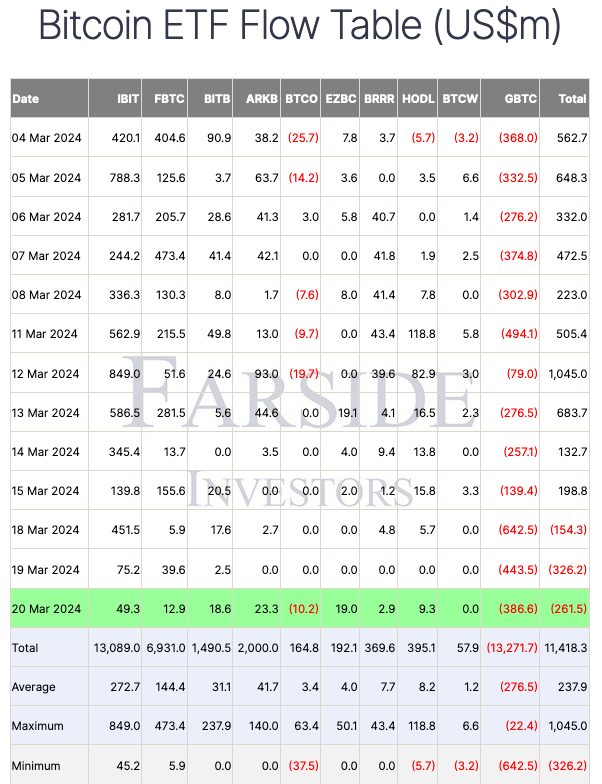

United States spot Bitcoin exchange-traded funds (ETFs) experienced withdrawals worth $261.5 million from ten approved funds on March 20th, marking the third consecutive day of net outflows. According to Farside Investors data, there were net outflows of $154.3 million and $326.2 million on March 18th and 19th, respectively, bringing the total three-day net outflows to $742 million.

What’s Happening in the ETF Space?

The primary reason for these outflows was an additional withdrawal of $386.6 million from the Grayscale Bitcoin Trust (GBTC), while the Invesco Galaxy Bitcoin ETF (BTCO) also saw outflows of $10.2 million. These two overshadowed the inflows from the other eight approved ETF funds.

BlackRock’s iShares Bitcoin Trust (IBIT) fund experienced its second-lowest net inflow day with $49.3 million, only $4 million more than the lowest daily level reached on February 6th, and the Fidelity Wise Origin Bitcoin Fund (FBTC) similarly had its second-lowest inflow day with $12.9 million.

Bitcoin and the Halving Process

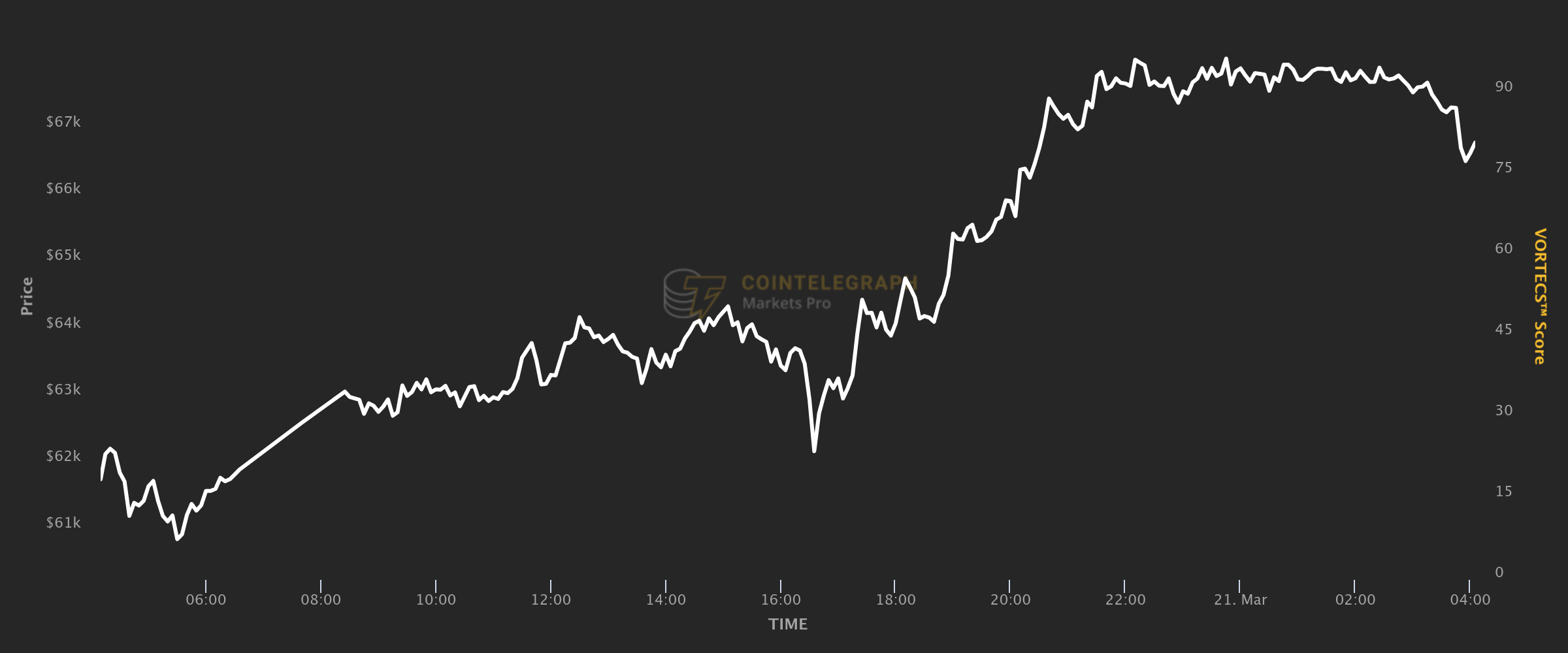

These developments marked the second-highest net outflow day for the ten ETF funds, only surpassed by the $326.2 million withdrawn on March 19th. According to Tradingview data, Bitcoin gained over 3% during US trading hours and surged 7.5% within 24 hours, trading at $67,089 at the time of writing.

As the countdown to the Bitcoin halving event, which will see mining rewards cut by 50% on the Bitcoin blockchain network, enters its final month, Bitcoin has started to decline from its record level on March 14th. This trend clearly indicates that Bitcoin miners are selling before the halving event.

According to CoinMarketCap data, historically, Bitcoin has experienced a decline before halving events, and this time it followed a similar pattern entering the last 30 days before the event. Many analysts have issued serious warnings about the price correction before halving events, and especially short-term Bitcoin holders have taken these warnings seriously, creating significant selling pressure.

Türkçe

Türkçe Español

Español