The term “whale” in the cryptocurrency markets refers to individuals or institutions that control significant assets and use this control to influence markets. Whales can cause significant market fluctuations with large buy or sell orders. This leads to rapid price changes and forces small investors to reconsider their strategies. Today, a whale’s significant move is in the spotlight. The development was reported by Lookonchain.

Whale Makes Moves in AAVE and UNI

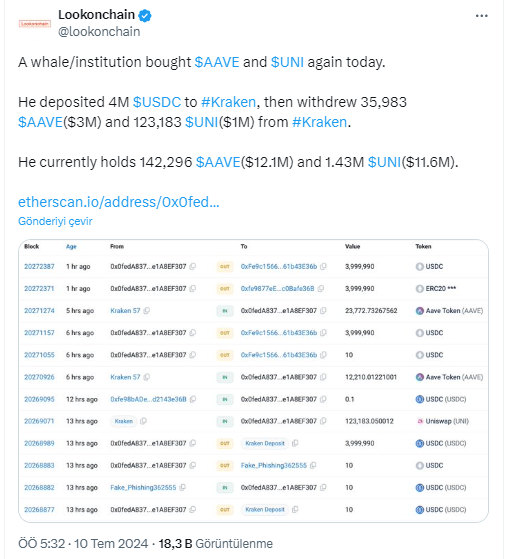

Recently, a notable whale or institutional investor made significant moves in the cryptocurrency market. This whale sent a large amount to the Kraken exchange to strengthen their holdings in DeFi tokens like Aave (AAVE) and Uniswap (UNI).

Lookonchain reported that this whale deposited 4 million USDC tokens to Kraken and then withdrew 35,983 AAVE. The withdrawn AAVE is worth approximately 3 million dollars.

On the other hand, the same whale used the remaining USDC to purchase 123,183 UNI. The UNI purchased is worth approximately 1 million dollars. As a result of these strategic moves, the whale’s portfolio now contains significant amounts of AAVE and UNI. This situation reinforces confidence in the value and potential of these cryptocurrencies, while also highlighting their role in the DeFi ecosystem.

Whales Known for Stirring and Tensing Markets

It’s worth noting that such whale movements increase market volatility and fuel speculation. These whales can deeply affect investors’ risk perceptions. Some whales chase short-term gains, while others shape market trends with long-term investment strategies.

This situation leads to debates about fairness and healthy competition in the market, while also playing a crucial role in ensuring liquidity and overall market stability in the cryptocurrency ecosystem. As seen in the example above, the whale’s purchase of AAVE and UNI may indicate expectations of a future rise. At the time of writing, AAVE is trading at $87.35, while UNI is trading at $8.21.

Türkçe

Türkçe Español

Español