Prominent on-chain analytics platform Santiment reports that, following a sharp decline that sent prices to their lowest in three years, deep-pocketed investors have been accumulating millions of Chainlink (LINK). The analytics platform also highlights Cardano’s (ADA) potential as a buying opportunity, signaling that the altcoin market is entering a phase of rebalancing.

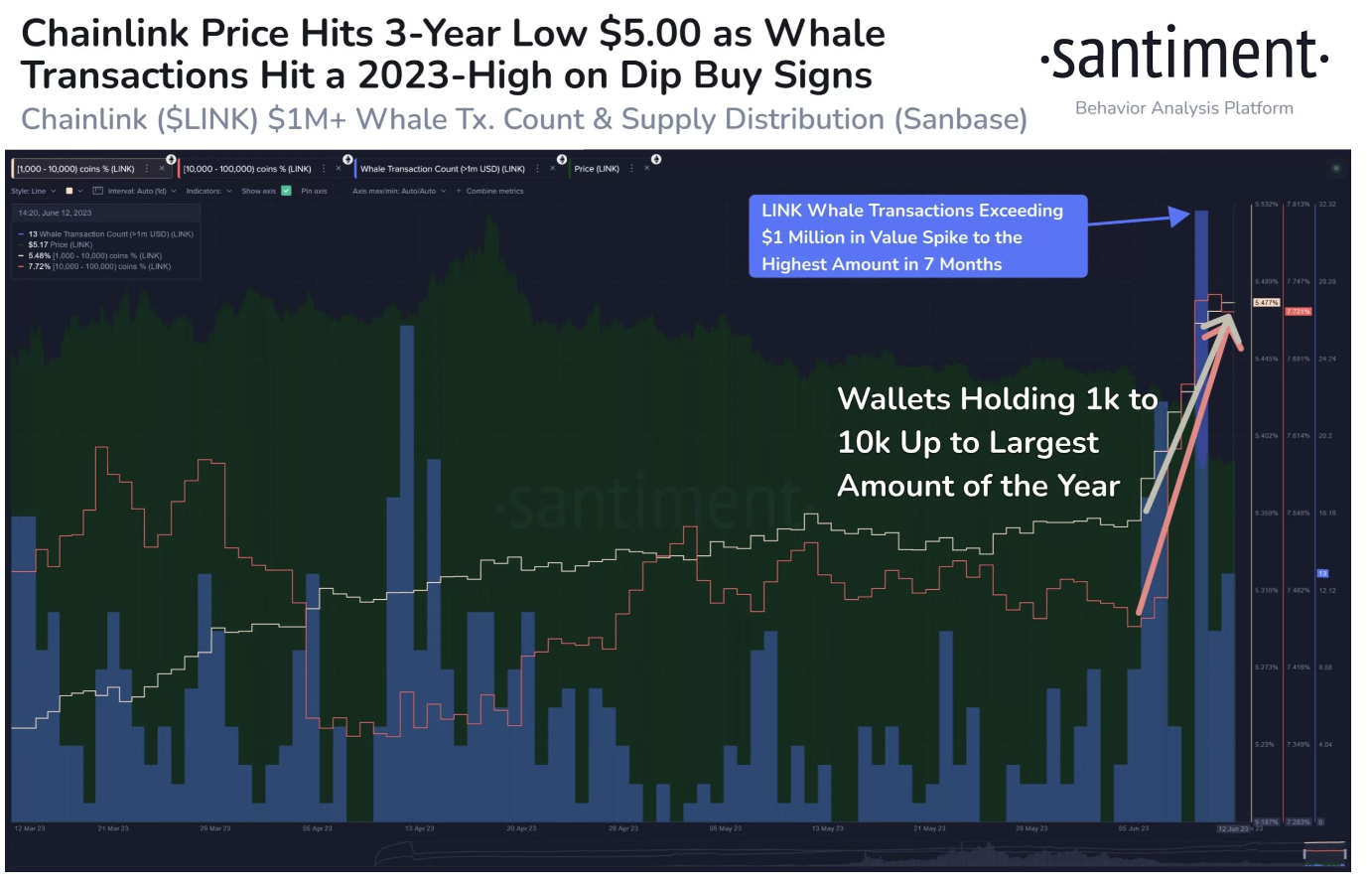

Middle-Size Wallet Addresses Hoarding LINK

Santiment noted that wallet addresses holding between 1,000 and 100,000 LINK have accumulated roughly 3.9 million LINK worth about $20 million over the past week. According to the analytics platform, the activity of these large whales has reached a record level for 2023:

The amount of Chainlink whale transactions has reached its highest level in 2023 as prices plummeted to a three-year low of $5 over the weekend. Medium-sized wallet addresses (holding between 1,000 and 100,000 LINK) are especially accumulating in large volumes, accumulating 3.9 million LINK ($20 million worth) over the past week.

Chainlink’s native asset LINK, a decentralized oracle network, is currently trading at $5.37, down by 13.44% in the last seven days, pricing over 90% below its all-time high as of this writing.

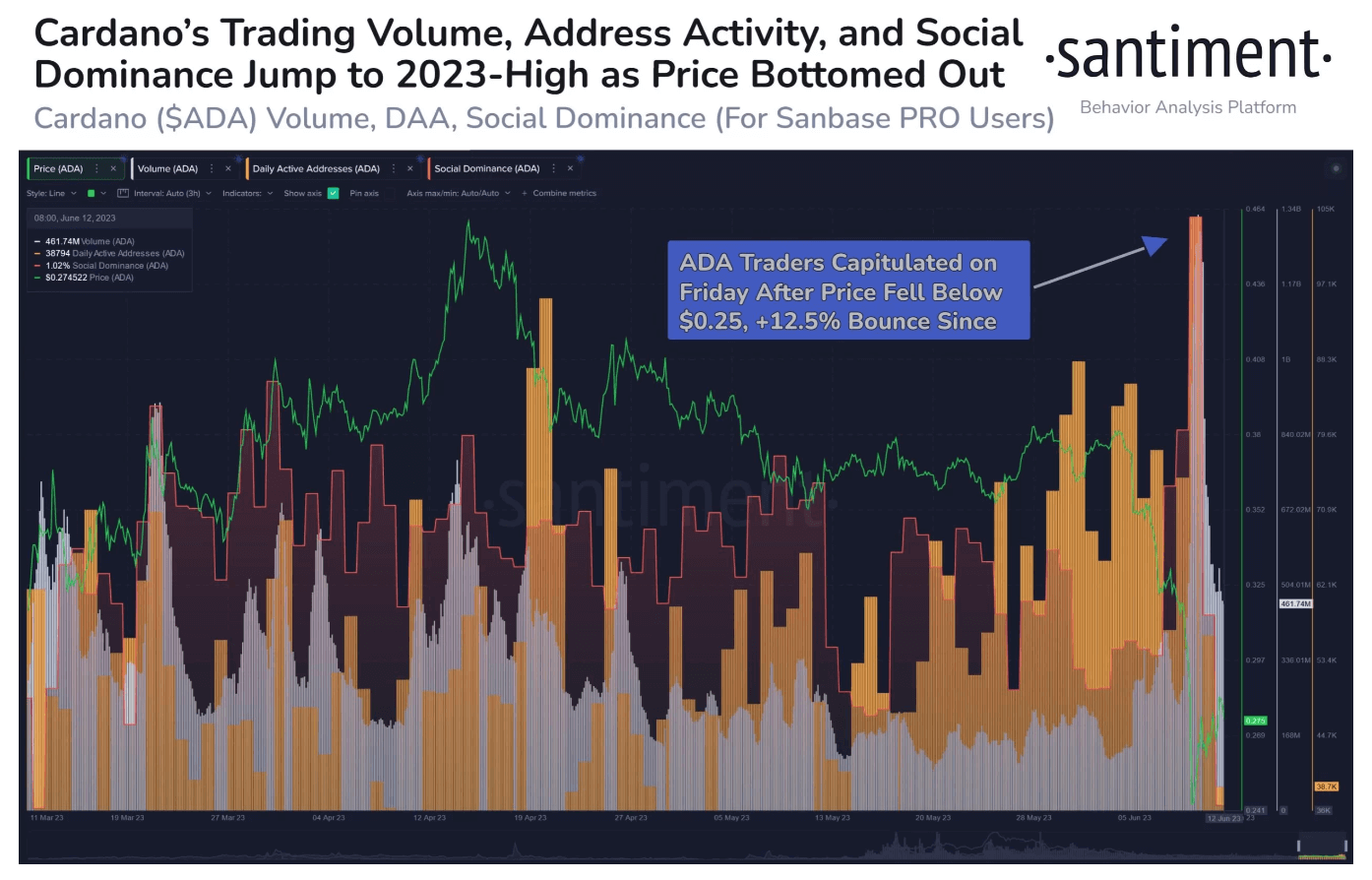

Cardano Offers a “Buy the Dip” Opportunity

Santiment also suggested that following the recent collapse, Cardano (ADA), seen as a competitor to Ethereum (ETH), may have reached a buying level. The platform stated that ADA’s trading volume and social dominance have reached the highest levels of 2023 after falling to $0.25:

The Cardano capitulation was more pronounced during the June 9 crash compared to other altcoins. After prices fell 35% between June 5 and 9, a buying opportunity arose when ADA volume, wallet address activity, and social dominance reached their 2023 peak on June 10.

Currently, Cardano is trading at $0.2747, down 20.90% over the last seven days, pricing 91% below its all-time high with current rates.

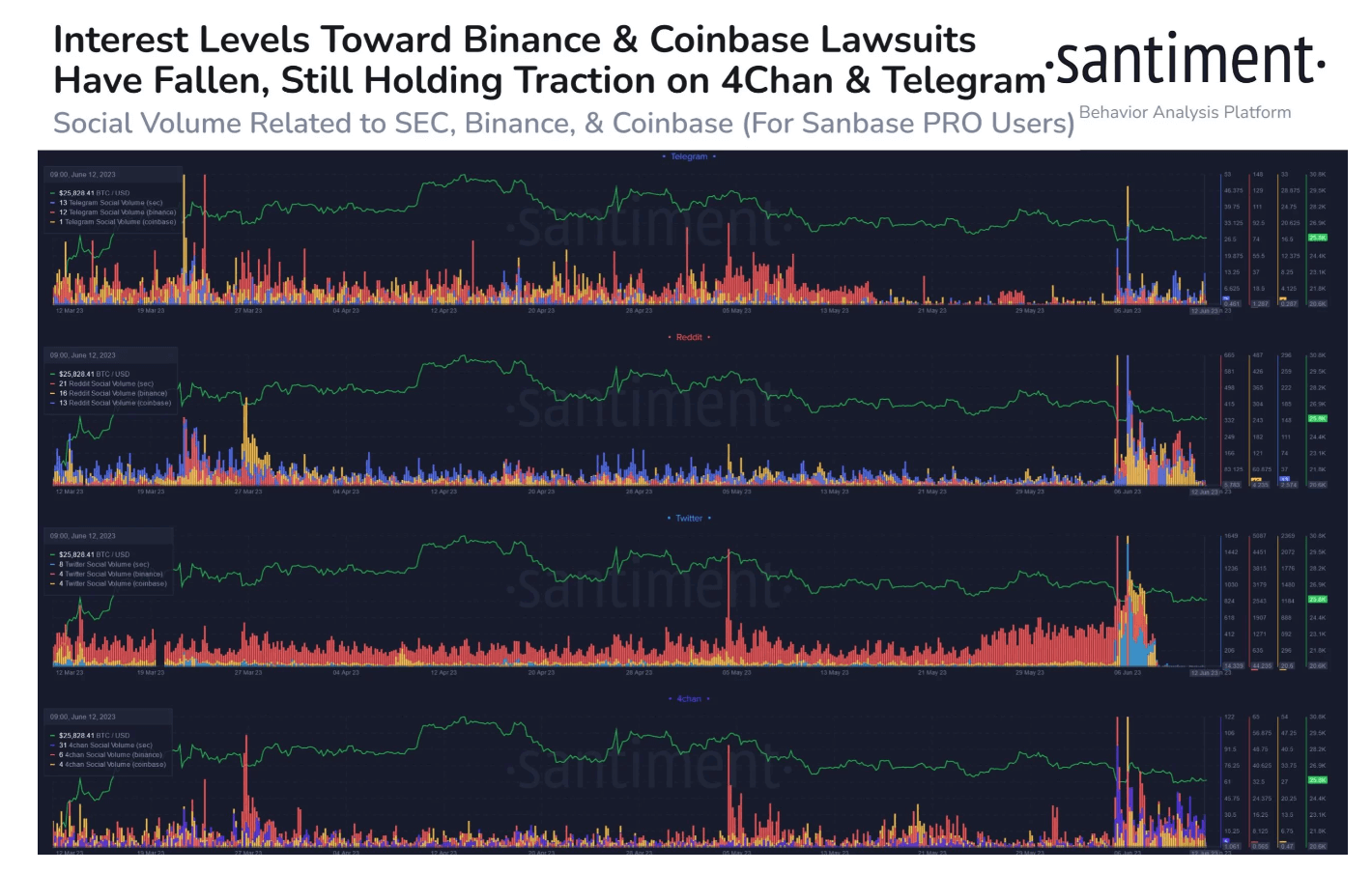

Addressing the broader altcoin market, Santiment noted that the market is undergoing a balancing process this week following the weekend’s downturn:

With investors aware that the SEC might go after Binance and Coinbase, the situation seems to have calmed down for now. We could see prices gradually rising back to pre-crash levels until the next developments in the lawsuits.