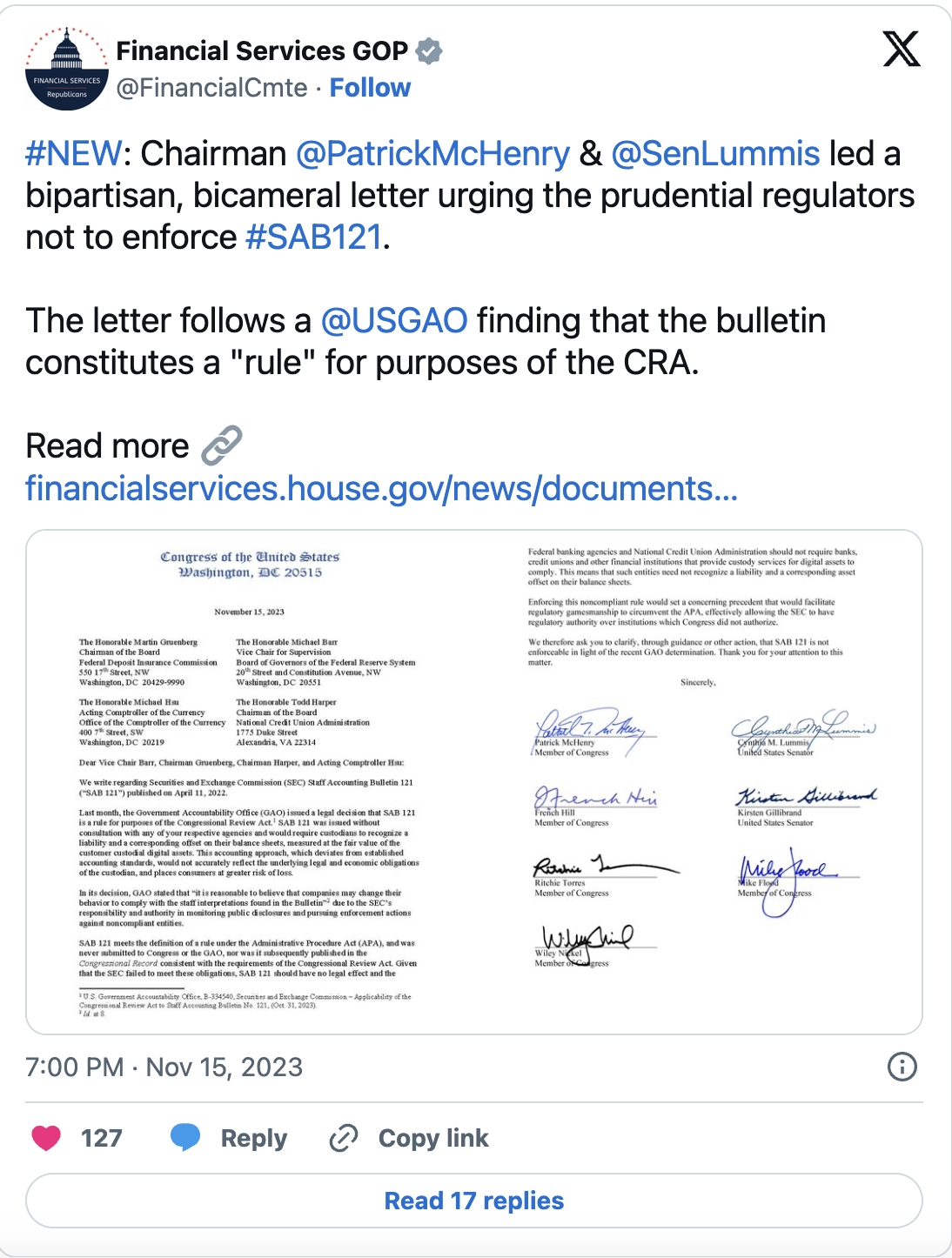

Members of the United States Congress, including key financial officials such as the chairman of the Federal Deposit Insurance Commission and the acting currency auditor, have called for guidance or action to clarify that the SEC Staff Accounting Bulletin 121 (SAB 121) is not applicable, following recent data from the Government Accountability Office (GAO).

Noteworthy Requests for SAB 121

With this development, members of Congress stated that SAB 121 should not play a legal role and that federal banking agencies and the National Credit Union Administration should not require banks, credit unions, and other financial institutions providing custody services for cryptocurrencies to comply with it.

SAB 121 is known as a law that requires banks to hold customers’ cryptocurrency assets on their balance sheets, disclose the value of these assets, and maintain capital against them. The industry and Republican members of Congress argued that this rule jeopardizes the willingness of regulated banks to act as cryptocurrency custodians and that it treats cryptocurrency assets differently from other assets.

Based on a letter written by Lummis in August 2022, the GAO stated that the SEC’s compliance with SAB 121 should be subject to congressional review. The evaluation focuses on whether the bulletin qualifies as a rule under the Congressional Review Act (CRA). According to the CRA, an agency rule must be reported to the Inspector General and both houses of Congress, along with a mechanism for Congress to disapprove the rule.

Debates Continue on SEC

Members of Congress, including Patrick McHenry, Cynthia M. Lummis, French Hill, Kirsten Gillibrand, Ritchie Torres, Mike Flood, and Wiley Nickel, expressed their concerns about this non-compliant rule through a report, stating that it would set a concerning precedent. This development could allow for legal regulatory steps to bypass the Administrative Procedure Act (APA) and ultimately grant the SEC the authority to regulate unauthorized entities by Congress.

In June 2022, five Republican senators, including Lummis, wrote a letter to SEC Chairman Gary Gensler stating that they did not approve the regulation they saw as background regulation in the bulletin. Additionally, Representative Mike Flood made remarks about the bulletin to Gensler during a hearing before the House Financial Services Committee in September.

Türkçe

Türkçe Español

Español