According to a new report published on December 8, investment manager VanEck predicts that despite the long-anticipated US recession finally happening next year, the expected spot ETF approvals and the upcoming halving event will result in Bitcoin reaching its all-time high levels in the fourth quarter.

Bitcoin Price Will Continue to Rise

VanEck analysts Matthew Sigel and Patrick Bush expect the US economy to enter a recession in the first half of 2024 due to the slowing economic momentum and declining inflation leaving it more vulnerable to potential shocks. Along with these forecasts, the analysts predict that if approved, there will be more than $2.4 billion of inflows into spot Bitcoin ETF funds on the US front in the first quarter, and these products will keep the Bitcoin price high.

VanEck believes that spot Bitcoin ETF products will trade with approximately a 0.1% discount and zero commission at many brokerages and will meet demand. The Securities and Exchange Commission has not yet approved a spot Bitcoin ETF application in the US, but it had previously approved futures-based funds in 2021.

The next deadline for the SEC to approve, deny, or delay applications from companies such as BlackRock, Bitwise, WisdomTree, Invesco, Fidelity, and Valkyrie, in addition to VanEck, is expected to be mid-January. Bloomberg analyst James Seyffart recently announced that the process for potential spot Bitcoin ETF approval is expected to take place between January 5 and 10.

A $160,000 Target for Bitcoin

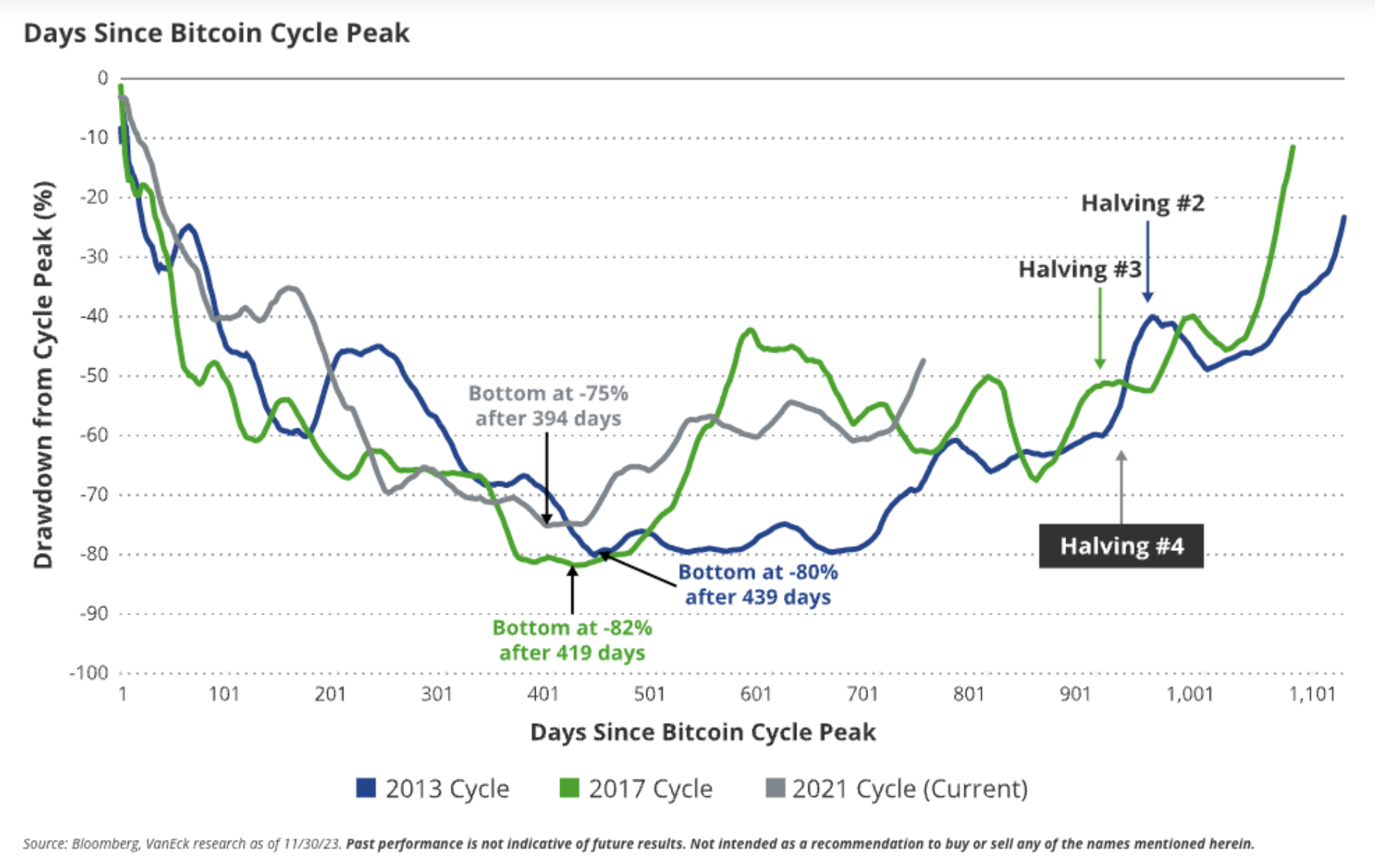

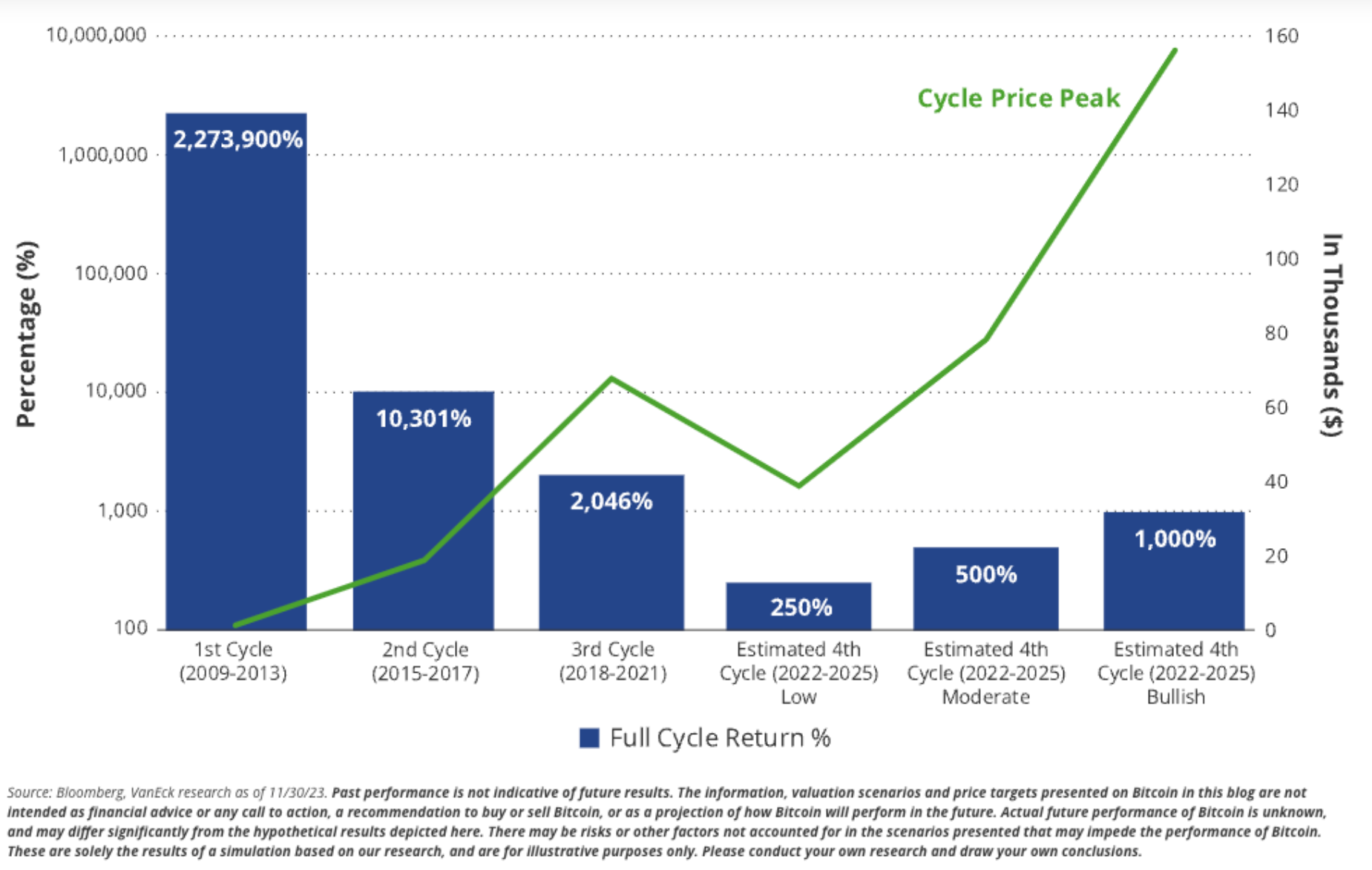

The expected fourth halving event for Bitcoin is set to take place in April and is another potential factor in conjunction with halving events that happened prior to significant rises for the cryptocurrency between 2016 to 2017 and 2020 to 2021. VanEck analysts expect Bitcoin to exceed $48,000 after the halving and miners to emerge unscathed from the reward halving process thanks to much better balance sheets.

With these developments, analysts expect Bitcoin to climb a wall of worry of presidential magnitude in the US election year and reach an all-time high and even a significant cycle peak of up to $160,000 by November. The report included the following statement on this subject:

“If Bitcoin reaches $100,000 by December, we are making a long-term call for Satoshi Nakamoto to be selected as Time Magazine’s ‘Person of the Year’.”

Türkçe

Türkçe Español

Español