As usual this Sunday, we discuss significant developments awaiting us in the week ahead. The first quarter has been challenging for cryptocurrencies and is nearing its end. Trump’s firm stance has sparked a global trade war, significantly dampening market participants’ risk appetite. However, it is anticipated that at least uncertainty will clear in the coming days.

Major Developments in Cryptocurrency

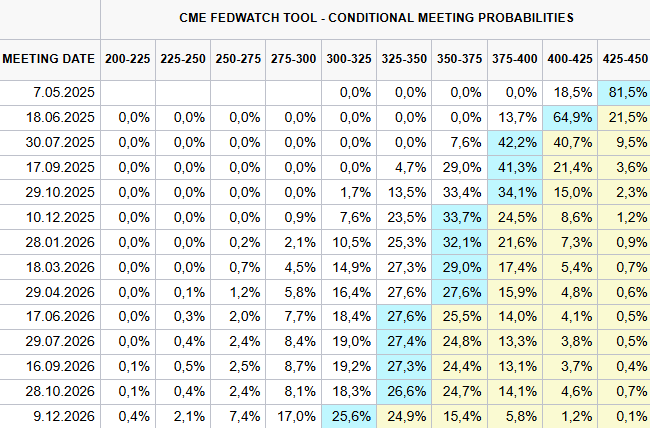

The PCE data released on Friday disrupted the risk markets once again, initiating a downward trend. Sales accelerated alongside the weekend’s low trading volume. The losses in Bitcoin  $89,100 and altcoins reflect concerns over tariffs set to be announced on April 2. While recent U.S. data indicates a resurgence in inflation, the Fed’s cautious stance has notably slowed down the pace of balance sheet reduction, which is promising.

$89,100 and altcoins reflect concerns over tariffs set to be announced on April 2. While recent U.S. data indicates a resurgence in inflation, the Fed’s cautious stance has notably slowed down the pace of balance sheet reduction, which is promising.

What awaits cryptocurrencies in the upcoming days?

April 1, Tuesday

- 16:00 Fed Member Barkin Speaks

- 16:45 U.S. S&P Manufacturing PMI Final (Expectation: 49.8 Previous: 49.8)

- 17:00 U.S. JOLTS (Expectation: 7.68M Previous: 7.74M)

- 17:00 U.S. ISM Manufacturing PMI (Expectation: 49.5 Previous: 50.3)

- 17:00 U.S. Construction Spending Monthly (Expectation: 0.3% Previous: -0.2%)

April 2, Wednesday

- 15:00 Trump to Announce Tariffs

- 15:15 U.S. ADP Employment Data (Expectation: 120K Previous: 77K)

- 17:00 U.S. Factory Orders (Expectation: 0.5% Previous: 1.7%)

- 23:30 Fed/Kugler to Speak

Critical Moment for Cryptocurrencies

The first week of April marks a crucial period with the announcement of tariffs and incoming U.S. data. We will witness how concerns regarding tariffs affect the labor market and the economy through the forthcoming data releases. Both PMI and employment figures are significant, and Powell’s comments will be closely monitored.

Details regarding tariffs in the ECB minutes could trigger sudden fluctuations.