Today was one of the most important days in October on the macro front. The price of BTC dropped to $34,000 before the release of data. In addition to GDP and unemployment data, quarterly PCE data was also released. So what does all this mean for cryptocurrency investors? Can it halt the rise in Bitcoin price?

US Data and Cryptocurrencies

Despite high interest rates, ongoing inflation pressures, global issues, and many problems, the US economy grew better than expected. Powell had previously mentioned how important it is to fight sub-trend growth. Gross domestic product, which measures all goods and services produced in the US, rose by 4.9% annually in the July-September period, reaching the 2.1% increase seen in the second quarter.

This increase also indicates that the efforts of the Fed to cool down the economy have not been as successful as expected. The increase is driven by consumer spending, increased inventories, exports, housing investments, and government spending.

On the other hand, jobless claims met expectations, resulting in the expected situation in the employment sector. PCE, which the Federal Reserve uses as a measure of short-term inflation risks, was announced at 3.5%, well above the estimated 2.5%. However, the core PCE data, which excludes food and energy prices, fell to 2.4%, reaching a very good level since the fourth quarter of 2019. This supports the possibility of no interest rate hikes and is positive for cryptocurrencies.

The benchmark 10-year bond yields fell 5bps to 4.936%. The US dollar index is expanding its red candle, which is also related to the PCE data.

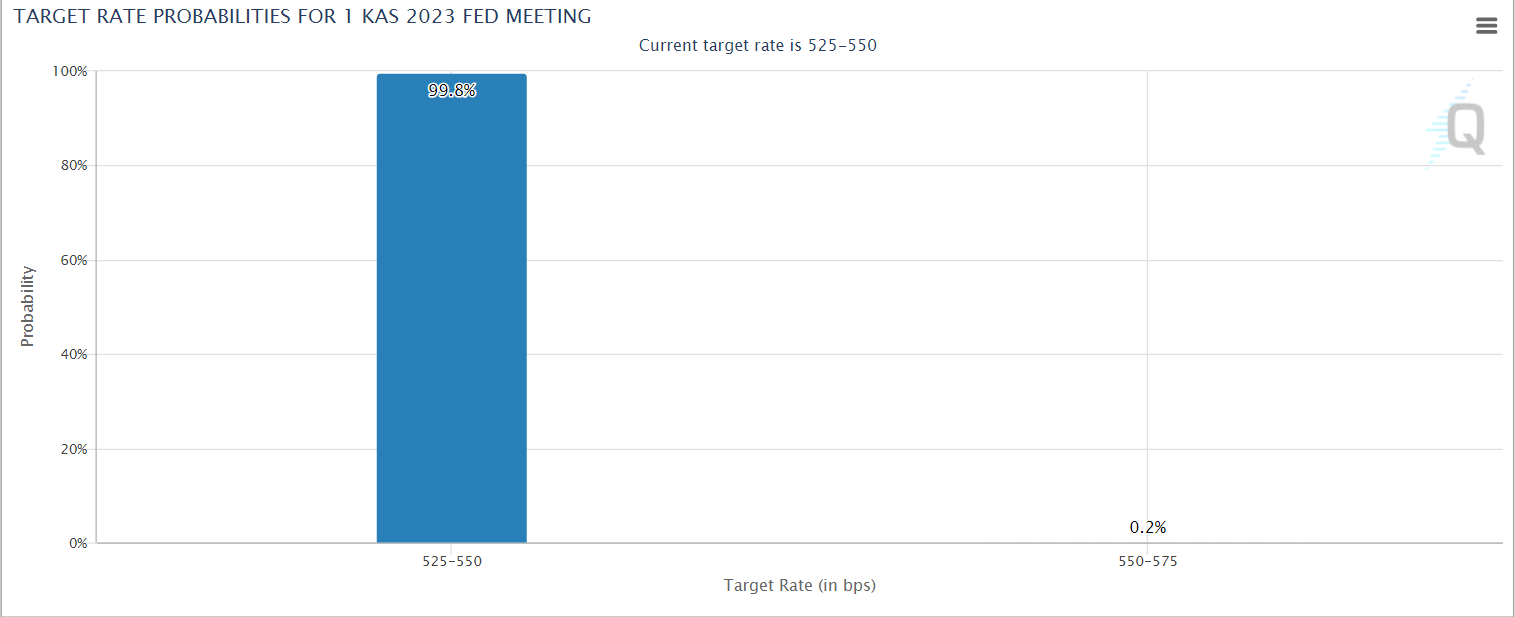

Here’s some more good news. The probability of interest rates remaining unchanged is 99.8%. For the December 13th meeting, the probability of interest rates remaining unchanged is 71.4%. This indicates that unless there is a big surprise, the Fed has declared the ceiling for interest rates with its latest hike.

Türkçe

Türkçe Español

Español