As crypto enters a new bull market, some Web3 startups are turning to accelerator programs, with investors eager to get involved. These programs are known for offering mentorship and guidance in exchange for early capital. For instance, the United States-based Y Combinator counts several crypto firms like Coinbase and OpenSea among its investments.

Appetite for Startups Continues to Grow

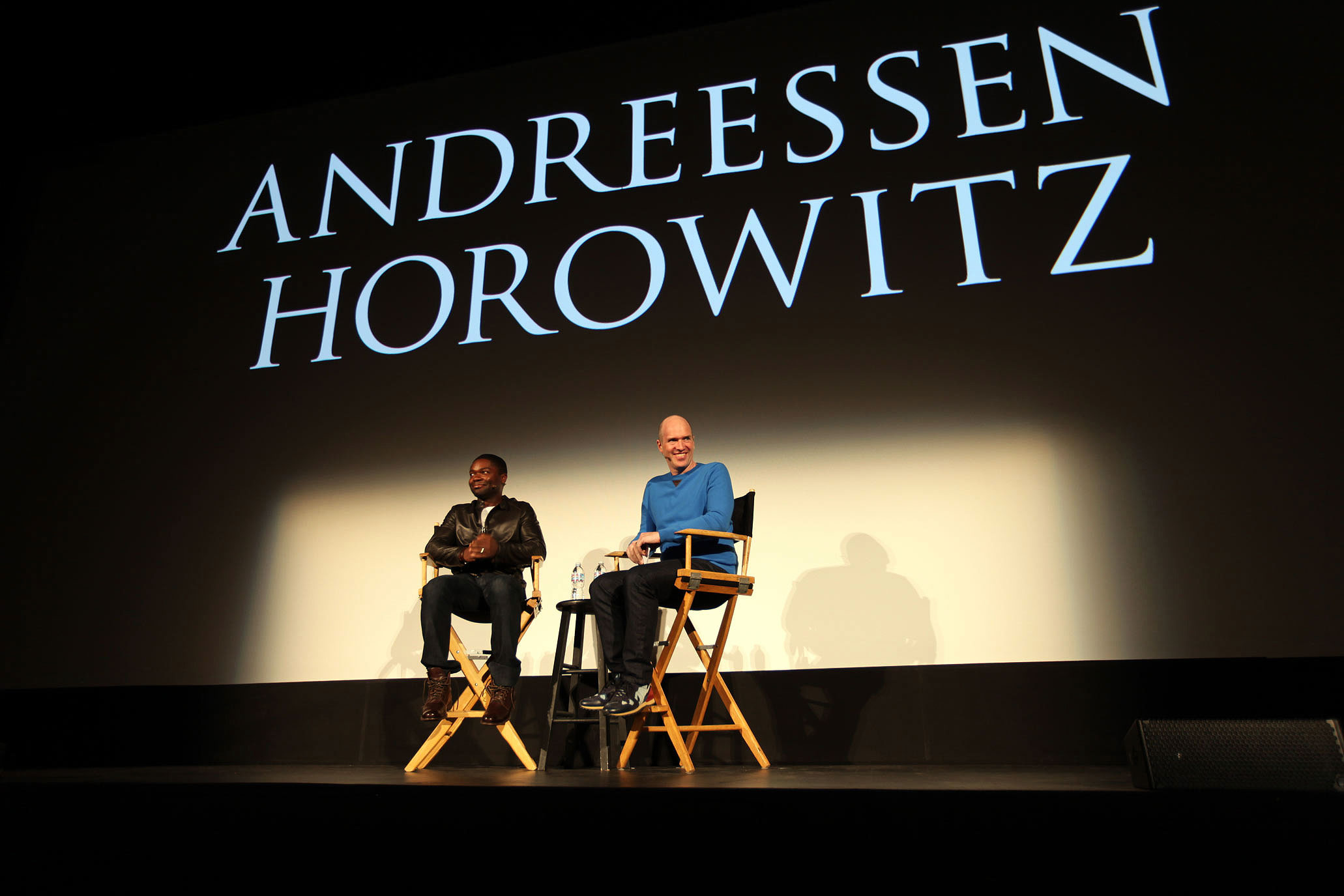

On March 26, Andreessen Horowitz (a16z) announced the lineup for its 2024 spring crypto startup accelerator. 25 startups will undergo a 10-week mentorship program in London, managed by the a16z crypto team. Business partner Jason Rosenthal shared a list of projects including Farcaster infrastructure, decentralized food distribution, and zero-knowledge-backed passport identity verification. Startups in a16z’s accelerator receive $500,000 for a 7% equity stake. Projects involved include Flashbots and Phantom.

On November 9, 2023, the Avalanche Foundation and Ava Labs introduced the first group of startups in their Codebase accelerator program. The program will invest between $500,000 and $1 million in these startups. A Web3 gaming infrastructure company, Helika, in collaboration with Pantera Capital, Spartan Capital, Sfermion, and other venture capital firms, has allocated up to $50 million for startups joining its new Web3 gaming accelerator, Helika Accelerate.

Crypto Market and Capital Firms

As the crypto bull market rises, there is a resurgence in venture capital activities. Crypto venture firm 1kx recently announced a fundraising round of $75 million, while Hack VC completed a $150 million round in February. Symbolic Capital‘s director Sam Lehman, in a March 26 article, highlighted the vital role of strong crypto accelerators in fostering community among founders in the network-centric Web3 space.

Lehman emphasized the rise of new crypto accelerators driven by funds aiming to strengthen their brands and rapidly deploy capital. However, he also cautioned about potential predatory practices among some accelerators:

“Some accelerators are taking extremely large positions in companies by leveraging the early stage they invest in and the added value they propose. Founders should definitely think twice about whether the terms they accept from an accelerator are worth what they receive in return.”

Web3 gaming investment activities have also seen a steady increase recently. 0G Labs completed a $35 million pre-seed funding round on March 25, with participation from over 40 crypto companies, including Hack VC and the Blockchain Builders Fund.

Türkçe

Türkçe Español

Español