The crypto world was shaken in the early hours of the day by the brief emergence of a spot Bitcoin ETF approval, which turned out to be fake. The leading crypto data platform Greeks.live emphasized that the fake ETF approval caused high volatility in Bitcoin (BTC), noting that the ETF’s propelling effect on Bitcoin was understood to be limited.

Greeks.live: Fake ETF Approval News Did Not Increase Predicted Volatility

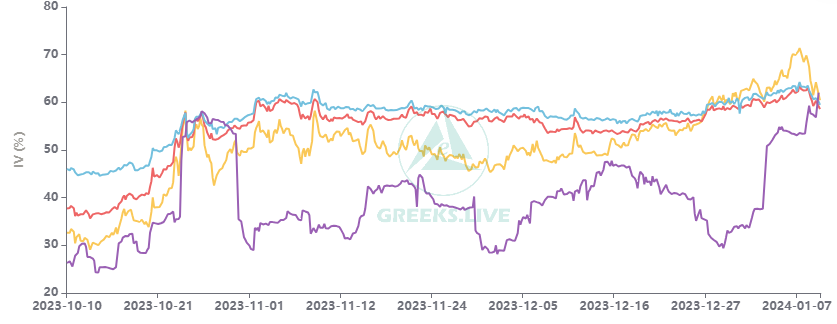

The crypto data platform Greeks.live evaluated the market activity following the fake spot Bitcoin ETF approval. The platform noted, “The SEC’s fake ETF approval nonsense caused high volatility in BTC,” emphasizing that Predicted Volatility decreased instead of increasing:

The SEC’s fake ETF approval news caused high volatility in BTC, and the events were even stranger than expected. Although the sharp movements significantly pulled up the Realized Volatility (RV), the Predicted Volatility (IV) dropped a bit. The logic of these data is different from the norm because the ETF has been priced for over a month, and many investors have been investing in this narrative. This suggests that short-term IV might have reached its highest level recently.

The fake ETF approval news revealed that the majority of investors understood the limited propelling effect of the ETF on Bitcoin, and on the other hand, it exhausted the already fragile power of the game, with many investors carrying out leverage and position reduction operations earlier than planned.

Interpreting Realized Volatility and Predicted Volatility

Realized Volatility and Predicted Volatility, pointed out by Greeks.live, are two different measures of volatility used in both traditional financial markets and the crypto market.

Realized Volatility refers to the volatility calculated based on past price movements. It is typically measured using the standard deviation of price changes over a specific time period and reflects actual market conditions. This is a backward-looking measure of volatility and can also be called historical volatility.

Predicted Volatility is a measure of volatility derived from option prices. Option prices are based on various factors that determine the value of the option, one of which is volatility. Predicted Volatility is calculated by extracting or deriving from option prices. It indicates how much uncertainty market participants expect about future price movements. In other words, Predicted Volatility is considered an indicator that predicts future volatility.

Both measures of volatility play an important role in risk management and pricing in markets. While Realized Volatility reflects past performance, Predicted Volatility expresses the uncertainty about the future.