The market-wide decline on August 15 increased the downward pressure on Shiba Inu’s (SHIB) price. Although the market has somewhat recovered since then, the downward trend continues, and there are other significant factors affecting SHIB’s price besides the overall market decline.

Whale Sales and Increase in Short Positions

Shiba Inu’s price decreased by 1.5% in the last 24 hours, falling to 0.00001359. According to on-chain data, whale exits from SHIB could be one of the main reasons behind this decline.

IntoTheBlock data indicates a 32.29% decrease in large investor transactions, suggesting whales might be selling their SHIB. This is supported by the 48 billion SHIB (657 thousand dollars) net exchange inflows reported by CryptoQuant.

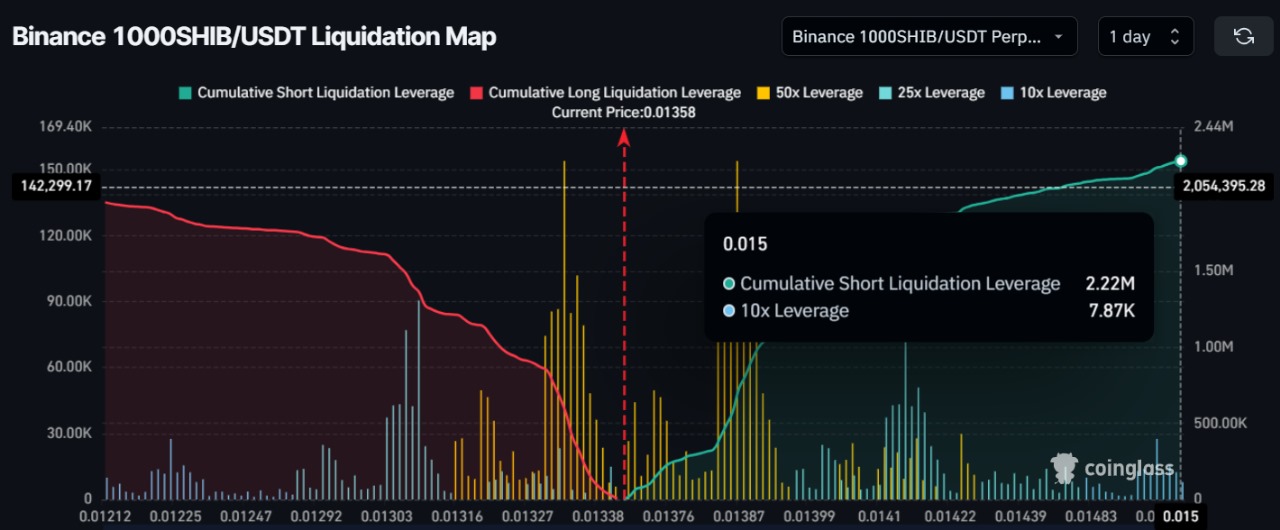

The increase in SHIB’s open interest also strengthens bearish signals. Open interest increased by 3.75% in the last 24 hours, indicating a rise in short positions. When combined with a 2.2% decrease in cumulative volume delta (CVD) data, it confirms that market players expect a decline. Such a scenario usually means the downtrend will continue.

The SHIB Liquidation Map provided by Coinglass reveals an imbalance in the liquidation of short positions. This indicates an increasing bearish sentiment against SHIB due to weak network growth and overall negative market conditions.

Shiba Inu May Recover from Key Support Levels Despite Everything

Technical analyses also support the emerging bearish trend. SHIB confirmed the downward trend by breaking the lower boundary of the rising channel formation, but it is expected to find support at 0.00001350 and 0.00001100 levels. These support levels could be recovery points in case of a pullback.

The narrowing Bollinger Bands, indicating low volatility, suggest that downward pressure might increase. However, the Relative Strength Index (RSI) and Chaikin Money Flow (CMF) also support this bearish trend, but a reversal could be expected if the price drops further.

If SHIB’s price rises above the upper band of the Bollinger Bands, this bearish scenario could be invalidated, and the price could target the next major resistance at 0.00001655. Currently, it seems that whales are waiting to buy SHIB at lower levels.

Despite the current downtrend, it is known that large whales have placed buy orders worth 1.775 million dollars at 0.0000099, 0.0000109, and 0.0000119 levels. This indicates a potential for recovery in SHIB’s price in the near future.