Recently, the DeFi sector has been making headlines thanks to numerous reports. A recent development in Uniswap, in particular, sparked discussions within the Web3 communities. Through a new series of code in an open-source data set of the protocol, users can ensure that their transactions in a stake pool are verified with the Know Your Customer (KYC) feature before proceeding.

Notable Development from the Uniswap Team

A user who criticized this development predicted that decentralized finance protocols would have a higher chance of being whitelisted by regulatory authorities and commented as follows:

“As I explained in all my articles last year, DEXs start with the KYC option and eventually move to a regulatory whitelisted database hosted outside the blockchain. Then, protocols without the KYC option will be labeled due to the possibility of money laundering.”

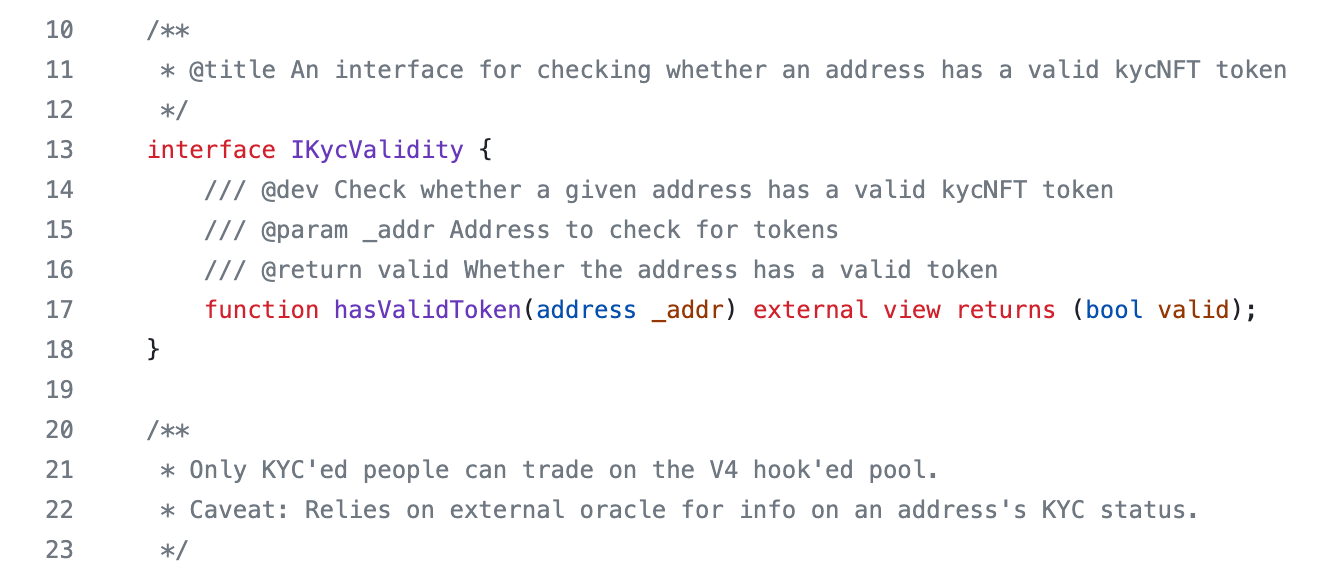

These code series, referred to as hooks, allow developers to customize a code without criticising the main structure of the program. This hook, observed in Uniswap V4, will enable developers to use KYC verification within the decentralized finance protocol.

Financial platforms are required to use KYC procedures to verify customer identities and assess associated risks. The most important aspect of KYC is to detect money laundering activities.

How Was the KYC Step Taken?

The KYC step was introduced as an optional function in the directory of Uniswap V4 by a community developer. KYC verification is performed by an NFT. Another user related to the topic explained that this feature is specific to liquidity providers and could be beneficial for projects that need to comply with regulatory requirements in certain jurisdictions:

“It seems you don’t understand how this works. Firstly, this step was introduced only for the staking feature. Some projects may want to operate within the legal boundaries of jurisdiction. Secondly, these hooks can be created by community developers. You’re throwing away something that has done more than anyone else for the real DeFi experience.”

Advanced country governments are closely scrutinizing DeFi protocols and transactions. Recently, the G20 group consisting of the world’s largest twenty economies accepted a crypto policy proposed by the International Monetary Fund (IMF) and the Financial Stability Board (FSB), tightening crypto regulations.