The highly anticipated US inflation data that has been keeping investors on their toes for the past 24 hours has finally been announced. This data was crucial as the medium-term fate of the risk markets depends on when the Fed will begin its interest rate cuts. For this to happen, the decline in inflation needs to continue. Moreover, the significance of the inflation data increased as comments made by Powell and other members indicated the possibility of further hikes.

US Inflation Data Revealed

In last month’s September inflation data, we saw a significant increase in fuel prices, which undermined the decline in inflation. The worrisome $100 target for oil prices erased some of the gains in inflation, despite the tightening measures. However, the good news is that the price of oil is now fluctuating below the $80 mark again after 3 months. For now, the rise against cryptocurrencies has stopped.

We will see the real impact of the decline in oil prices in the upcoming November inflation data. The inflation expectations for this month were as follows:

- Annual Expectation: 3.3% Previous: 3.7%

- Monthly Expectation: 0.1% Previous: 0.4%

- Core Inflation Expectation: 4.1%

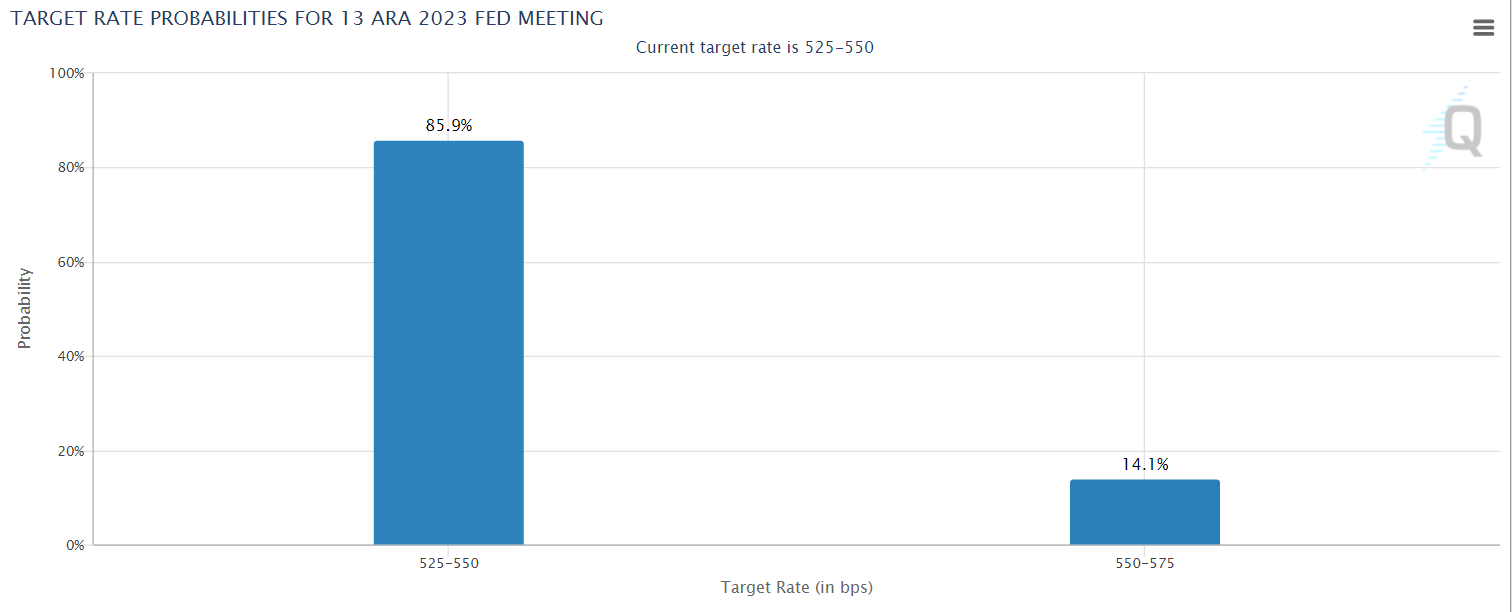

Before the announcement of the inflation data, the expectation for the December 13th US interest rate decision was that it would remain unchanged at a rate of 85.8%. At 16:20, Bitcoin was finding buyers around the $36,400 region. The announced data is as follows:

- Announced: 3.2% Annual (Expectation: 3.3% Previous: 3.7%)

- Announced: 0% Monthly (Expectation: 0.1% Previous: 0.4%)

- Announced: 4% Core Inflation (Expectation: 4.1%)

The data came in favor of cryptocurrencies and below expectations. In the coming days, a continuation of Bitcoin’s rise is expected.

Türkçe

Türkçe Español

Español