Interest from crypto whales in an asset often signals a potential price rally. Individual investors gain confidence when they see large investors increasing their trading activities. This increased confidence typically leads to more buying activity and sustainable price rallies. We examine three altcoins that have recently made headlines.

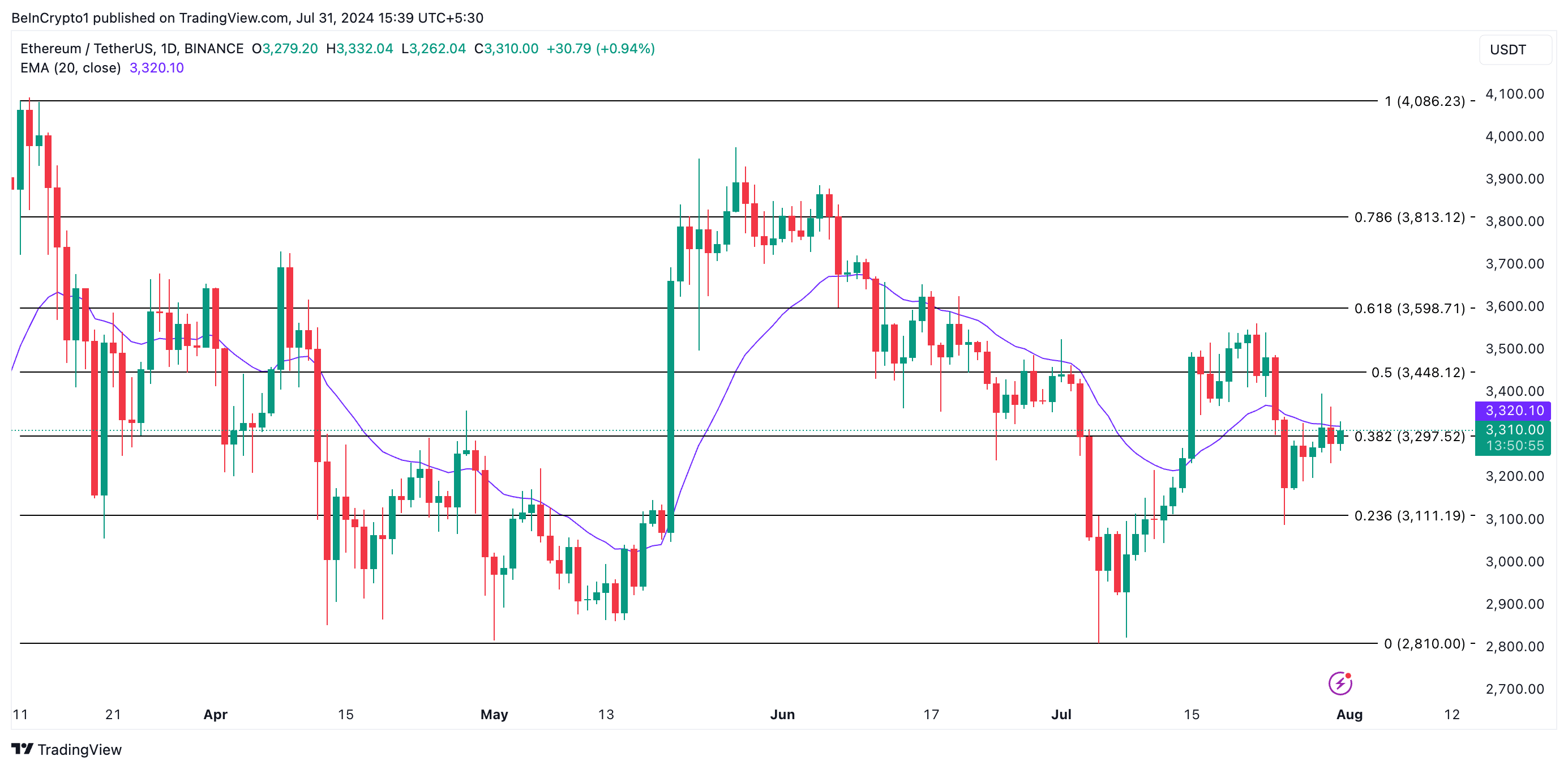

What’s Happening with Ethereum?

As the market anticipates more inflows from spot exchange-traded funds, Ethereum whales have increased their holdings. Onchain data from IntoTheBlock revealed a 167% increase in the net flow of large holders over the past seven days.

Large holders are addresses that own more than 0.1% of an asset’s circulating supply. The net flow of large holders measures the difference between the assets these investors buy and sell over a certain period. When this metric rises, it indicates that whale addresses are purchasing more assets.

At the time of writing, Ethereum was trading at $3,311. It is preparing to surpass its 20-day exponential moving average (EMA), which tracks the average price over the last 20 trading days. This crossover usually indicates an increase in buying pressure. If it occurs, Ethereum’s price could rise to $3,448.

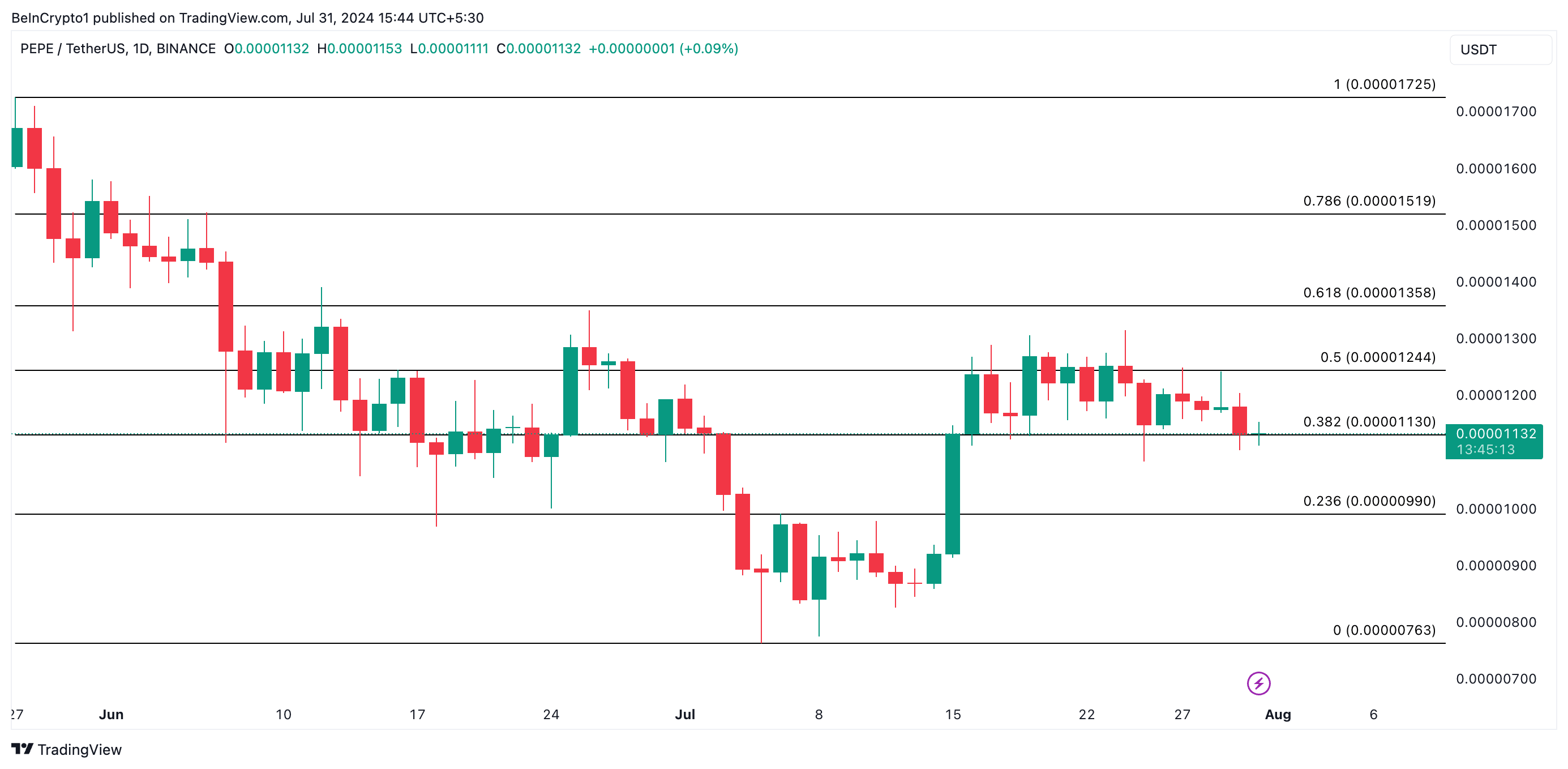

Interest in PEPE Continues

The frog-themed memecoin PEPE has seen an increase in whale addresses. According to Santiment, 85,400 addresses currently hold between 10,000 and 10,000,000 PEPE tokens, marking the highest number since its launch in April 2023. In the last month alone, the number of these PEPE holders has increased by 12%. This occurred despite the token consolidating within a price range during that period.

PEPE whales have recently increased their holdings due to the profitability of holding the token. Readings from the Market Value to Realized Value (MVRV) ratio indicate that the memecoin is currently overvalued, suggesting that investors might sell for profit.

At the time of writing, PEPE’s MVRV ratio was positive according to various moving averages. Specifically, the 30-day and 365-day moving averages recorded MVRV ratios of 8% and 97.58%, respectively. However, it is important to note that consistent selling could put downward pressure on PEPE’s price. If selling pressure starts to exceed supply, the memecoin’s value could drop to $0.0000099.

Possible Scenarios for ONDO

According to IntoTheBlock, Ondo Finance’s governance token ONDO saw an increase in large holders’ inflows over the past 30 days. During this period, this increased by 19%.

This data tracks the amount of cryptocurrency flowing into wallets owned by large holders. When it rises, it indicates increased buying pressure from significant investors. ONDO whales could push the altcoin’s price to $0.99 if they continue accumulating in August.

However, if profit-taking activity continues, it will put downward pressure on the token’s price, potentially causing it to drop to $0.84.

Türkçe

Türkçe Español

Español