Uniswap’s native token UNI, at the pinnacle of decentralized exchanges, excited investors with a surge of over 70% on Friday following an announcement by Erin Koen, the governance lead of the Uniswap Foundation, which signaled a proposal to overhaul the protocol’s governance system.

Comments and Developments on Uniswap

According to the announcement, the proposal aims to “strengthen and revitalize” Uniswap’s governance, while also revealing that UNI token users who stake and delegate their tokens will be rewarded.

Erin Koen shared the following words in a post:

I believe we need to upgrade the protocol to reward UNI token holders who stake and delegate their tokens through a fee mechanism.

Koen’s proposal is a significant development for the largest decentralized exchange by trading volume and indicates a departure from last year’s initiative to reward token holders with accrued fees.

In June of last year, a critical vote by the Uniswap community rejected a proposal that would have introduced fees for many of the exchange’s liquidity pools and distributed a portion of the revenue among token holders.

Following a move in October, the Exchange announced that it had implemented a fee of 0.15% on crypto swaps involving ETH, USDC, and other tokens launched in the protocol’s interface.

If the proposal that emerged on Friday receives a positive response from the community vote, it will pave the way for the protocol to programmatically and permissionlessly collect fees, which will then be distributed proportionally among UNI token holders who participate in and authorize votes.

What is the Current Price of Uniswap (UNI)?

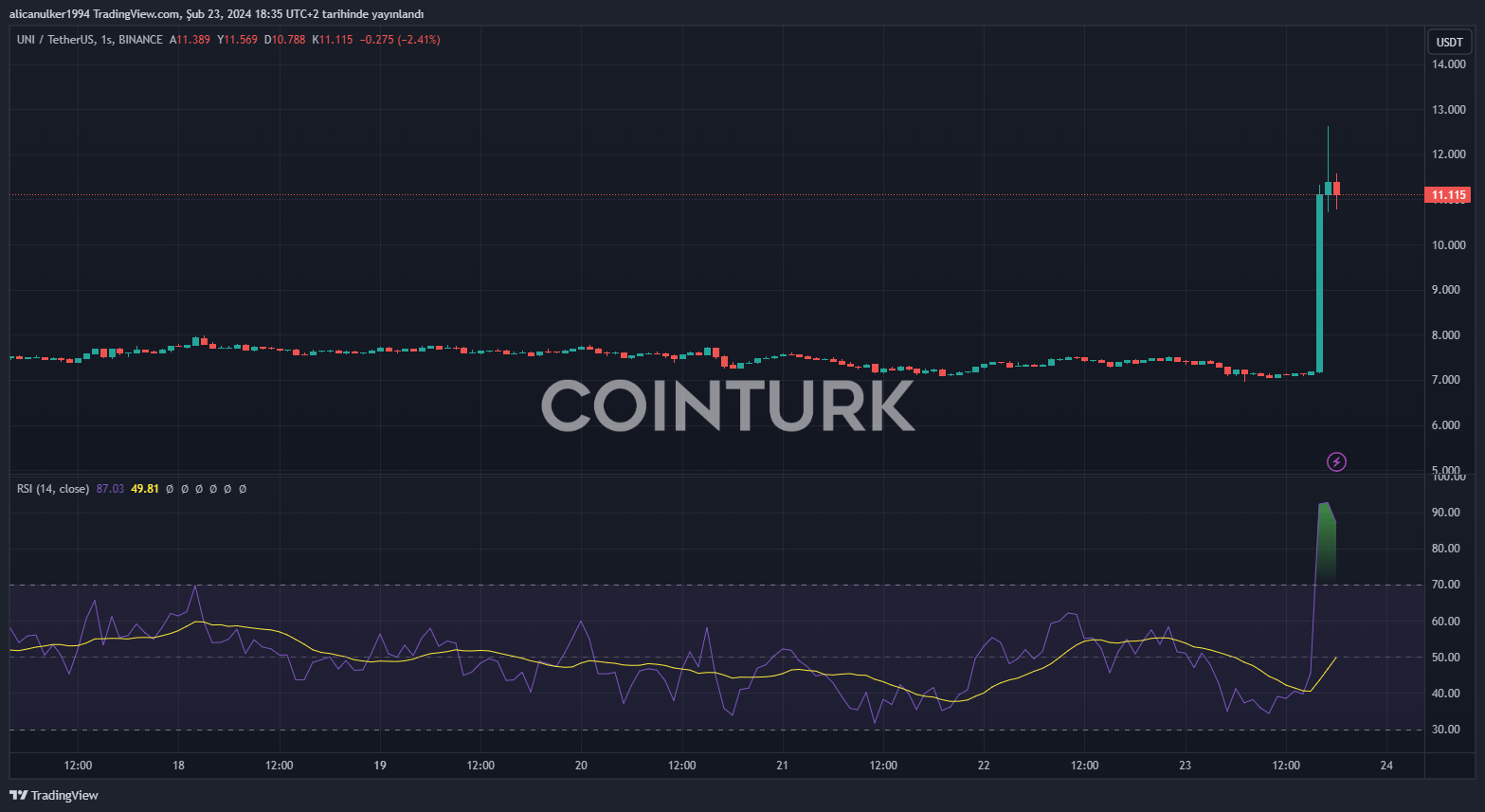

UNI hosted an incredible price movement in the past 3 hours. The altcoin, which soared from the $7 level, jumped nearly 75% to $13 within about 2 hours but later retreated to $11.11.

This price level marked the highest price seen since April of the previous year. This price movement showed that UNI performed much better than Bitcoin, ETH, and many other high-volume altcoins under stagnant market conditions.

Meanwhile, UNI’s market capitalization also saw an increase of over 50%, surpassing the $6.7 billion mark. The 24-hour trading volume of UNI increased by 1265%, reaching $1.3 billion. The RSI value of UNI is at 87, indicating it is at the peaks of overbought conditions.

Türkçe

Türkçe Español

Español