The US federal appeals court ruled in favor of lifting sanctions imposed on Tornado Cash (TORN), a technology that anonymizes crypto transactions. The court determined that the US Department of the Treasury exceeded its authority regarding these sanctions. Furthermore, it stated that the ownership of Tornado Cash’s smart contracts cannot be deemed property.

Court: “Treasury Exceeded Its Authority”

The Office of Foreign Assets Control (OFAC) of the US had sanctioned Tornado Cash last year, alleging it was used by actors like North Korea’s Lazarus Group for money laundering. However, the appeals court concluded that this technology could not be evaluated under the International Emergency Economic Powers Act, indicating the Treasury Department overstepped its bounds.

Many crypto companies, including Coinbase, had challenged the sanction decision in court. Paul Grewal, the chief legal officer of Coinbase, characterized the federal appeals court’s ruling as a “historic victory for the crypto world.” Grewal stated, “The government’s overreach has been curtailed. US citizens can now use Tornado Cash.” The court emphasized that existing laws were insufficient to regulate the technology, indicating that legal regulations fall under Congress’s jurisdiction.

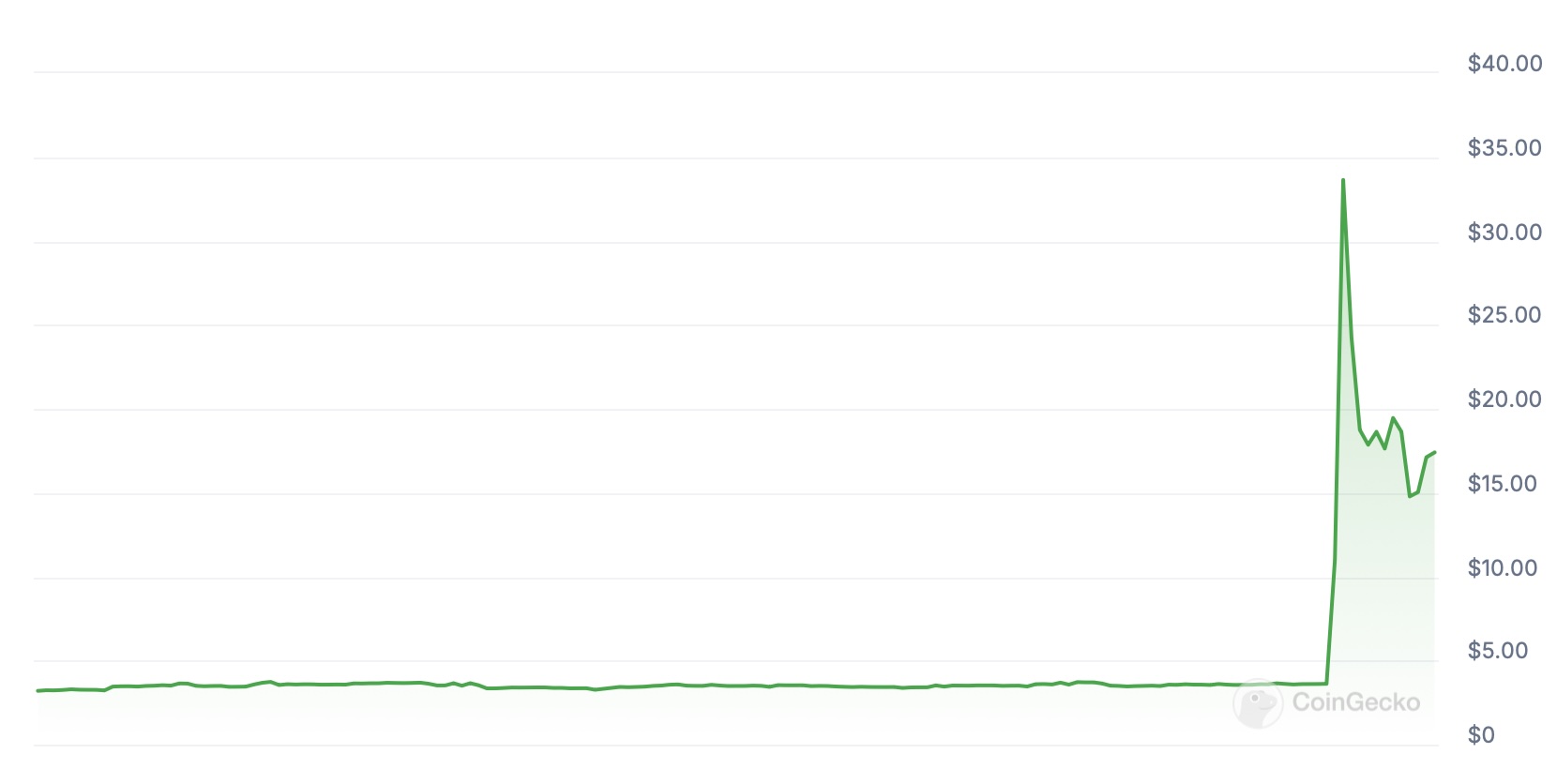

TORN Token Surges

Following the ruling, Tornado Cash’s main network asset, TORN coin, attracted significant market attention. According to CoinGecko data, the altcoin‘s price surged over 500% within hours, exceeding 20 dollars. TORN coin had previously dropped below 8 dollars due to the impact of the sanction decisions.

Experts noted that the ruling signals a reduction in regulatory pressure on the cryptocurrency sector. The development is also viewed as a precedent for similar protocols.

Türkçe

Türkçe Español

Español