Uniswap Foundation’s latest proposal, aimed at strengthening the governance of the Uniswap Protocol, has sparked a significant debate within the crypto community. A blog post published on the Wu Blockchain platform by Chinese crypto journalist Colin Wu addressed the fundamental elements of this proposal. Consequently, discussions on the subject continue.

What Does the Uniswap Proposal Intend?

Uniswap Foundation’s governance lead, Erin Koen, emphasized on February 23rd that the proposal aims to encourage active, relevant, and thoughtful delegation. If approved, the proposal is thought to enhance the foundation’s flexibility and its decentralized structure.

As Wu’s article points out, while Uniswap Labs is a commercial company, the Uniswap Foundation is a non-profit organization focused on the management of the protocol and community development. This distinction is highlighted as important because, although the proposal has been presented by the foundation, Labs has not yet made an official statement on the matter.

According to analyses, while Uniswap’s annual Liquidity Provider (LP) fee is around $626 million, the annual profit share for UNI token holders can vary between $62.62 million and $156.5 million. This situation could potentially bring significant income to UNI holders.

Long-Term Success and Flexibility to Be Achieved

Uniswap Foundation Executive Director Devin Walsh argues that the proposal will provide not only short-term but also long-term success and flexibility. Encouraging active delegation is emerging as a critical element for the long-term sustainability of the protocol.

Uncertainties continue regarding the acceptance and passage of the proposal. According to Wu, this proposal actually aims to transform the UNI token into a utility token. If the proposal fails, other institutions or community leaders may make efforts for a similar transformation.

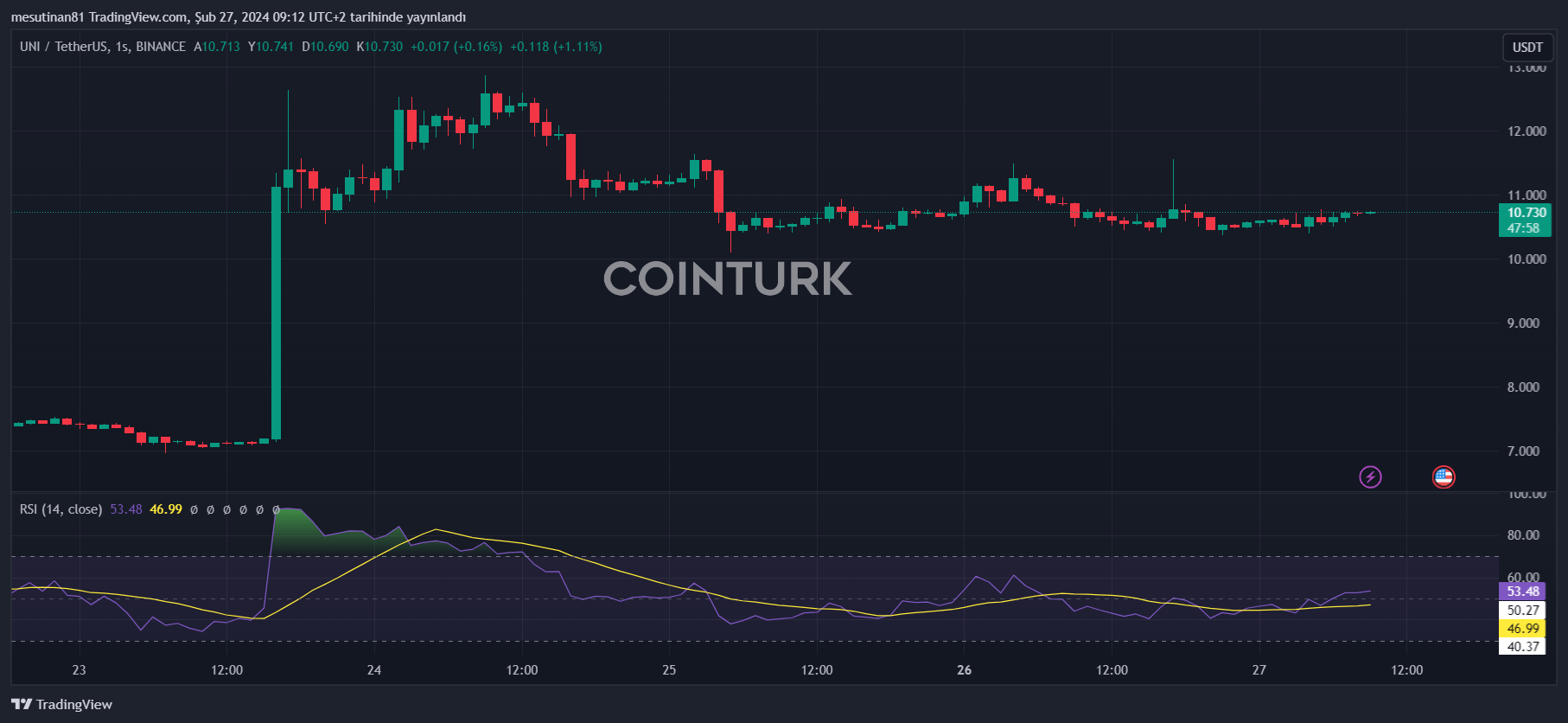

Following the proposal, it should be remembered that the UNI token experienced a rapid increase. The cryptocurrency UNI, which showed a significant increase of over 40%, rose from $7.24 to $10.22. Despite a 4.36% drop in a 24-hour period, the cryptocurrency UNI is currently trading at $10.73, showing a weekly gain of 41.3%. During the rise, a wallet holding 5.44 million UNI tokens benefited from the increase and sold 90,000 tokens for $1.03 million. After the rise, we see that the UNI price has leveled off.

Türkçe

Türkçe Español

Español