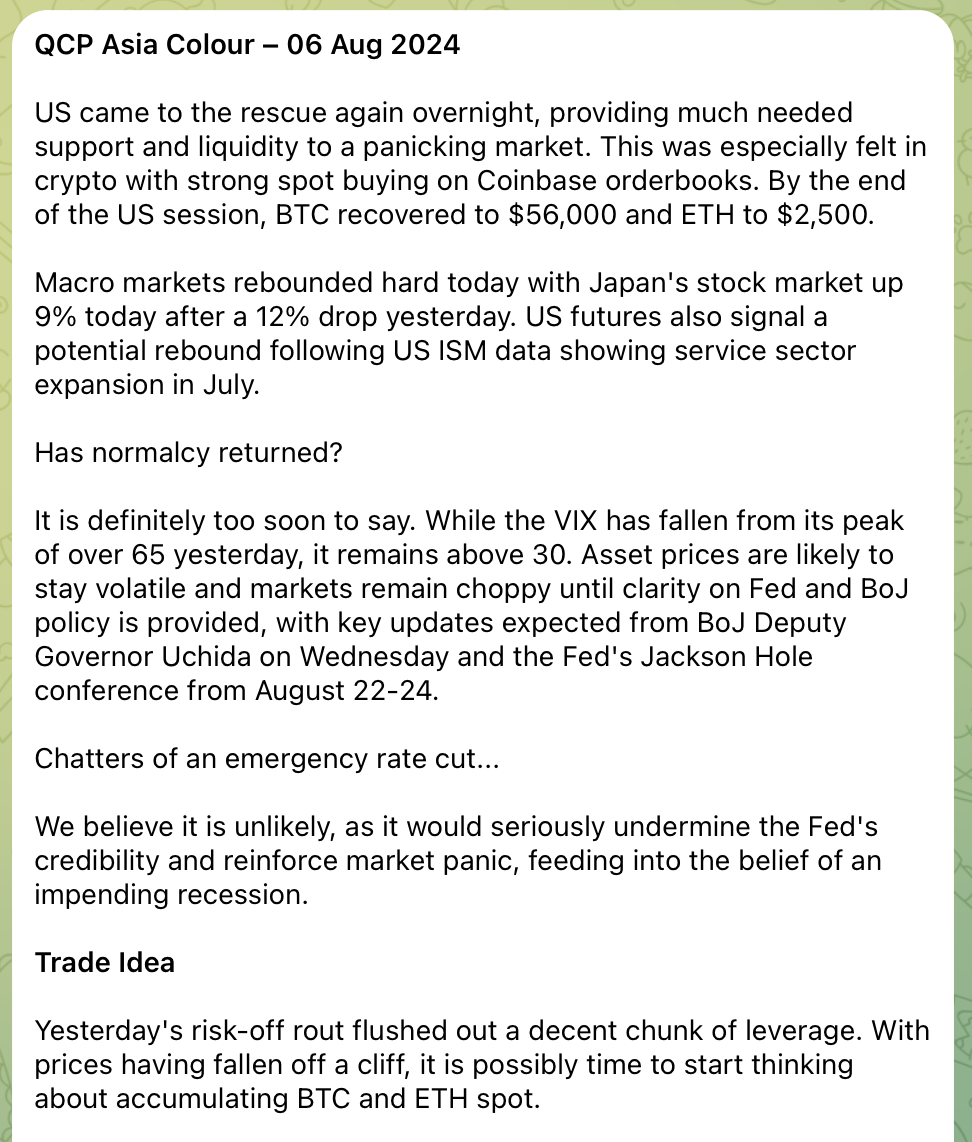

Last night, the support and liquidity interventions in the US markets brought the needed relief to panic-stricken markets, especially the cryptocurrency market. According to the Singapore-based crypto investment company QCP Capital, this was particularly evident with strong spot purchases in Coinbase’s order books. By the end of the US trading session, Bitcoin (BTC) rose to $56,000, and Ethereum (ETH) climbed to $2,500, confirming this trend.

Sharp Recovery in Macro Markets

Today, macro markets experienced a significant recovery. The Japanese stock market rose by 9% today after a 12% drop yesterday. US futures also signal potential recovery following ISM data showing growth in the services sector for July.

According to QCP Capital’s analysis, it is still too early to say that markets have normalized, as the Volatility Index (VIX) remains above 30 today after surpassing 65 yesterday. Therefore, markets are expected to remain volatile and fluctuate. Important announcements from the Fed and the Bank of Japan (BoJ) are anticipated, with BoJ Deputy Governor Uchida speaking on Wednesday and the Fed’s Jackson Hole conference from August 22-24. All these announcements will be closely monitored by the markets.

QCP Capital analysts believe that although an emergency interest rate cut by the Fed is on the agenda, the likelihood of it happening is low. This is because such a move would severely damage the Fed’s credibility and fuel market panic, increasing fears of an approaching recession.

“Consider Buying Bitcoin and Ethereum on Spot”

Yesterday’s wave of risk aversion led to the liquidation of a significant number of leveraged positions. According to QCP Capital, after the sharp price drop, it might be time to consider buying BTC and ETH on the spot market.

Despite all these developments, uncertainty still dominates the markets, but the support provided by the US has brought short-term relief. Market participants will continue to focus on upcoming important policy announcements to determine their strategies in the coming days.

Türkçe

Türkçe Español

Español