The king cryptocurrency is considered within risk markets and frankly, most investors view it like a tech stock. Although Bitcoin has proven to be an asset class of its own for a long time, it continues to have a high correlation with the US stock exchange SPX. However, this also opens up an important channel. Here are the details.

BTC and S&P 500 Correlation

For those who don’t know, SPX or S&P 500 encompasses America’s largest 500 companies. This represents about 75% of the total stock market size in the region. SPX, which generally shares a positive correlation with Bitcoin, responds to macro developments similarly to cryptocurrencies. This is because BTC, SPX, and the rest of crypto are grouped within risk markets, and this is the investors’ approach.

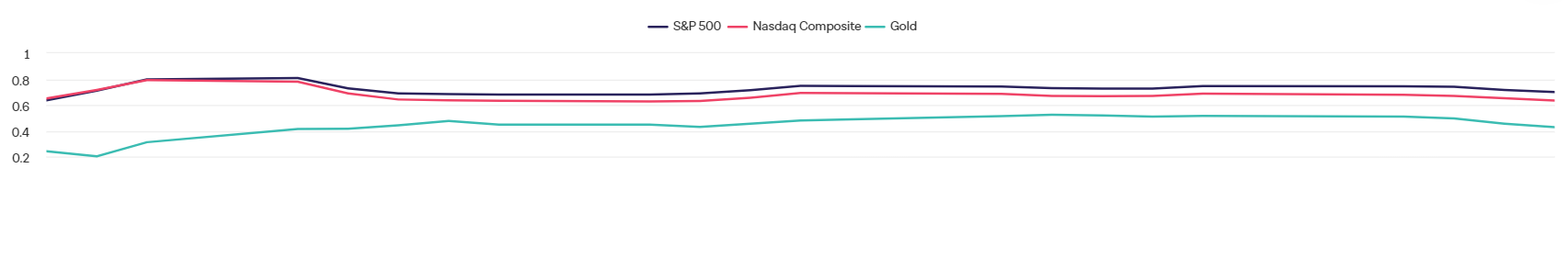

The graph above shows the correlation over the last month. Although the correlation with gold has weakened somewhat, it remains strong with SPX.

Current Commentary on S&P 500

The US stock markets continued their strong performance last week and have been rising for 9 weeks. If the streak completes 11, it could surpass the period from 1985. In 2023, SPX’s gain of more than 24% reflects the increasing expectation of interest rate cuts for this year.

Despite the profit-taking at 4,793 on the SPX front, the trend is upward. However, the RSI has created a negative divergence, which could be an early warning for a decline. Sellers will struggle to pull the index below 4,690, and the 20-day exponential moving average will continue to act as a key support here.

If we see a bounce from support or the current range, the 5,000 psychological resistance could be tested. And of course, this is positive for BTC. In the opposite scenario, a drop to 4,502 in SPX is expected.

US Dollar Index Commentary

The Dollar Index (DXY) measures the performance of the dollar against a basket of selected currencies (with distributions ranging from 57.6% to 3.6% for EUR, JPY, GBP, CAD, SEK, and CHF, in that order). Looking at the DXY performance, there has been a wide fluctuation between 101 and 108 for several months. On December 27, we saw a move to support, and the 102.26 level is expected to take on the role of strong resistance.

If it drops below 101, the 99.57 level could be seen, which would mean more upside for BTC. A falling DXY (weakening dollar) helps the BTC price to rise.

Türkçe

Türkçe Español

Español