Telegram’s recent tap-to-earn project Notcoin (NOT) shows a decline in whale activity due to a drop in the altcoin‘s price. Since early August, major investors in NOT have been one of the main reasons for the double-digit declines in the altcoin during this period, as they have been selling more than buying.

Notcoin Whales Fleeing the Market

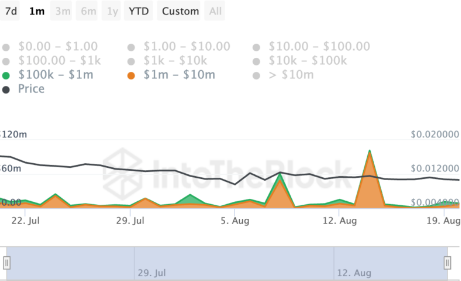

On-chain data reveals a noticeable decline in daily transaction volume linked to major NOT investors. According to data provided by IntoTheBlock, there was a 74% decline in buy/sell transactions involving whales with transactions between $100,000 and $1 million. Additionally, transactions between $1 million and $10 million also saw a 21% decline.

This decline in large transactions could indicate a negative trend due to its adverse effect on the asset. Individual investors may perceive a lack of confidence in the asset when they notice a decline in whale trading activities. This can often lead to increased selling pressure and continuous price drops.

Confirming this, the net flow of major NOT holders saw a 98% decline over the past 30 days.

What Will NOT’s Price Be?

NOT has been trading within a horizontal channel indicating consolidation since August 6. This suggests that neither bears nor bulls have shown the necessary strength, and the price lacks a definitive direction. During the same period, the RSI value also remained flat, indicating no significant overbought or oversold conditions in the market.

As of the time of writing, NOT is trading at $0.01057 after a 3.46% drop in the last 24 hours, with a 30% decline over the past 30 days. However, if NOT breaks its narrow range within the channel upwards, the price could move towards $0.13. If the trend is downward, the price could fall below the lower boundary of the horizontal channel, potentially dropping to $0.008.

Türkçe

Türkçe Español

Español