Whale movements continue to attract attention in the world of Bitcoin and altcoins. Today, a whale made a move that resulted in a significant loss. And it’s not just any loss, it’s a whopping 6 million dollars. The whale activated its Arbitrum holdings, causing a stir in the cryptocurrency world. Lookonchain X reported this move.

Whale’s Arbitrum Sale Results in 6 Million Dollar Loss

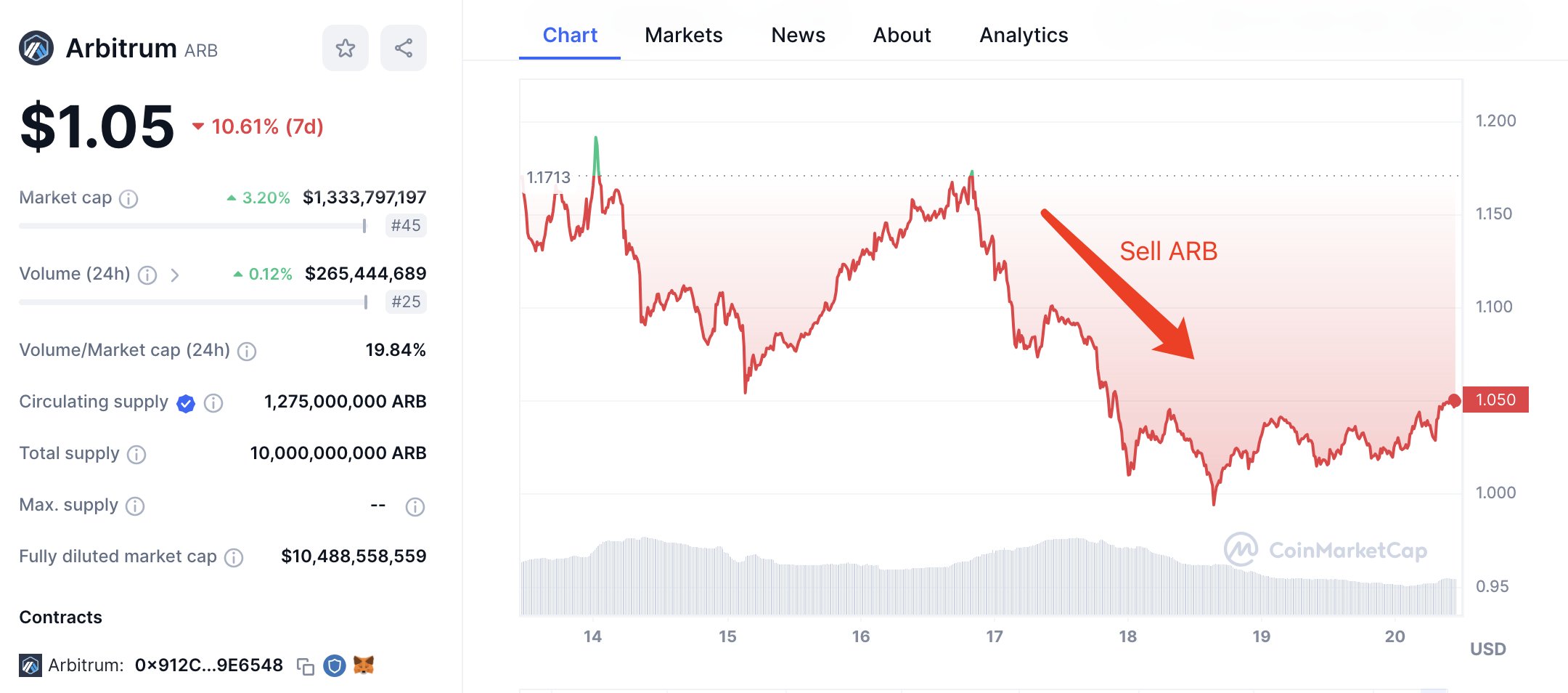

A massive whale in the cryptocurrency market made a surprising turn of events and sold 14 million ARB at a price of approximately $1.05 since November 16. This significant move caused fluctuations in the crypto community, leading to a closer examination of the whale’s strategic maneuvers.

This recent sale followed a series of notable transactions by the whale. In April, the whale bought 22,550,000 ARB from both Binance and Gateio at an estimated price of $1.23. The purchase amounted to $27,760,000. In September, the whale deposited 8,440,000 ARB to Binance when the price was at $0.82, resulting in $6,920,000.

Evaluation of the Sale: Total Loss of 6 Million Dollars

As things calm down, the financial consequences of these strategic moves have emerged. With a series of transactions at different price points, the whale is now facing a significant loss of approximately 6 million dollars. This loss highlights the inherent risks associated with large-scale cryptocurrency transactions, even for entities with substantial assets.

The whale’s decisions to withdraw and deposit significant amounts of Arbitrum ARB at different market values emphasized the intricate nature of navigating the cryptocurrency market dynamics. While the whale’s maneuvers may seem like a unique spectacle, they serve as important lessons for the crypto community. It reminds investors of the importance of strategic decision-making, risk assessment, and understanding market trends.

In conclusion, the recent sale of 14 million ARB by a significant whale is a reflection of the dynamic nature of the cryptocurrency market. It is also a reminder that profits are not always guaranteed. This incident, resulting in a total loss of 6 million dollars, serves as a cautionary tale for both experienced investors and beginners.

Türkçe

Türkçe Español

Español