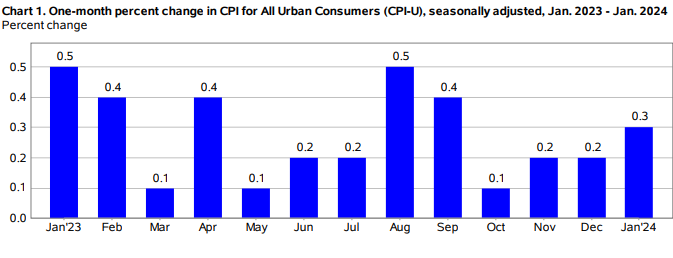

Crypto investors have been closely monitoring inflation data during the recent bear market. The Federal Reserve rapidly increased interest rates in the last cycle, devastating risk markets. The collapse in the crypto lending space further intensified the severity of the bear market. However, inflation is falling again and has been showing positive signs for the last six months. It’s crucial for this trend to continue.

US Inflation Data

Fed members and Powell have clearly stated in recent weeks that they expect the decline in inflation to continue. This is good news, but unexpectedly high data could still destroy optimism. While everyone hopes for a relaxation in employment to allow for more interest rate cuts, a resurgence of inflation could upset cryptocurrencies despite the excitement of halving.

That’s why today’s data was of critical importance. No reduction was expected for March, but the fate of the reduction in May and the annual total will depend on future inflation data. Today’s expectations for January were as follows,

- Announced Annual Inflation: 3.1% (Expectation: 2.9% Previous: 3.4%)

- Announced Core Annual Inflation: 3.9% (Expectation: 3.7% Previous: 3.9%)

The latest data indicates that the expected decrease in core inflation did not occur. Although the data exceeded expectations, the monthly increase suggests that interest rate cuts will be slow in the coming period. The negative impact of this is likely to be felt more in risk markets in the coming hours. The dollar index rose from 104 to 104.580 immediately after the data was released. The US stock market turned to pre-market sales. Fed Swaps are giving a lower probability to interest rate cuts in May and June. Investors have postponed the first 25 basis point BoE interest rate cut from August to September.

Türkçe

Türkçe Español

Español