Cryptocurrency markets are witnessing a surge with Bitcoin leading the way, as many altcoins hit record highs. Accordingly, the price of Uniswap reached its two-year peak of $12.85 on February 24, but has since experienced a slight decline. During its upward trend, UNI managed to break above long-term horizontal and resistance levels.

Weekly UNI Chart Analysis

The weekly chart analysis indicates that UNI has been on the rise within a long-term horizontal support area since October 2023. The upward movement resulted in a breakout from a declining resistance trend line that had been in place for 480 days. After several retests, UNI’s price started another upward move at the beginning of 2024, breaking out from a horizontal resistance area. The increase culminated last week with a high of $12.86. UNI then experienced a slight pullback.

The Weekly Relative Strength Index (RSI) also supports the rise. Market investors use the RSI level as an important indicator of movement. Initially, there was a bullish divergence in the RSI level (green trend line) before the upward movement. The RSI has been trending upwards since then and was above 70 at the time of writing.

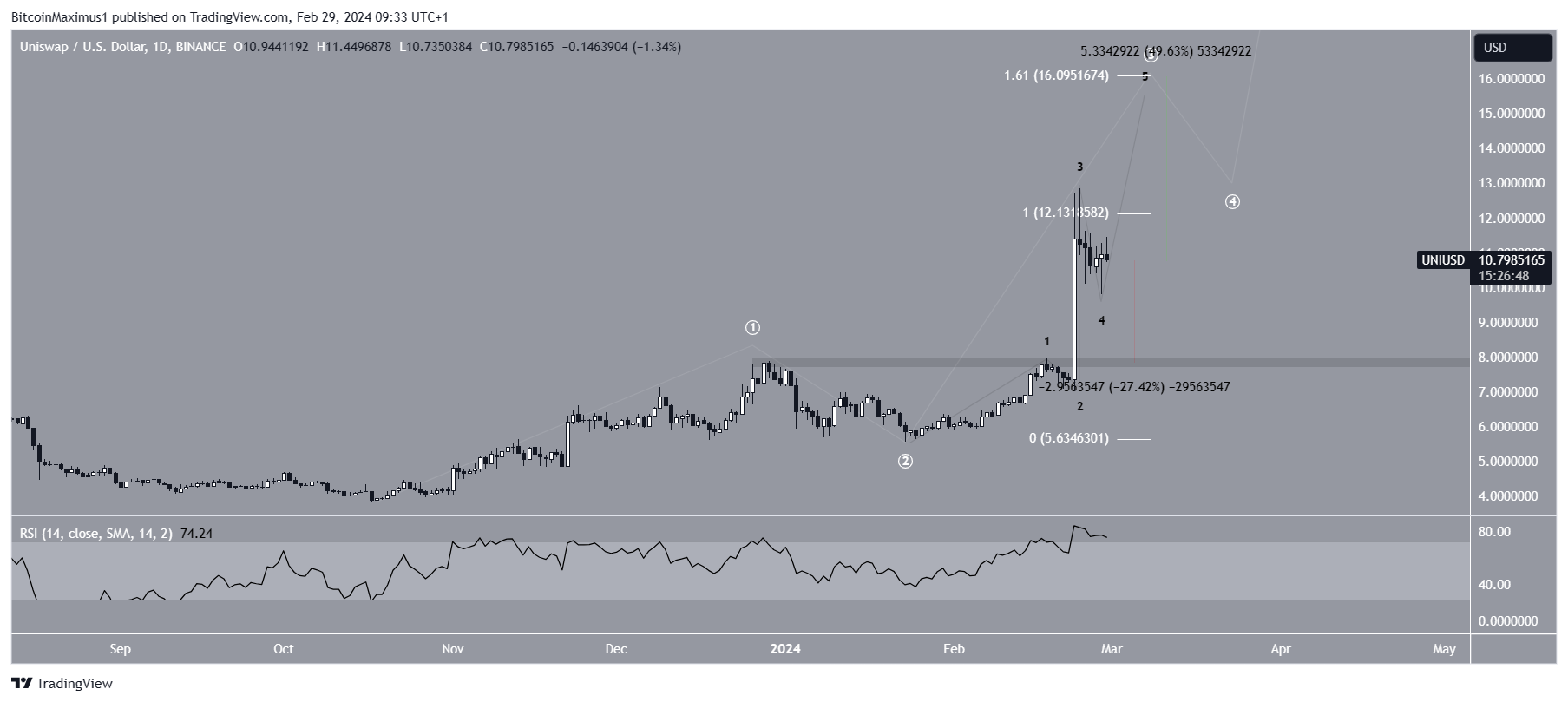

Daily UNI Chart Analysis

The technical analysis of the daily timeframe aligns with the weekly chart, indicating an upward trend. This is evident in the wave count and RSI levels. The most likely wave count suggests that UNI’s upward movement will continue. Technical analysts prefer to use the Elliott Wave theory to determine the direction of the trend by examining recurring long-term price patterns and investor psychology.

The wave count predicts that UNI is in the third wave of a five-wave upward movement (white). The sub-wave count is shown in black and indicates that UNI is in the fourth sub-wave. If the count is correct, UNI’s price will start another upward move after the current correction is completed. This could take the UNI price to the next resistance level of $16.10, potentially triggering a 50% upward movement. The daily RSI level supports this possibility as it has increased and is above 70.

Despite the rising UNI price forecast, failure to break out from the high levels of $12.10 could trigger a drop to the nearest support at $7.80, a roughly 30% decrease.

Türkçe

Türkçe Español

Español