Cryptocurrency markets are experiencing various developments today. Today, an important player known as a whale or institution in the cryptocurrency market made significant sales affecting the prices of various tokens. The sales in different cryptocurrencies indicated that the whale was making significant preparations. Let’s look at the details.

Whale Sold 4 Altcoins

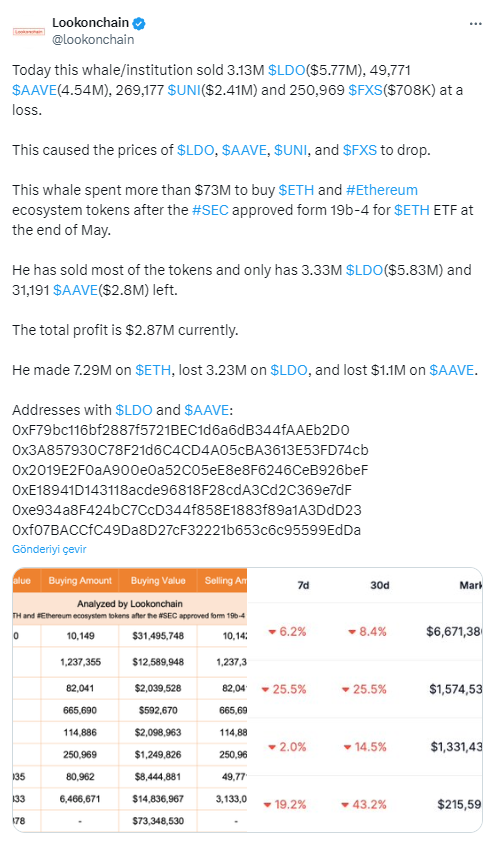

According to Lookonchain, this whale sold approximately 3.13 million LDO tokens worth about $5.77 million, 49,771 AAVE tokens worth about $4.54 million, 269,177 UNI tokens worth $2.41 million, and 250,969 FXS tokens worth $708,000. These sales contributed to a noticeable decline in the prices of LDO, AAVE, UNI, and FXS.

This whale had invested over $73 million in Ethereum (ETH) and various Ethereum ecosystem tokens following the U.S. Securities and Exchange Commission’s (SEC) approval of a 19b-4 form for an Ethereum Exchange-Traded Fund (ETF) at the end of May. Following this approval, the whale accumulated significant amounts of these tokens, investing in the potential positive impact of the ETF on Ethereum-related assets.

However, the whale has now sold most of these tokens. Currently, they hold only 3.33 million LDO tokens worth approximately $5.83 million and 31,191 AAVE tokens worth about $2.8 million. Despite the losses, the whale’s overall trading activities have resulted in a net profit of $2.87 million to date.

Overall Gains and Losses

Looking at gains and losses, the whale made a profit of $7.29 million in Ethereum. However, they incurred losses of $3.23 million in LDO tokens and $1.1 million in AAVE. This situation indicated a strategic decision to capitalize on the initial rise in Ethereum‘s value following the ETF approval, while enduring losses in other Ethereum ecosystem tokens.

These sales and the subsequent price declines highlighted the impact of large investors on the cryptocurrency market. The actions of such whales can influence market sentiment and token valuations, causing significant fluctuations. This example also demonstrated the risks and rewards of trading and investing in the highly speculative and rapidly evolving cryptocurrency environment.

Türkçe

Türkçe Español

Español