Investors have been significantly affected by the US Government’s Bitcoin sales, especially in the past two years. The days when on-chain movements caused major drops seem like yesterday. Speaking of which, this week they moved a substantial amount of assets seized in the Bitfinex hack. So, how much cryptocurrency does America hold?

How Did the US Acquire Cryptocurrencies?

The government doesn’t buy cryptocurrencies with money from exchanges or over-the-counter (OTC) markets. Assets have been seized following the resolution of past crimes. Cryptocurrencies were a payment system that, until recently, made it nearly impossible for criminals to be caught. However, this is changing due to advanced on-chain intelligence tools and an increase in technically skilled personnel.

Governments detecting crimes committed years ago are eventually catching criminals and seizing their illicit gains. The US government, in particular, has seized billions of dollars worth of assets from the Bitfinex and Silkroad incidents. On May 11, 2020, they seized assets worth approximately 1 billion dollars at that day’s exchange rate.

List of Cryptocurrencies Held by the US

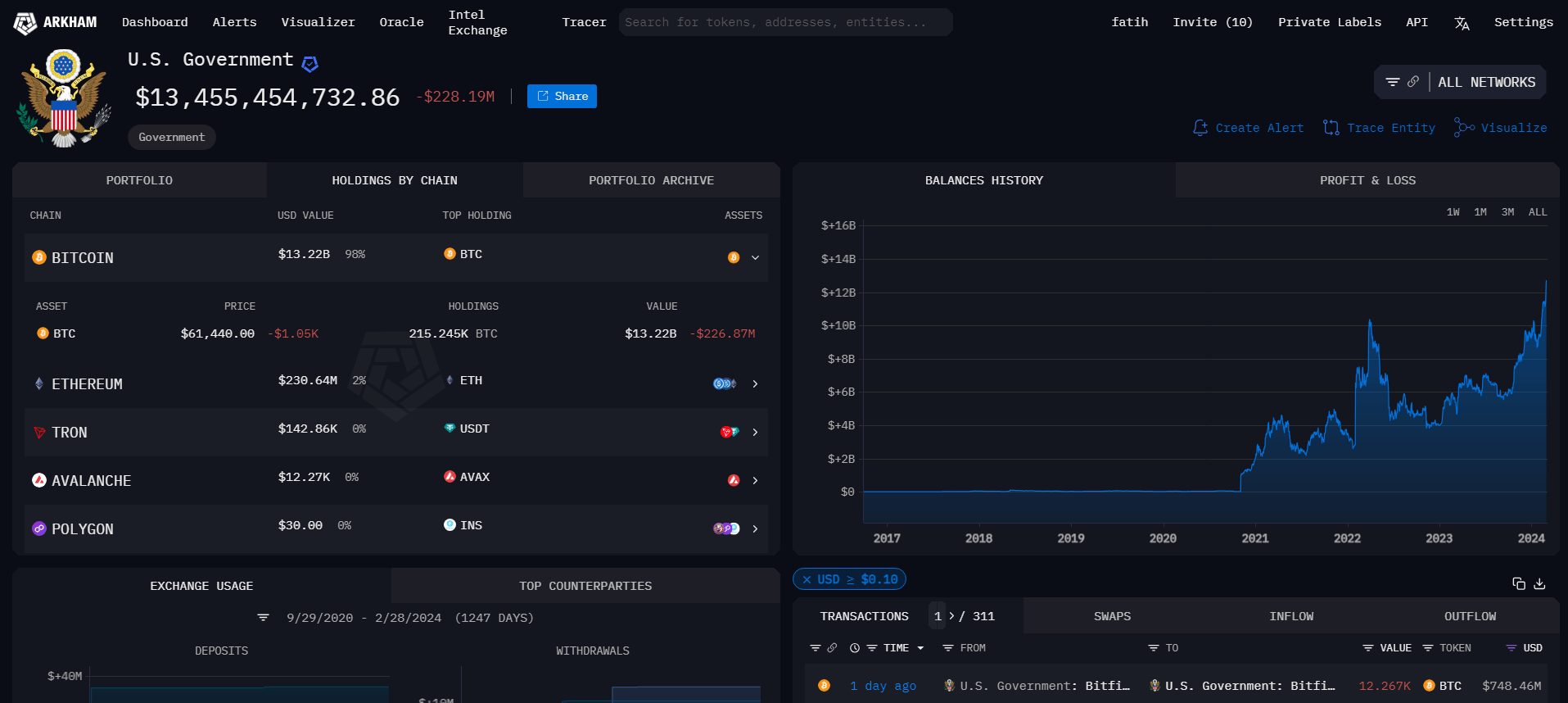

The US currently holds $13.4 billion in cryptocurrencies, most of which were seized during the Bitfinex and Silkroad operations. To better understand the size of Bitcoin they hold, it’s worth noting that the US government alone holds roughly 1% of the supply. This is more than the Bitcoin reserves created by BlackRock since their ETF launch in January.

According to Arkham data, government wallets holding 215,245 BTC also have assets worth $230.6 million on the Ethereum network. The list is roughly as follows;

- 215,245 BTC

- 56,086 ETH

- 18.4 Million AUSDC

- 11 Million USDC

- 5.36 Million DAI

- 1,146 WETH

- 142,835 USDT

- 189,906 TRX

The wallets of the United States are currently experiencing their best days in terms of profitability. When calculated based on cost, they have roughly $6.5 billion in holding gains. During the bear markets of 2022, they had written losses close to $3.5 billion.

Since February 23, the US wallets have made a profit of $1.35 billion and seem likely to start selling before it’s too late. Although the last moved asset did not cause a major panic, quickly directing all assets for sale could create FUD with a supply exceeding BlackRock’s reserves.

Türkçe

Türkçe Español

Español