Crypto investors have been searching for ways to make profits in four-year cycles. Most of the time, large masses have ended up on the losing side. The main reason for this is the unpredictability of cryptocurrencies in the medium term despite cycle patterns and the difficulty in managing market psychology. The latest report published by Ecoinometrics also highlights these issues.

When to Buy Cryptocurrencies?

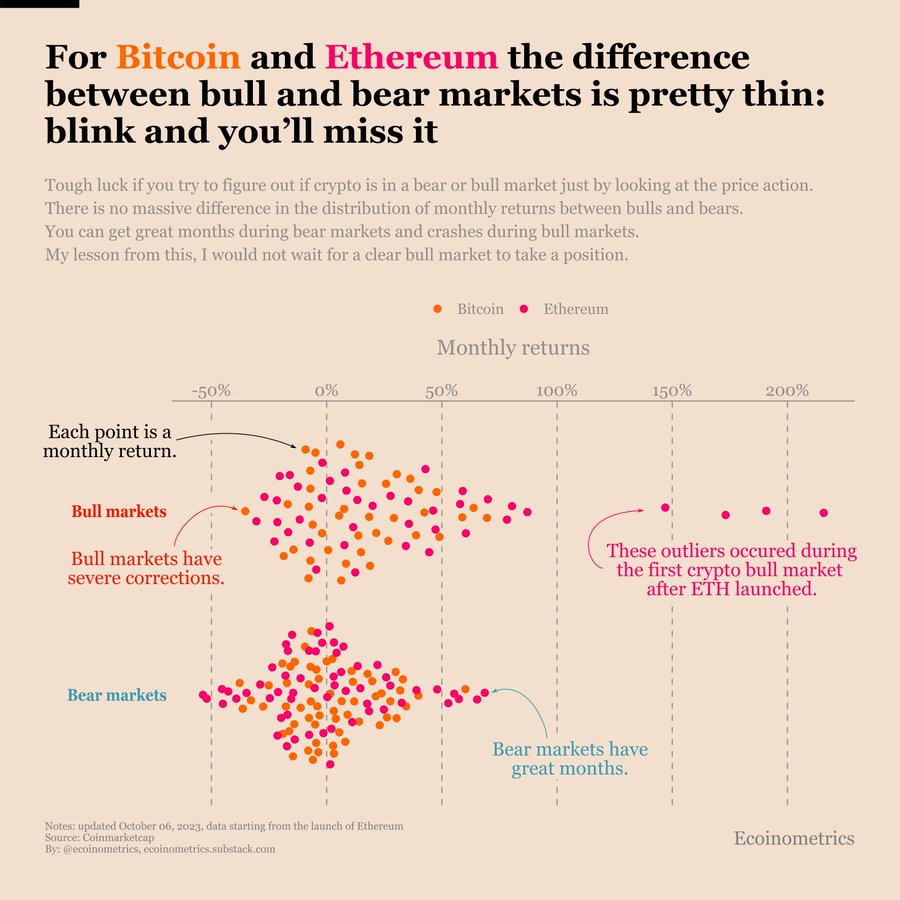

The latest report published by crypto research company Ecoinometrics discusses the performance differences between bulls and bears. The price of Bitcoin and Ethereum has followed similar routes in terms of price performance for years. According to Nick, the founder of Ecoinometrics, focusing on what will happen in the market may not be sensible.

Nick says that it is better to act in accordance with market conditions rather than timing the market, especially in crypto markets. According to him, there is excessive uncertainty in crypto markets. Most investors take risks with high possibilities of being wrong.

Therefore, it may be more reasonable for investors to follow variable strategies according to current market conditions. However, there are always safe zones. For example, when the Bitcoin price turned around from the bottom, many experts suggested that investors who are concerned about deeper bottoms could follow closings above $23,000 and $28,000 to take risks. They made profits in the rally in the first quarter, but the profit rates were lower compared to those who evaluated the bottom.

On the other hand, the image below tells us that significant rises and falls can occur in bull and bear markets in similar proportions.

“If I were to take a position in Bitcoin or Ethereum, I wouldn’t wait for a clear signal that the bull market is back. When you compare the distribution of monthly returns in bull and bear markets, the difference is not striking. You can have great months in bear markets. There can also be collapses in bull markets. Good luck trying to understand when Bitcoin transitions from one market regime to another. Instead of making a decision right now, do your homework, find out which entry point makes sense for you, and apply it when you find the opportunity.”

Crypto Investment Strategy

Ecoinometrics recommends tactical investments considering long-term macro cycles and market liquidity conditions. William Cai, partner at financial services company Wilshire Phoenix, says that market timing is ultimately dependent on time frames.

“Historically, market timing has shown that it is difficult to achieve consistent superior performance, especially in the long term.”

Still, Cai is one of those who believe that long-term risks can be taken due to the relatively new nature of crypto. Of course, the investment options mentioned here are mostly BTC and ETH. For investors who want to reduce their risk, the best option may be a consistent and repetitive investment planning known as dollar-cost averaging (DCA).

Professional trader Oliver Veliz says that he has been following this strategy for Bitcoin for about 3 years and has no regrets. On the other hand, the same person said that he has been focusing on dollar-cost averaging in his investments since 1981.

So, if you want to make quick trades, you should look for ways to spend time in the market instead of timing the market. The return on an investment made in a bull market may be more enjoyable than the stress of trying to catch the bottom in a bear market. Perhaps most investors prefer to stay on the sidelines and that is why volumes have been low for months.