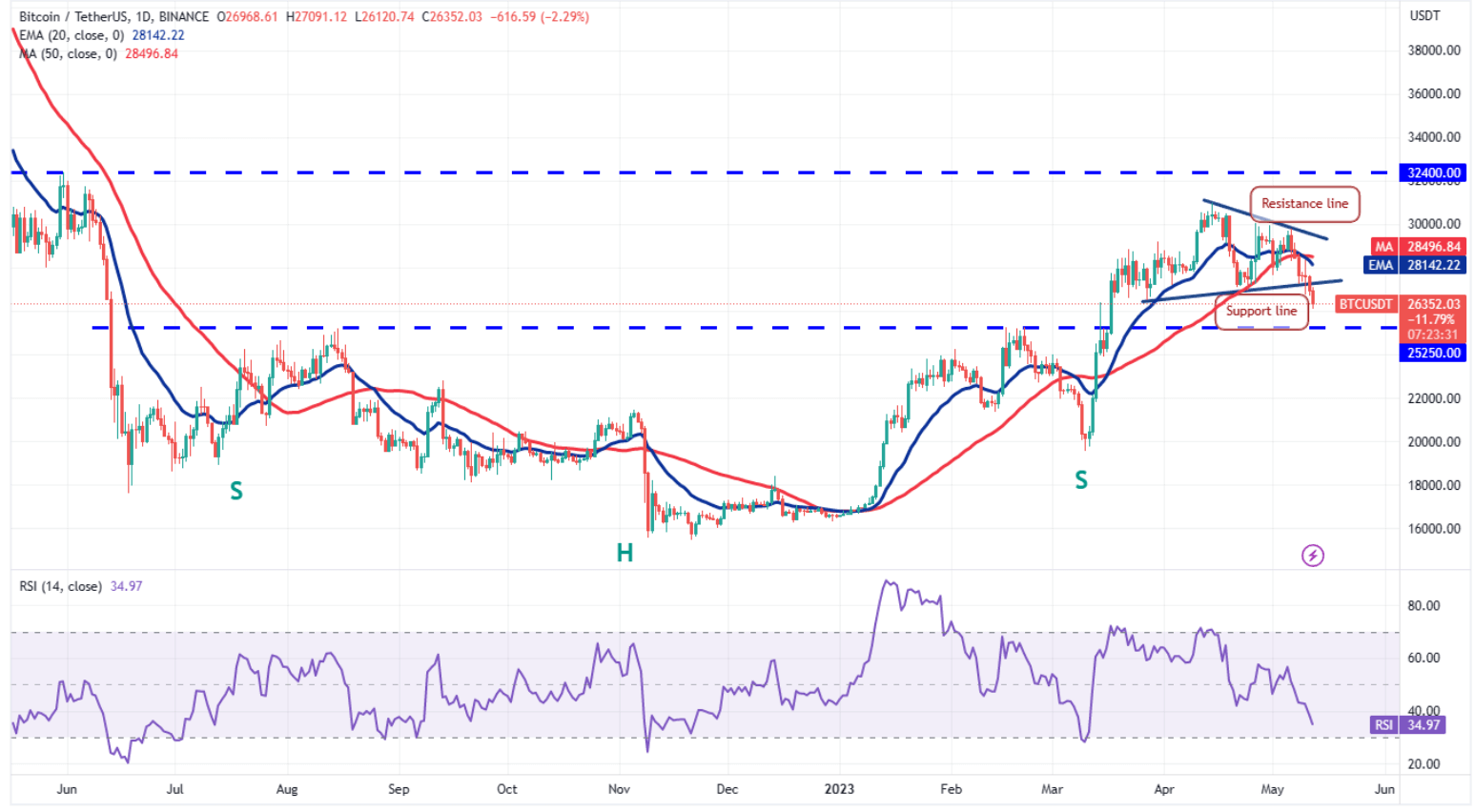

The king cryptocurrency continues the day below $26,300 and support for $26,800 has been lost. The decline on the Bitcoin front is gaining momentum with decreasing volumes. The fact that short-term investors are taking a selling position has enabled altcoins to advance significantly to the March 10 bottom. So what are the expectations for the weekend?

Bitcoin (BTC)

We may be near the bottom now. Philip Swift, co-founder of DecenTrader and the man behind data source LookIntoBitcoin, thinks there won’t be any more big sell-offs. One of the reasons keeping analysts bullish is the halving cycles that Bitcoin has stuck to so far. Referring to previous cycles, investor and entrepreneur Alistair Milne said that the right time to buy cryptocurrency is now.

Bitcoin formed a doji candlestick pattern on May 10, signaling indecision between bulls and bears. Sellers showed their intention to continue the downward movement by breaking below the support line of the symmetrical triangle pattern.

The next target for the Bitcoin price seems to be $25,250. If it loses this level, its journey to $20,000 may begin. For a rise, closes above the $26,800 and $27,200 levels are needed again.

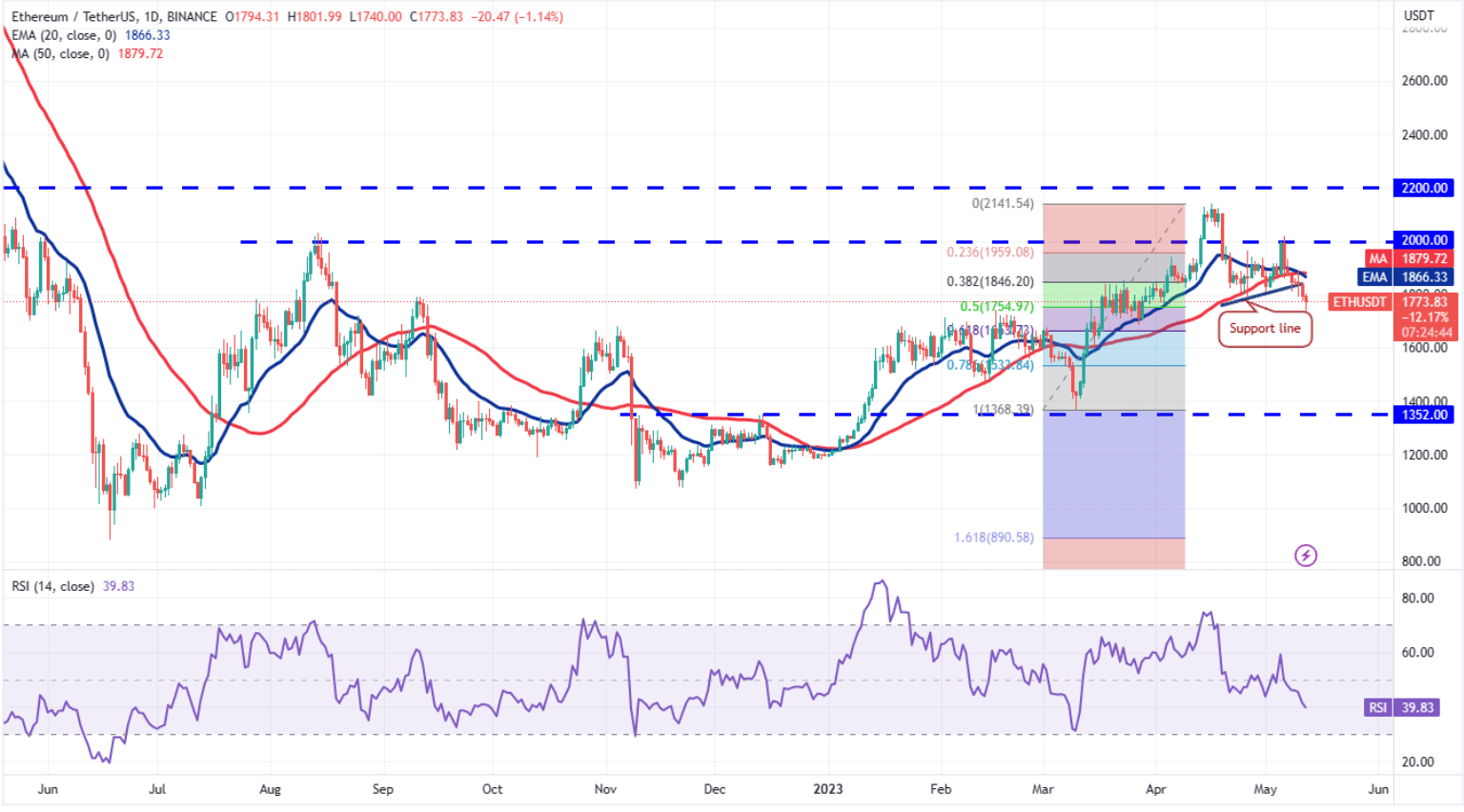

Ethereum (ETH)

Ether turned down from the 20-day EMA ($1,866) on May 10, indicating that sentiment has turned negative and traders are selling. The ETH/USDT pair broke below the support line on May 11, indicating the resumption of the correction. The pair could fall as low as $1,663 in the next phase.

Despite the ongoing negative sentiment, if the ETH price can recover $1,866, the psychological resistance area of $2,000 can be targeted again. However, there are important developments in the last 24 hours such as the withdrawal of the Binance exchange from Canada, decreasing liquidity, negative consumer confidence indices that support the bears.

Investors should be aware that sudden declines may occur in this environment. Declining liquidity makes the job of both bears and bulls much easier.