There has been a significant decline in the cryptocurrency markets in the past 24 hours. Some altcoins have experienced losses of over 5%. UNI Coin is one of them, and investors may be trying to reduce their risks as BTC is preparing for a major breakthrough. So, what price levels can we expect for UNI Coin in the coming days?

UNI Coin Analysis

The price of UNI Coin dropped to its lowest level of the week at $5.5 today, with a daily loss of 7%. Moreover, it brought the losses for August 2023 to around 17%. On-chain data indicates that whale investors have started to enter the market during this downturn.

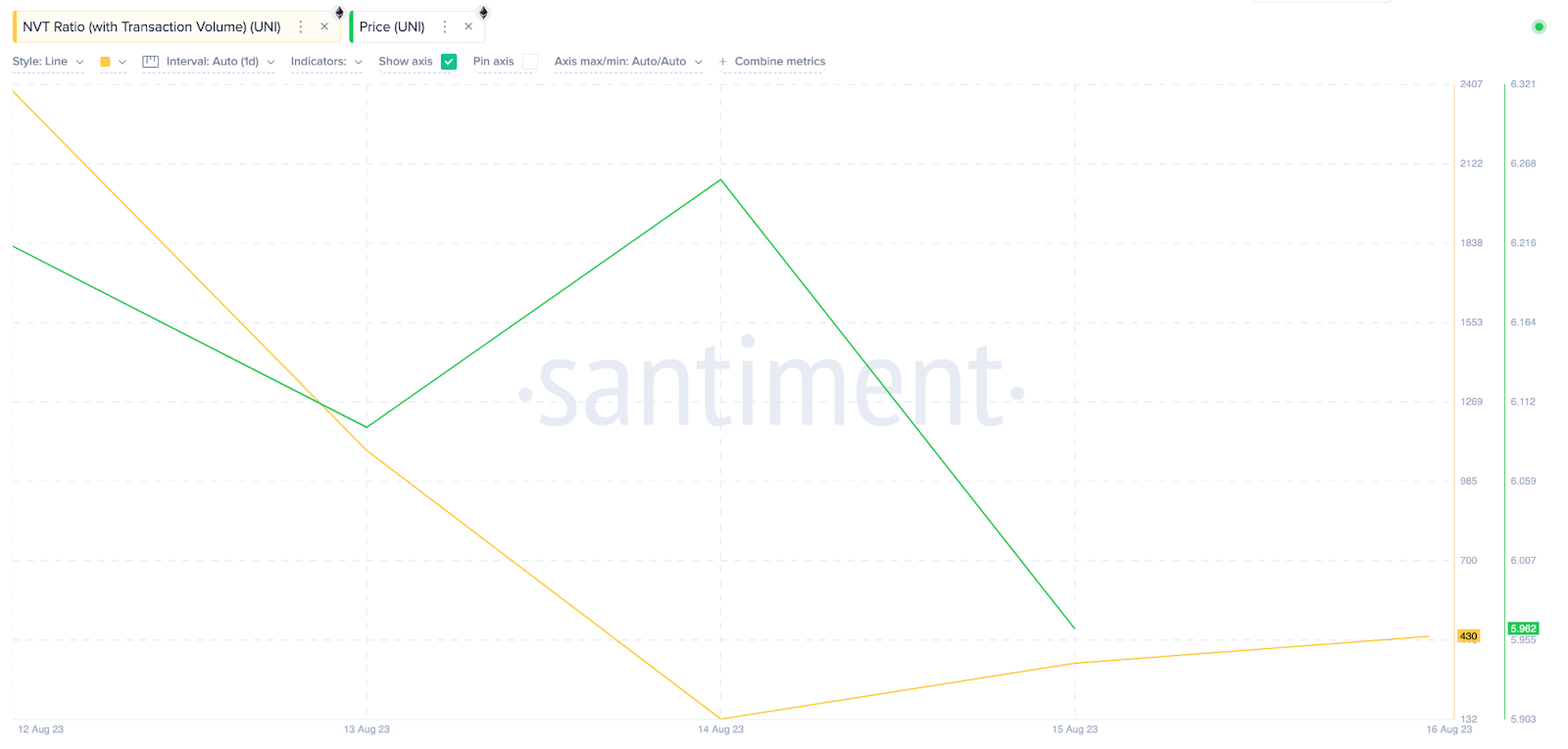

Uniswap underperformed in the first half of August 2023. However, with losses nearing 17%, whale investors have become active. Data provided by Santiment shows that UNI whale transactions have increased tenfold this week. The chart below shows that Uniswap recorded only 3 Whale Transactions on August 12th. Remarkably, it reached 38 and 34 Whale Transactions on August 14th and 15th, respectively.

Large transactions allow investors to execute high-volume trades at favorable prices, providing much-needed market liquidity. Furthermore, the presence of whales enhances individual investors’ confidence.

Will UNI Coin Price Increase?

Currently, the price of UNI is dangerously trading below $5.60. Price charts indicate that UNI has lost more than 16% of its market value in the first half of August. As the losses increase, many indicators have started to send oversold signals. For example, NVT decreased by 82% between August 12th and 16th.

This decrease is a typical signal of a recovery, of course, under normal market conditions. If BTC does not enter a major downtrend, the price is likely to increase due to the aforementioned reasons. The $5 support is crucial for the continuation of the bullish outlook. On the other hand, resistance levels at $6.4 and $7 are likely to be tested.

At the time of writing, the price of Bitcoin is at $29,150, and the possibility of interest rate hikes in the upcoming meeting is extremely low. However, US macro data suggested that the Fed may need to tighten further.

Türkçe

Türkçe Español

Español