of this inflation.

Current Data on BTC

If the leading cryptocurrency reaches its highest speculative demand with a market value of $1.302 trillion, BTC could trade at a lower price proportionally from its all-time high. Considering the circulating supply at the time of writing, Bitcoin would trade at a high capitalization of $66,574. Additionally, there was a loss of $2,215 (3.2%) compared to the previous price in 2021.

However, this could still indicate a potential increase of 77% from the current price of $37,600. It is important to understand that Bitcoin would require the same demand as in 2021. There is no guarantee that this demand will be seen again, yet it is also possible that demand will increase in the coming years. Considering the current supply of Bitcoin, a potential price increase of 77% is anticipated in the coming years if demand increases. This highlights the uncertainty of future demand for Bitcoin and advises investors to adopt a cautious approach.

- Cryptocurrency supply inflation impacts market.

- Bitcoin’s economic structure influences its value.

- Potential for future demand raises investor caution.

Türkçe

Türkçe Español

Español