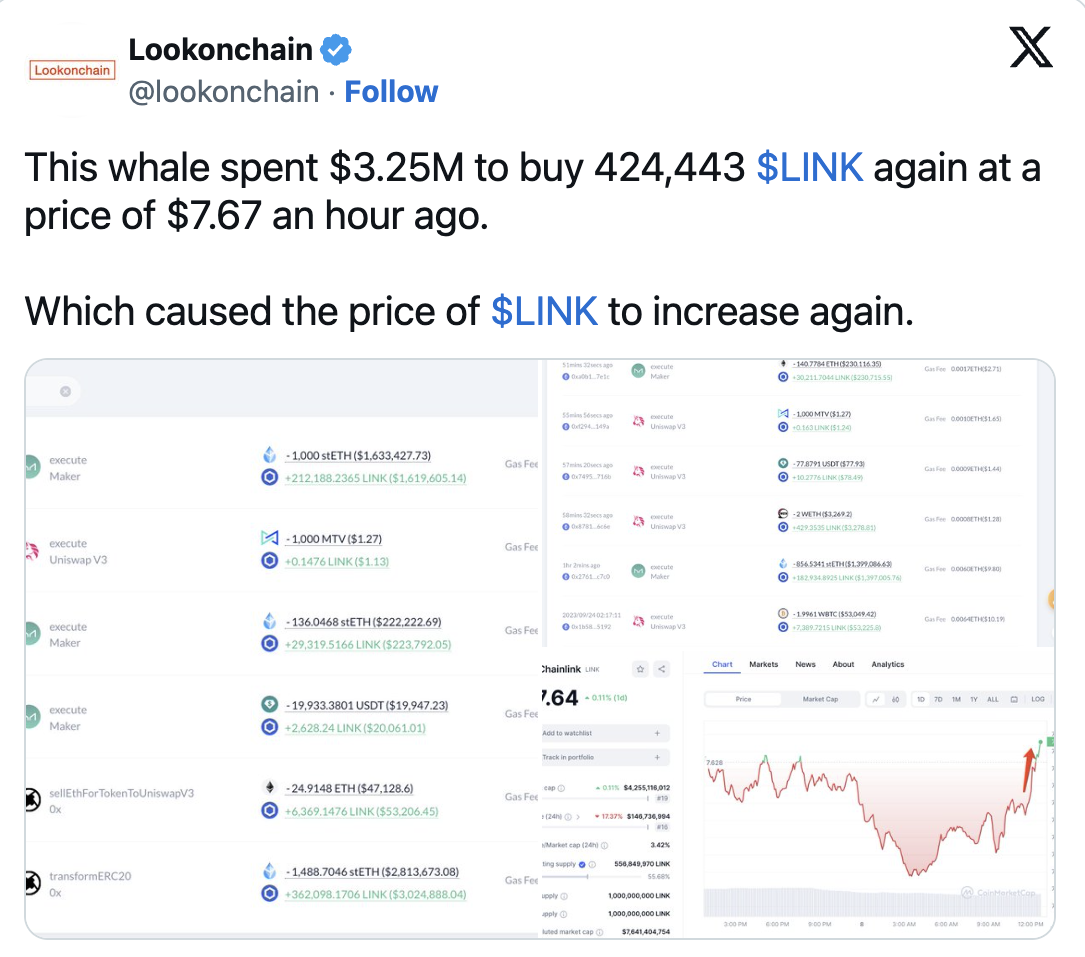

Chainlink showed a lackluster performance this week compared to the rise of many altcoins. However, whales’ interest in Chainlink is increasing day by day, and this situation is being followed by many analysts and institutional companies. On October 8, a whale made a purchase of 424,443 LINK at a price of $7.67. The amount paid by the whale for this purchase is equivalent to $3.25 million.

Rise Begins with Whales

This significant development had a serious impact on the Chainlink price and supported the upward movement of the LINK/USD pair. A detailed chart analysis conducted after the purchase also shows that this purchase provides great support for the upward movement. The impact of whale purchases has become a topic that has once again come to the agenda in the crypto sector.

Whale purchases are not new to Chainlink. A short time ago, two important purchases were made. Analysts predict that both purchases were made by the same person or institution. These buyers purchased a total of 788,877 LINK tokens, with a total value of $6 million. The purchases were made when the LINK price was trading at $7.62.

To facilitate the transactions, the whale exchanged 3,074 stETH worth $5.87 million and 71 ETH worth $136,000 with LINK tokens. After this transaction, there was a 6.5% increase in the LINK/USD pair. Such large-scale purchases made by major investors are usually based on the future value gain of the asset, showing confidence in the asset.

LINK Takes the Lead

Chainlink’s price performance, although it disappoints investors, has achieved a 30% increase from its lowest level. This remarkable rise has allowed LINK to stand out compared to the troubled processes in other crypto assets.

The continuation of whales’ interest and trust in the Chainlink project can be attributed to its unique value proposition in the decentralized finance (DeFi) field. Chainlink, defined as a DeFi network, combines smart contracts with Web2 data, enabling DeFi platforms to function seamlessly.

Türkçe

Türkçe Español

Español