The Federal Reserve has postponed interest rate cuts in its latest meeting, yet markets anticipate at least four reductions. During a closed meeting last Friday, the Fed refrained from making any decisions. However, some notable signals compel the Fed to act. What should we expect moving forward? What will happen to cryptocurrencies?

What Will the Fed Do?

Stocks have fallen alongside interest rates, and cryptocurrencies have also experienced turbulence. The high costs, reduced sales, and issues in exports and imports have frightened companies, thus explaining the losses in stock prices. However, the accelerating sell-off in government bonds this week has heightened concerns, especially as this asset, deemed safe, also sees market exits.

Firstly, the Fed operates as an independent entity, and Powell does not share political affinity with Trump. The perception that political decisions could influence the Fed’s actions, especially if it appears to rescue Trump, is something to avoid. Consequently, Trump recently urged Powell, saying, “Stop playing politics and do your job; lower the rates.”

The Fed has often been late to respond, as seen during the 2008 financial crisis and the recent inflation chaos. They consistently state, “We prefer to be late rather than take a wrong step.” This sentiment still resonates in their recent communications about having sufficient advantages to observe the situation.

Fed and Cryptocurrencies

Everyone seems to expect cryptocurrencies to rise immediately if the Fed makes a statement about lowering interest rates. Others are hopeful that Trump might say, “Oh, I made a mistake; I will withdraw or freeze the tariffs.” Today, we elaborated on why this second scenario is unlikely to occur soon. The Fed will not make such a move at this time either, as there is no immediate sign of a stock market collapse akin to 2008.

The index hasn’t decreased by more than 50%, nor have U.S. Treasury yields risen to the levels seen last January. The cost of government borrowing is also not yet at an alarming level. However, the absence of a crisis does not mean we’re moving away from it.

So, what should we think? The Fed’s inclination to observe before intervening remains strong, with considerable patience. Although the potential risk of being late does pressure the Fed, they perceive this risk as more reasonable compared to the chance of making a wrong move.

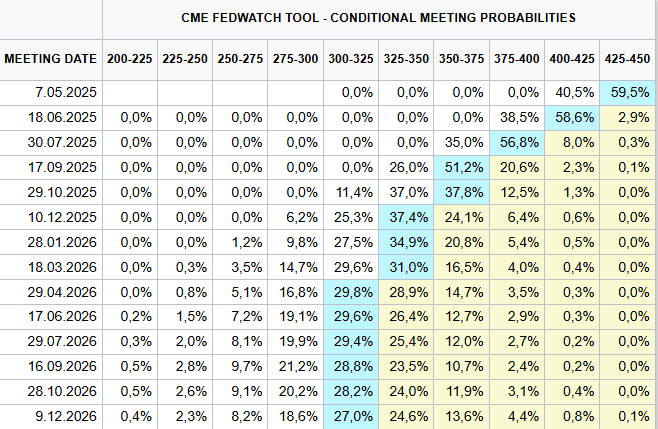

What if things deteriorate? The outlook for cryptocurrencies and risk markets appears gloomy in the short term, barring any significant surprises. However, when the Fed does take action, it will not simply announce a “100 basis point rate cut.” Markets continue to shift expectations for the first cut from May to June, with a target reduction of 25 basis points. Despite expectations for a 100 basis point annual reduction, BlackRock’s CEO does not foresee such an outcome.

If the Fed is compelled to intervene urgently, its first step would be to announce temporary purchases to stabilize bond volatility. In doing so, it will strive to avoid signaling monetary expansion.