Uniswap Labs recently announced the launch of its blockchain, Unichain. This move raised concerns about decentralization among UNI coin holders. Some major coin holders began to question Uniswap’s commitment to its decentralized structure when making significant decisions.

Did They Bypass DAO Decisions?

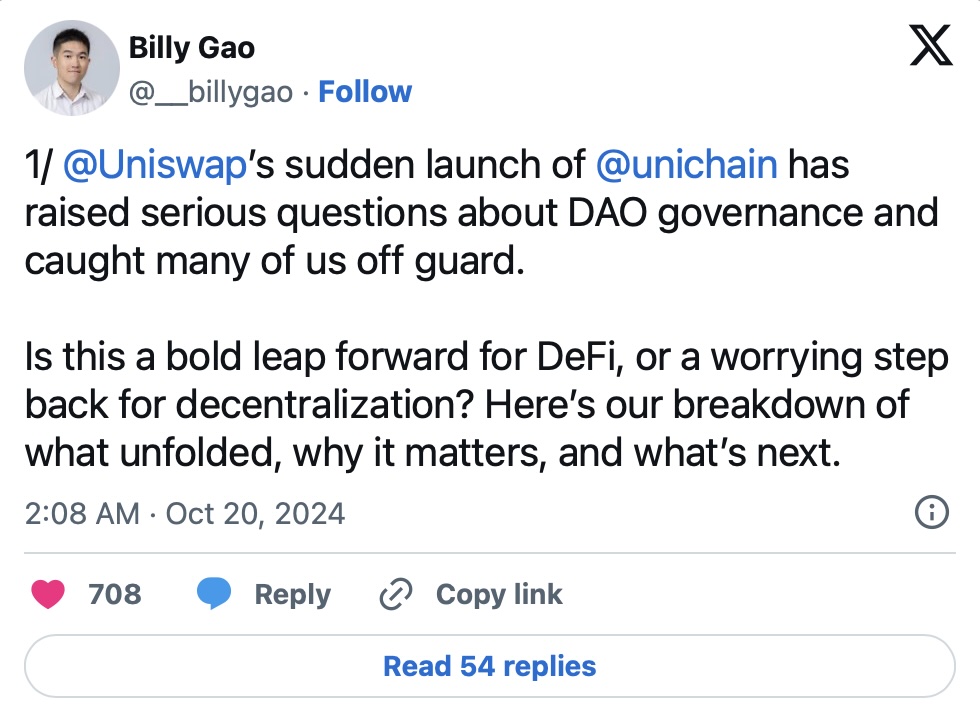

Billy Gao, the director of cryptocurrency management at Stanford University, criticized this development through 22 social media posts. Gao stated that the rapid launch of Unichain surprised many and suggested that the decentralized autonomous organization’s (DAO) decision-making process was overlooked. He expressed his concerns by asking, “Were delegates kept in the dark regarding this move? How much say do coin holders really have?”

Gao also speculated that Uniswap might have made agreements with Optimism behind the scenes. Optimism, a Layer-2 solution in the Ethereum  $2,520 ecosystem, has a market value that is less than one-fifth of the total value of Ethereum’s Layer-2 solutions. He questioned why Uniswap chose Optimism over Arbitrum, which has a market value twice as large, suggesting that there might be other dynamics at play.

$2,520 ecosystem, has a market value that is less than one-fifth of the total value of Ethereum’s Layer-2 solutions. He questioned why Uniswap chose Optimism over Arbitrum, which has a market value twice as large, suggesting that there might be other dynamics at play.

What Will Be the Role of UNI Coin Holders?

These discussions have raised serious concerns among community members who want to adhere to decentralization principles. UNI coin holders expect more transparency and participation in decision-making processes, but Uniswap’s decision to launch its blockchain contradicts these expectations. Gao’s comments have also led to further questions about how decentralized Uniswap’s future governance structure will remain.

The role of coin holders in this process continues to be a focal point in ongoing discussions about decentralization and governance in the blockchain world.

According to CoinMarketCap data, UNI coin traded at $8.09 with a 6.38% increase over the last 24 hours.

Türkçe

Türkçe Español

Español