Cryptocurrency market volatility continues, and rallies in altcoins have been gaining momentum as we approach the last week of the year. Investors have high expectations for the coming year. So, what are the predictions for the ETH price, which has not increased as much as desired in 2023? In the upcoming period, the price could surpass $2,500 for several reasons.

Ethereum (ETH)

Ether last approached the $2,400 resistance on December 9th but could not break through this level due to a BTC correction. ETH, the largest altcoin by market value, recently tested the $2,120 support. At the time of writing, the price has reached $2,318 again and could surpass the $2,500 level in the coming period. There are fundamentally three reasons for this.

DApp Volumes and Protocol Fees

Decentralized applications (DApps) are products that measure and demonstrate the value of smart contract networks. Ethereum, like other smart contract networks, is the reason for the existence of DeFi, NFT, and social networking protocols. The more interest these receive, the more network revenue increases, and the network becomes profitable. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

For Ethereum, network revenue is even more important because a portion of the fees is burned, meaning more transactions lead to a further reduction in supply. Below you can see the DApp volumes over the last 7 days.

Ethereum DApp volumes reached $27.8 billion in the last seven days, showing a 14.2% increase from the previous week. This growth was driven by a 21% increase in Uniswap and a 52% increase in Balancer volumes.

Spot ETH ETF Approval

Next month, the approval of spot BTC ETFs is finally expected. Following this, the focus will shift to spot ETH ETF applications made by trillion-dollar asset managers like Fidelity and BlackRock.

ETH, which has more growth potential than Bitcoin, could see significant demand when ETF products are launched due to reasons such as annual profitability and staking income. Issuers required to hold an equivalent amount of ETH in reserve for the issuance of spot ETFs will contribute to a shortage in supply. After January 10th, with the purchase of these expectations, ETH could surpass $2,500.

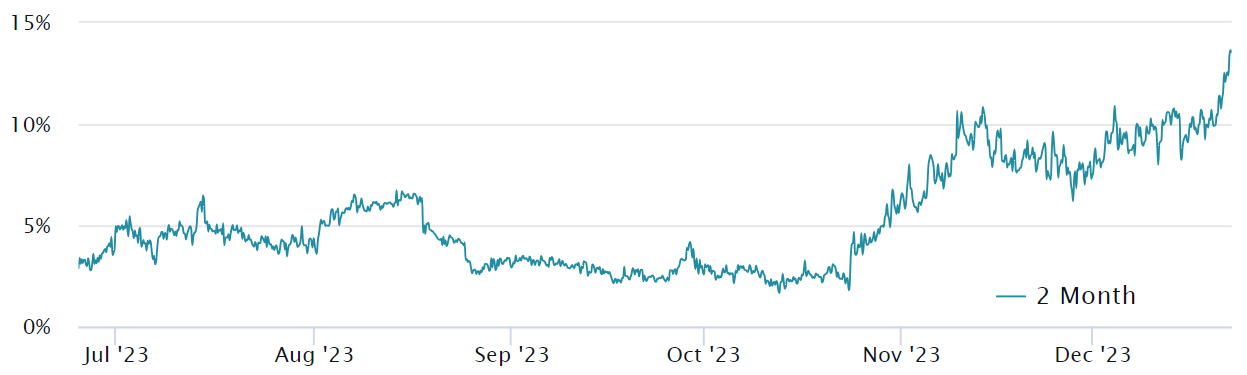

Derivatives Data

Derivatives market data is very important in determining the direction of the price. The premium of Ether futures contracts, which measures the difference between two-month contracts and the spot price, has reached its highest level in the last year. This indicates that institutional and accredited investors maintain a medium-term bullish expectation. The current 13.5% annual premium on Ether futures contracts is also promising for the $2,500 price target.

Türkçe

Türkçe Español

Español