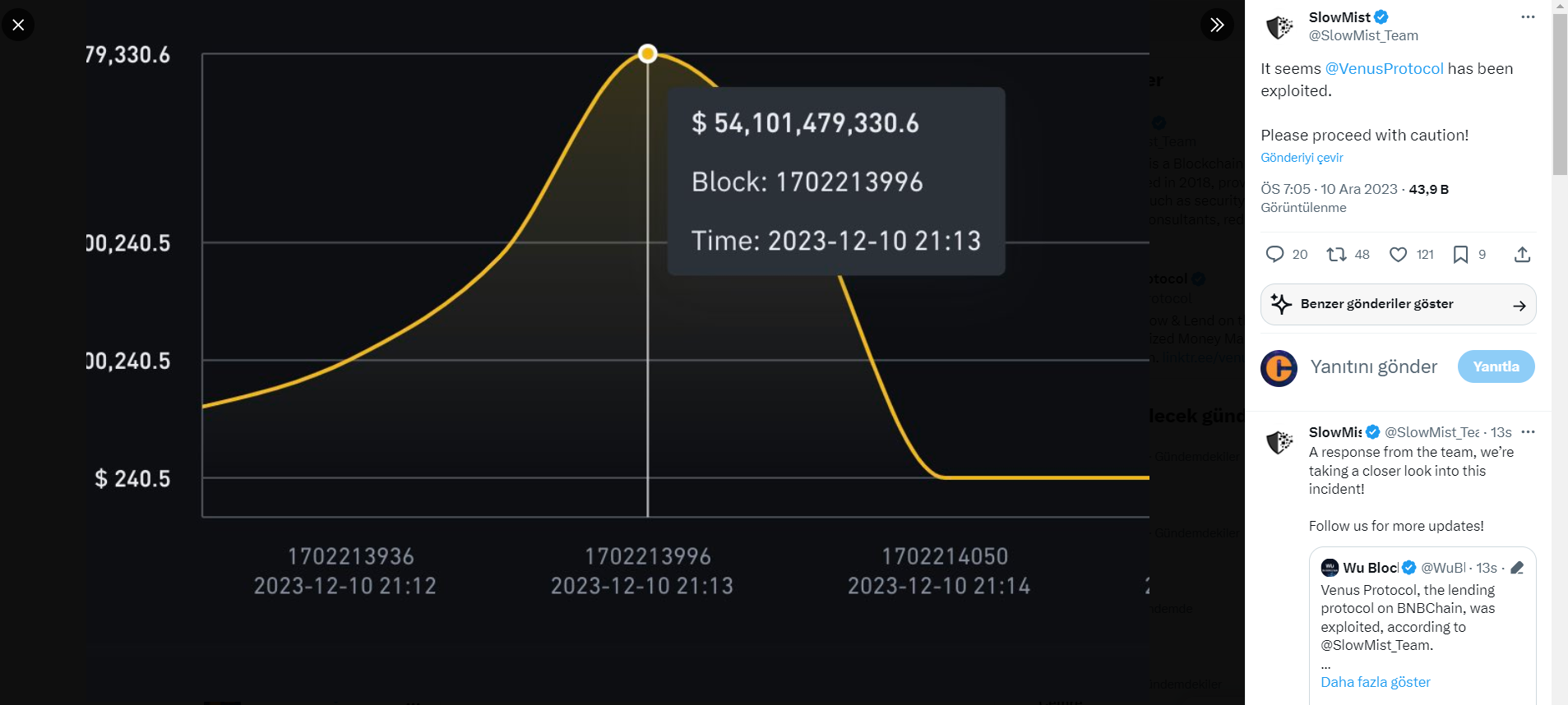

Venus Protocol, a decentralized lending market developing on the BNB Chain, quickly refuted claims of significant loss due to a hack over the weekend. The protocol team addressed concerns circulating on social media, debunking initial reports of an alleged $54 billion hack and clarifying the true nature of the incident.

Oracle Price Breakdown

In response to the event initially perceived as a major hack, Venus Protocol announced that the platform was actually working as intended. The alleged $54 billion hack turned out to be a short-term price inconsistency triggered by Binance Oracle, responsible for price feeds in an isolated pool.

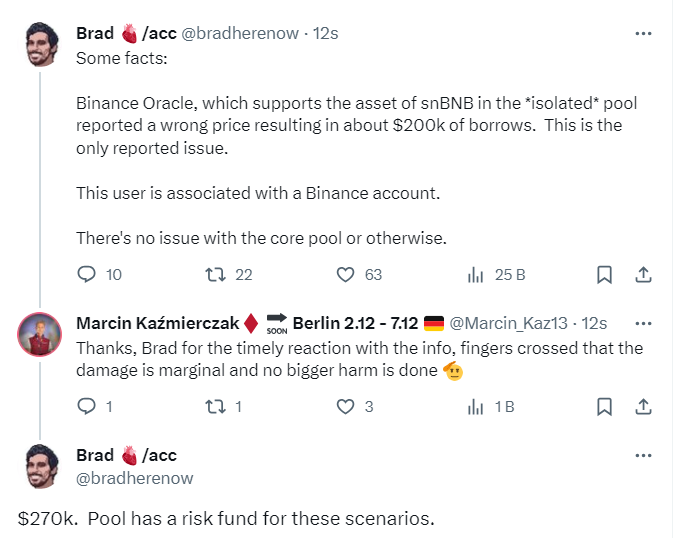

President of Venus Labs, Brad Harrison, made a statement on the matter, explaining that a problem with the oracle supporting the price of snBNB, a yield-generating, liquid staked version of BNB, mistakenly led to the borrowing of assets worth $270,000.

Though the protocol implemented the oracle to mitigate such situations, this incident underscored difficulties concerning long-focused assets without multiple price feeds. Harrison acknowledged the need for continuous improvement, stating, “In this case, we will look forward to enhancing security in isolated pools by adding support for price flexibility.”

Proactive Measures and Temporarily Suspended Markets

Exhibiting a proactive stance, Venus Protocol temporarily suspended the snBNB market and two other isolated markets sharing similar Binance Oracle configurations. This move aims to prevent further complications and ensure the platform’s integrity. The protocol team emphasized that the temporary pause was a precautionary measure, indicating that other pools were unaffected.

Harrison also pointed out that the Binance Oracle team quickly identified and fixed the problem. Venus Protocol reassured users that the incident was isolated, emphasizing their commitment to maintaining a secure and flexible decentralized lending ecosystem.

As part of their ongoing efforts, the team pledged to enhance security in isolated pools, acknowledging the inherent risks associated with such environments.

In the evolving environment of decentralized finance, such incidents underscore the importance of robust security measures. The transparent communication and swift actions of Venus Protocol demonstrated their commitment to promptly addressing challenges.

Türkçe

Türkçe Español

Español