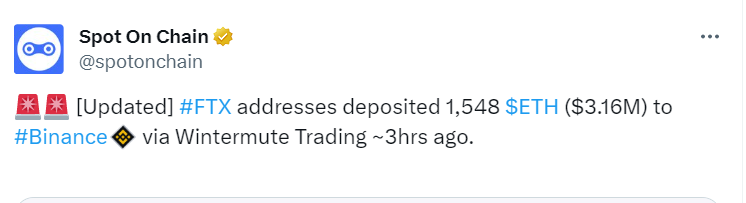

Token transfers from the bankrupt cryptocurrency exchange FTX and Alameda-associated addresses are closely monitored by the crypto community. In a strategic move, FTX deposited 1,548 ETH worth $3,160,000 to Binance through Wintermute Trading about three hours ago. This high-profile transaction has made waves in the crypto world as every move by the bankrupt FTX is interpreted as a sell-off wave. At the time of writing this article, Ethereum is trading at $2,016.

Unprecedented Token Transfers

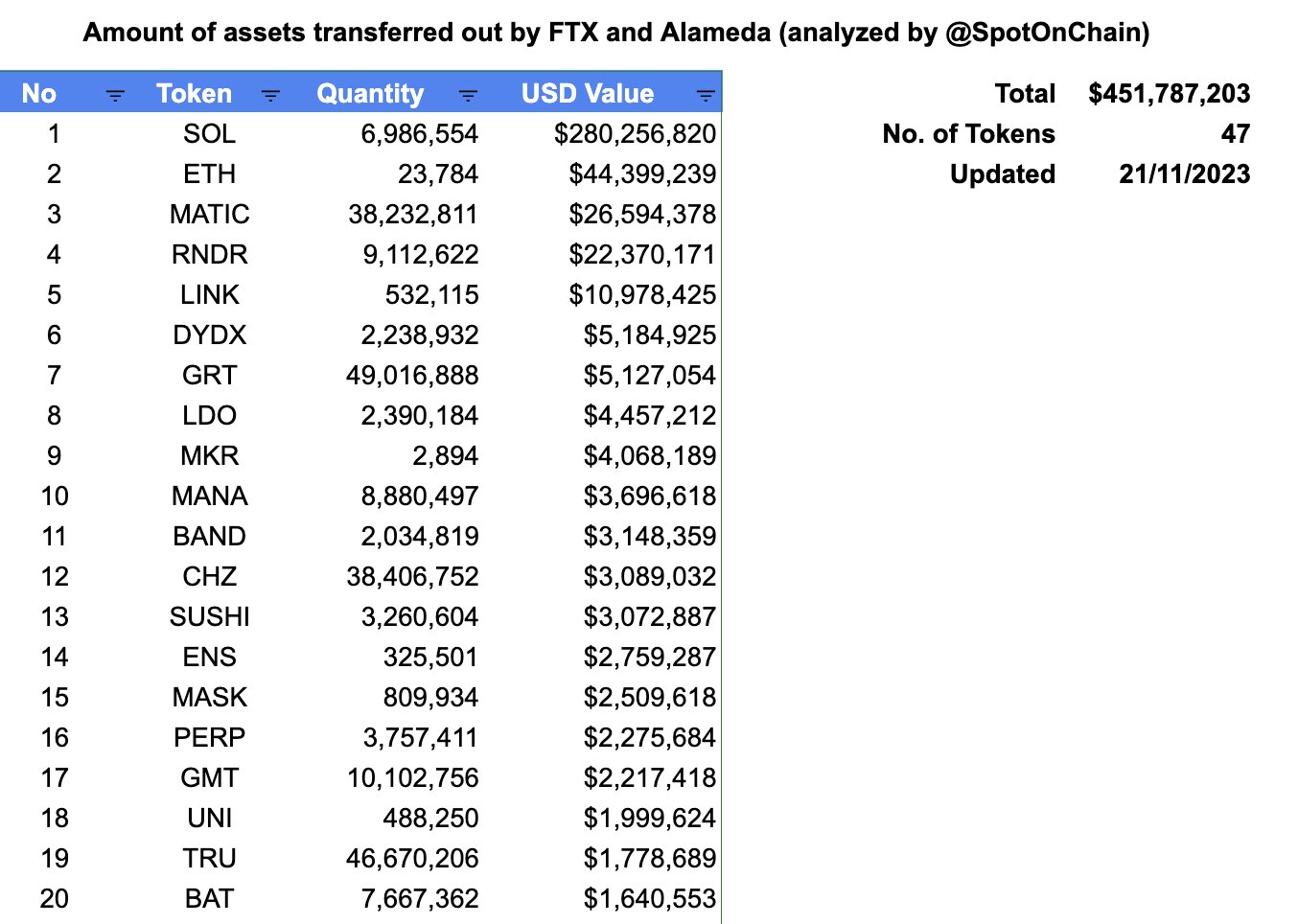

Since October 24, both FTX and Alameda addresses have conducted an impressive series of transactions, moving 47 different tokens and totaling a staggering $452 million in transfers. The significance of this unprecedented fund movement reflects the current state both organizations find themselves in. As for FTX, the legal process is still ongoing.

In a notable development, FTX and Alameda withdrew 11,500,000 MATIC worth $9,240,000 from staking on November 17. This strategic move aligns with the constantly evolving crypto landscape, where participants continuously reassess and optimize their assets for maximum returns. However, this situation can also trigger a sell-off wave.

Crypto Movements Continue

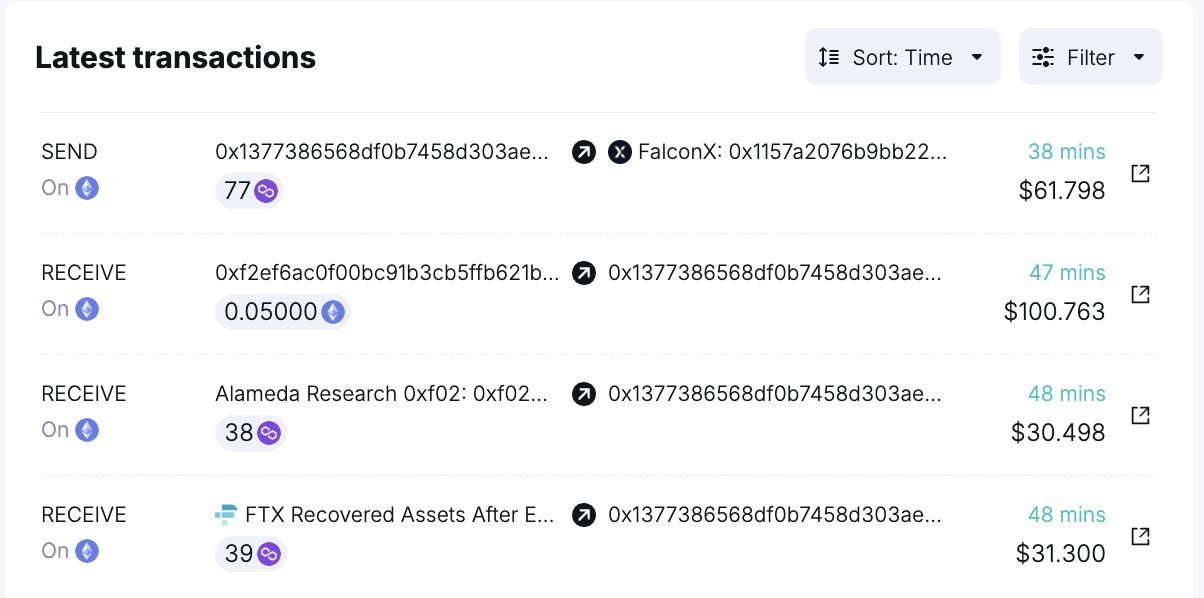

In addition to these developments, FTX and Alameda made deposits to FalconX for exploratory purposes and to optimize their operational strategies about 2 hours ago. The purpose of such test transactions is to explore different platforms for operations, as emphasized among other considerations.

As the bankrupt cryptocurrency exchange FTX and Alameda make significant moves in the crypto space, the broader market closely watches these developments. These multimillion-dollar transactions, strategic maneuvers, and exploratory test deposits contribute to the narrative of dynamism and adaptation in the crypto ecosystem. The actions of FTX and Alameda, who were once prominent in the industry but now face legal actions, serve as a barometer for market sensitivity, influencing the decisions of institutional and individual investors.