Short-term price movements are not that important because even when we look at periods of 6 months to a year, the picture is completely different. The losses experienced by investors due to the excitement of short-term movements do not concern professionals who focus on long-term projections. Indeed, as this article was being prepared, BTC experienced a drop back down to $42,000, and this happened solely because Powell stated there would be no rate cut in March.

Why Is Bitcoin Falling?

Fundamentally, it’s related to Powell’s statements. A few hours ago, Powell, as expected, said there would be no interest rate cut in March. In our pre-meeting expectation analysis, we had written that the markets continued to be influenced by what we could call froth, an excessive optimism. While the Fed insisted on a 75 basis point cut, investors (despite the bad experiences of the previous two years) were overly optimistic, expecting a 150 basis point cut.

The Fed has started to remove this froth and clearly stated that there will be no cut in March. Most likely, a message that a cut will begin in May or that cuts will be made cautiously and slowly will be conveyed if there is no massive relaxation in employment and inflation does not rapidly approach 2%.

A small note, after the bankruptcy lawyer announced that the FTX exchange would not be restarted, our warning when the price was at $3 found its place. The price of FTT at the time of writing this article is at $2.2, and it seems likely that this price will also go down, except for upward movements caused by the liquidity escape of speculative traders.

84% of Investors and Crypto

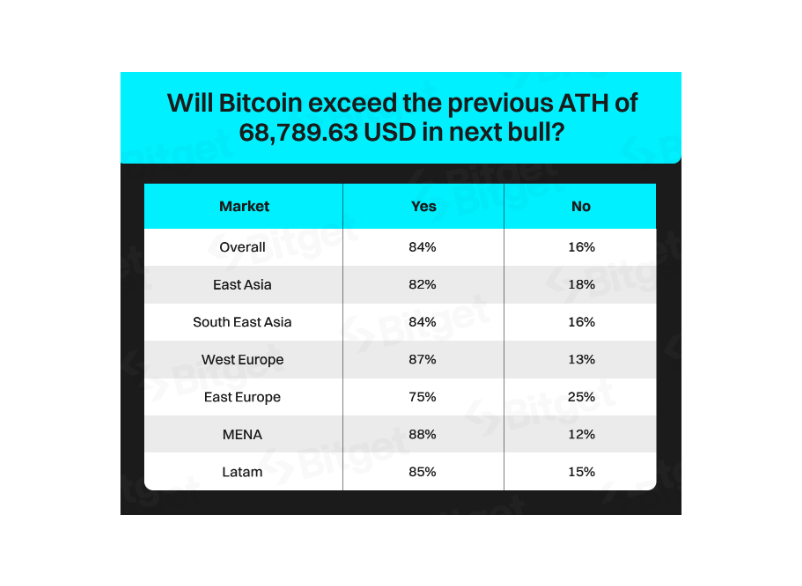

A market survey covering about 10,000 crypto investors was conducted. This is quite a significant number of participants, especially in the crypto field. According to this research, the upcoming halving is still seen as a catalyst for the rise in BTC price despite everything. 9,748 people participated in the study between November and December 2023.

According to this, 84% of the participants expect Bitcoin to exceed its all-time high of $69,000 from the 2021 bull market after the new halving. Following a prolonged bear market, investor optimism was strong, and 84% appeared inclined to sell at the peak after the halving.

Paul Sztorc had predicted at the end of last year that BTC could reach the new ATH region 18 months after the halving event.