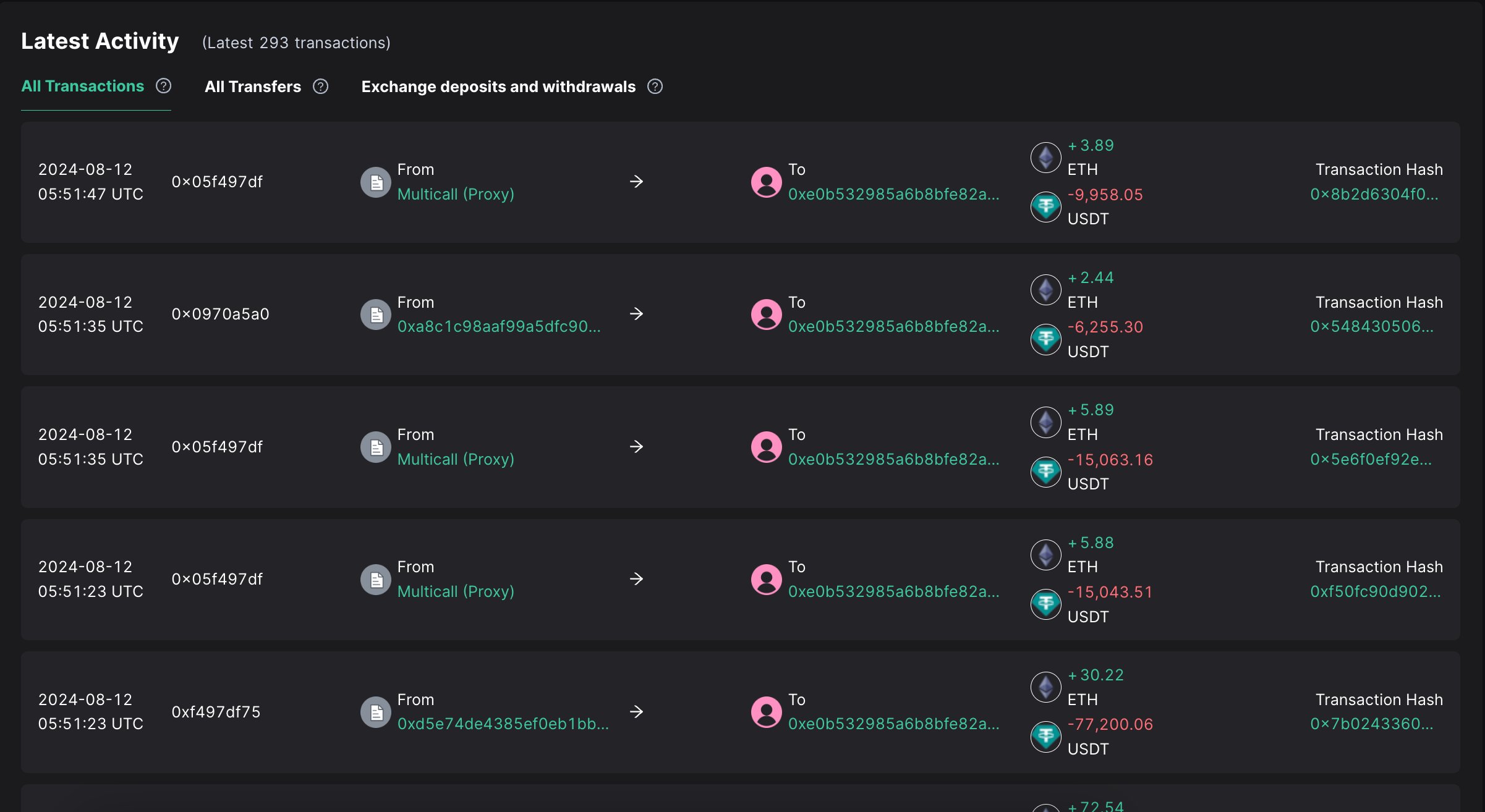

Whales continue to accumulate as Ethereum remains stuck below a significant psychological resistance line. A whale purchased 5,000 Ethereum, valued at over $12.8 million at the current valuation. According to Scopescan’s August 12 post, this whale address last bought Ethereum when it dropped to $2,100 and rose to $3,100.

What’s Happening on the Ethereum Front?

Investors often look at whale buying patterns to gauge sentiment around the underlying asset. The last time this whale bought Ethereum, it marked the local price bottom just before a strong recovery.

Ethereum showed significant gains after the $510 billion crypto market sell-off on August 5 and 6. According to CoinMarketCap data, its price increased by over 18% last week, trading at $2,655.

According to Nansen’s lead research analyst Aurelie Barthere, despite the rise, Ethereum needs to decisively reclaim the $2,700 resistance for more upward momentum. Barthere stated:

“A dead cross has already occurred in Ethereum, and the price needs to stay above $2,700 or the resistance tested yesterday and in January 2024.”

A dead cross is a technical chart pattern reflecting short-term price weakness compared to the underlying asset’s long-term moving average price. A dead cross can often signal a good opportunity to buy an asset at a discounted price.

Details on the Matter

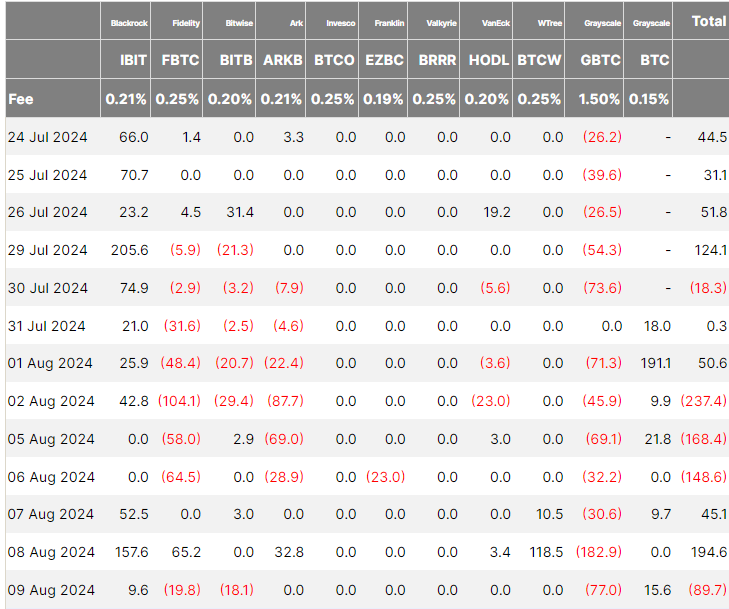

Institutional inflows continue to disappoint despite the launch of the first spot Ethereum exchange-traded funds (ETFs) in the U.S. on July 23. According to Farside Investors data, nine U.S. spot Ethereum ETF funds saw cumulative negative outflows of $15.8 million on August 9.

Since the launch, spot Ethereum ETF funds have recorded cumulative net outflows of $406 million, partially contributing to Ethereum’s lagging price action. ETF inflows can significantly contribute to a cryptocurrency’s price increase. For Bitcoin, ETF funds accounted for about 75% of new investments in the cryptocurrency by February 15, pushing it past the $50,000 mark.

Türkçe

Türkçe Español

Español