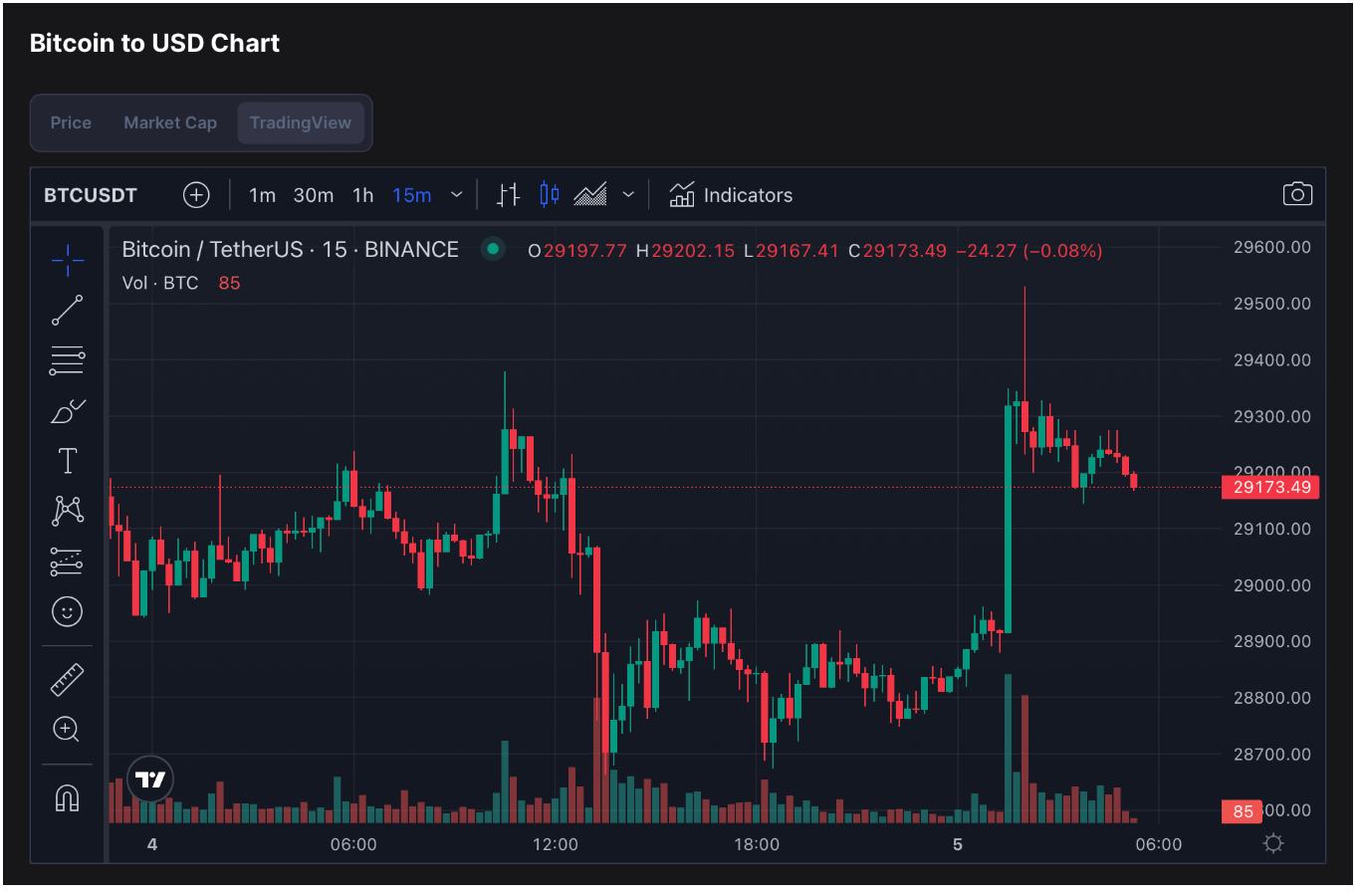

The cryptocurrency market experienced a dynamic week in light of the interest rate decisions by the Federal Reserve and the European Central Bank. Bitcoin, which plummeted to $28,700 yesterday, surpassed $29,000 earlier today. Concurrently, market volatility persists as analyst Michaël van de Poppe assesses the latest developments and highlights crucial near-term price levels for BTC.

Whither Bitcoin?

Interest rate announcements from the Federal Reserve and the European Central Bank, coupled with significant weekly events, reinvigorated the cryptocurrency market. The leading digital currency, Bitcoin (BTC), reached a low of $28,700 yesterday before rallying in the morning hours to exceed $29,000. The cumulative market capitalization of the cryptocurrency ecosystem approached the $1.2 trillion mark.

Meanwhile, Ethereum (ETH) experienced a modest depreciation of nearly 0.3% in the last 24 hours, dipping below $1,900. Additionally, heightened market volatility led to the liquidation of an average of $70 million in short and long positions over the past 24 hours, according to Coinglass data.

Analyst Pinpoints Vital Price Thresholds

As the market’s considerable volatility endures, cryptocurrency analyst Michaël van de Poppe shared his insights on the current state of the market through a series of tweets, identifying potential price levels that may prove critical for BTC in the near future.

The analyst posited that the premier cryptocurrency, Bitcoin, might experience a period of consolidation at present price levels. He emphasized the resistance thresholds that must be surpassed for a new ascent. Michaël van de Poppe suggested that BTC could accelerate its appreciation if the $29,200 level is breached in the near term. Furthermore, he contended that the ongoing banking crisis in the United States may serve as a bullish signal for Bitcoin.