The United States is gearing up to release annual core CPI rates, February PPI annual rates, one-year inflation rate expectations, and more significant inflation measurements. Here are the details!

Impact of US Data on BTC

Following a strong rally last week, the broader cryptocurrency market is currently experiencing a pause. The two largest cryptocurrencies by market value, Bitcoin and Ethereum, have respectively pulled back from their highest levels of $70,000 and $4,000. A similar retraction is also seen in other altcoins that had recovered strongly during the past week.

The CPI data to be announced on Tuesday will be at the center of this week’s economic reports. Predictions indicate that the core price index may have increased by 0.3% month-over-month in February, and by 3.7% on an annual basis, pointing to the smallest annual increase since April 2021. Further easing in US prices could strengthen the Fed’s narrative of fighting current inflation, despite a decrease in the expected number of rate cuts this year. Swap pricing may show that the cuts expected at the beginning of the year to be six could drop to three by 2024.

Critical View from Analyst

Last week’s US employment data did not significantly alter this outlook. Despite new job additions being above expectations, the unemployment rate reached its highest level in two years. This mixed signal currently indicates a gradual cooling of the labor market, which is consistent with expectations of a soft landing for the US economy. Morgan Stanley’s popular strategist Chris Larkin stated the following:

The employment report did not necessarily give the Fed a ‘completely clear’ signal, but it also did not contain anything that would disrupt the plan to lower interest rates.

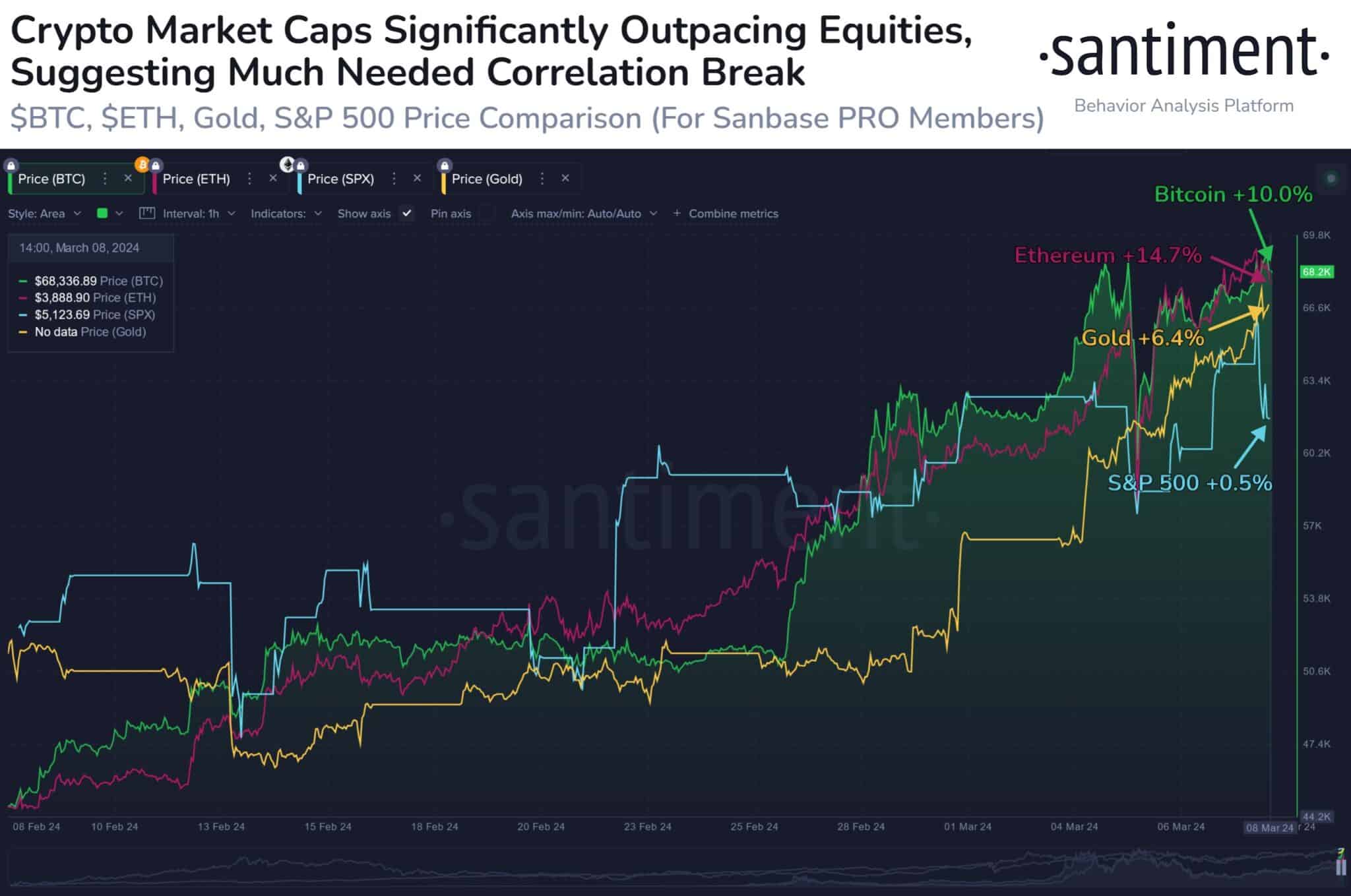

According to reports released by on-chain data provider Santiment, Bitcoin and Ethereum showed significant increases last week, outperforming the S&P 500’s returns. Bitcoin recorded a 10.0% increase, while Ethereum saw a 14.7% rise. The S&P 500 index’s percentage yield.

Türkçe

Türkçe Español

Español