A whale known for its influential Ethereum moves in the world of cryptocurrency transferred 3,700 ETH to Binance. The numerical equivalent of the transferred ETH is $8,720,000. While the whale’s move was being discussed, four analysts provided important evaluations for Bitcoin today. The analysts pointed to new levels for BTC and put forth perspectives for long-term investment.

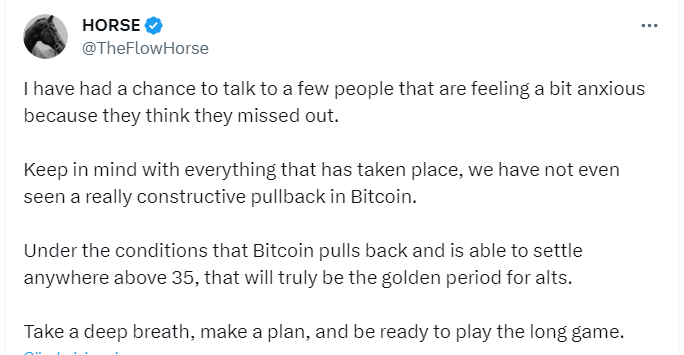

Did The Opportunity Slip Away For Those Who Did Not Buy Bitcoin?

Analyst The Flow Horse addressed the concerns of individuals who might have missed the latest market opportunities. Despite recent developments, he emphasized that Bitcoin has not yet experienced a significant and positive pullback.

The analyst suggested that if Bitcoin experiences a pullback and manages to balance above the $35,000 level, this could indicate a favorable period for altcoins.

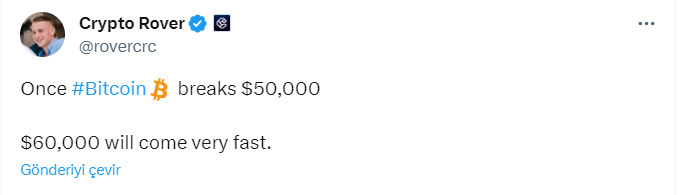

Emphasis on $60,000 For BTC

Analyst Crypto Cover pointed to a bullish outlook for Bitcoin and stated that he expects a rapid rise to $60,000 after the cryptocurrency surpasses the $50,000 limit.

Cryptocurrency analyst Michaël van de Poppe suggested that the most suitable time to invest in altcoins, particularly Ethereum (ETH), is the 3-8 month period leading up to Bitcoin’s halving. According to the analyst, this favorable investment window is currently ongoing, and there are indications of a short-term peak in Bitcoin dominance.

As a strategic move, van de Poppe suggests shifting investments from Bitcoin to Ethereum and implies the expectation of potential superior performance and favorable market conditions for Ethereum in the near term.

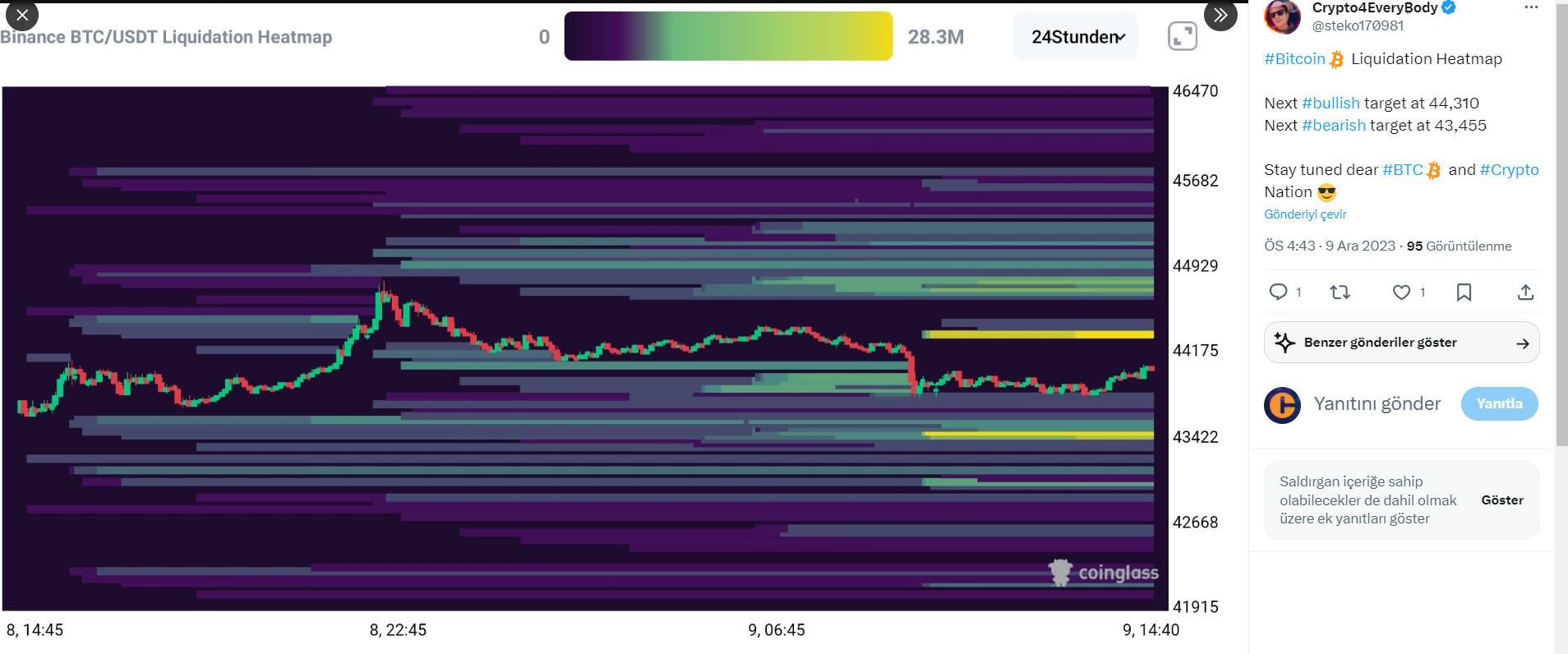

What Levels Did The Bitcoin Liquidation Heat Map Show?

Analyst Crypto4Every₿ody, who shared the Bitcoin Liquidation Heat Map, showed the next bullish target at 44,310 and the next bearish target at 43,455. These levels provide key indicators that investors can follow when assessing potential market movements.

The bullish target represents an optimistic threshold that could signal further upward momentum if surpassed, while the bearish target represents a critical level that could indicate a potential decline in the market if breached. These targets highlighted by cryptocurrency analysts serve as important reference points for those navigating the current dynamics of the Bitcoin market.

Türkçe

Türkçe Español

Español