Today is the most critical day of the week, and the most important event is the release of the Fed minutes. This document, known as the FOMC minutes, contains important details. It provides clear signals to investors about key moments of change in Fed policy. For example, with the January 2022 minutes, everyone became certain that the Fed had embarked on a long journey of interest rate hikes, and risk markets experienced significant sell-offs.

Why are the Fed Minutes Important?

The minutes, which also interest cryptocurrency investors, were announced at 9:00 PM. As we know from Fed Chairman Powell’s recent statements, we are now confident that the Fed has reached a “tight” level of monetary policy. The decision will be made regarding whether to continue tightening excessively or to maintain the current level of policy. Although investors have been waiting for the announcement of an interest rate ceiling for months, the Fed continued with 25bp rate hikes.

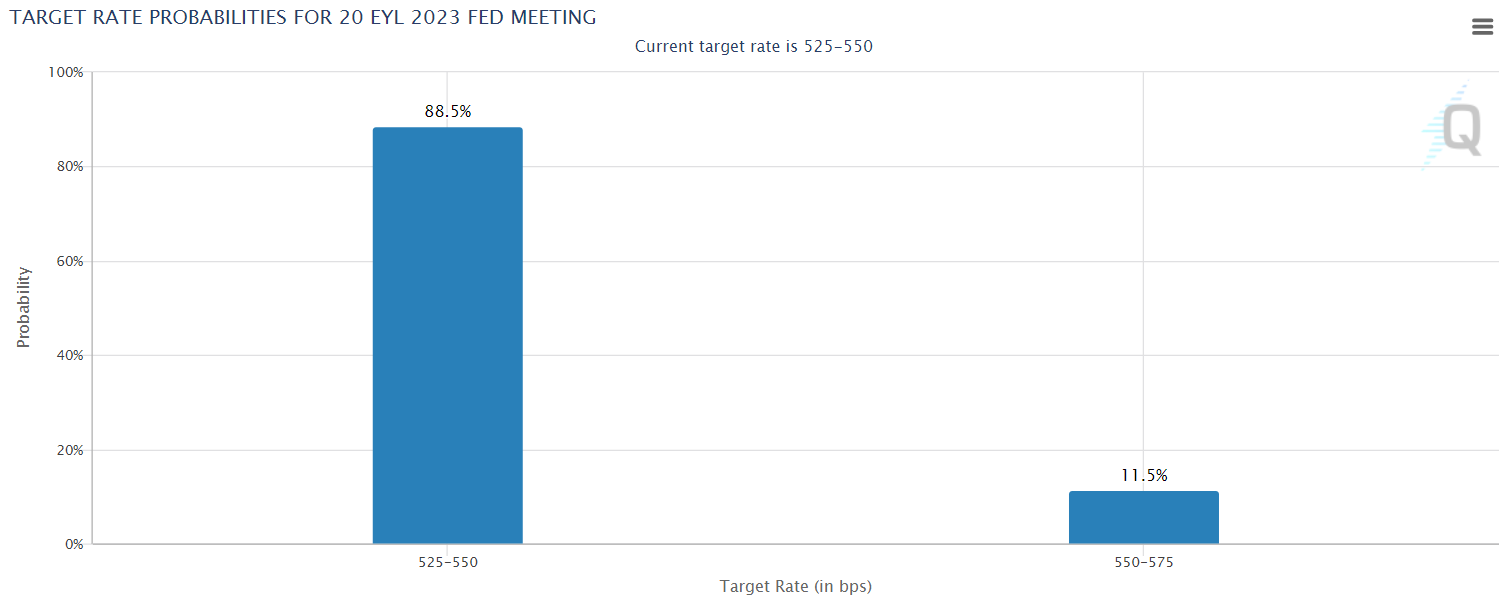

It was mentioned that the decision for the upcoming September 20 meeting will be based on future data. Although not all of the incoming data is positive, there is no definite expectation of an interest rate hike. This is quite risky for crypto because if this expectation becomes clear (the recent data supported the worst-case scenario), the markets will have to price in the last 25bp increase. Moreover, new data will be announced until the meeting at the end of September.

So what will happen to gold, crypto, dollar, and Bitcoin if interest rates rise? Gold, crypto, and Bitcoin will likely decline. Risk markets perform negatively under tight monetary policies. The dollar will probably continue to gain strength on a global scale.

Latest Updates on the Fed Minutes

As mentioned above, the significance of the minutes for investors has already been explained. If we examine the details of the minutes, we can list them as follows:

- The Fed minutes have been released.

- Most members still see inflation risks and more interest rate hikes may be needed.

- Some officials are concerned that tighter financial conditions could cause a sharper downturn than expected. Some officials believe that bank lending conditions are tighter than expected.

- We do not expect a recession in 2023, but economic growth will be low in 2024-2025.

- The next interest rate decision will be based on a comprehensive assessment of economic and inflation data.

- Some officials have highlighted the risks of excessive tightening.

- Inflation has remained moderate but well above the 2% target since mid-2022.

- Most Fed officials see significant upward risks to inflation. Inflation risks may require more tightening.

- Several participants supported keeping interest rates unchanged in the July decision.

The comments made are not favorable for cryptocurrencies and may cause a decline in the coming hours.